English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

96 NOTEs<br />

<strong>DFDS</strong> annual report 2009<br />

>>> Note 28 continued<br />

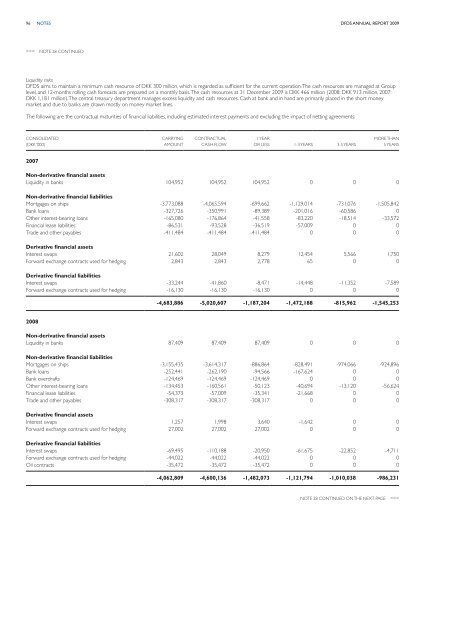

Liquidity risks<br />

<strong>DFDS</strong> aims to maintain a minimum cash resource of DKK 300 million, which is regarded as sufficient for the current operation. The cash resources are managed at Group<br />

level, and 12-months rolling cash forecasts are prepared on a monthly basis. The cash resources at 31 December 2009 is DKK 466 million (2008: DKK 913 million, 2007:<br />

DKK 1,181 million). The central treasury department manages excess liquidity and cash resources. Cash at bank and in hand are primarily placed in the short money<br />

market and due to banks are drawn mostly on money market lines.<br />

The following are the contractual maturities of financial liabilities, including estimated interest payments and excluding the impact of netting agreements:<br />

Consolidated<br />

(DKK ‘000)<br />

CARRYING<br />

AMOUNT<br />

CONTRACTUAL<br />

CASH FLOW<br />

1 YEAR<br />

OR LESS 1-3 YEARS 3-5 YEARS<br />

MORE THAN<br />

5 YEARS<br />

2007<br />

Non-derivative financial assets<br />

Liquidity in banks 104,952 104,952 104,952 0 0 0<br />

Non-derivative financial liabilities<br />

Mortgages on ships -3,773,088 -4,065,594 -699,662 -1,129,014 -731,076 -1,505,842<br />

Bank loans -327,726 -350,991 -89,389 -201,016 -60,586 0<br />

Other interest-bearing loans -165,080 -176,864 -41,558 -83,220 -18,514 -33,572<br />

Financial lease liabilities -86,531 -93,528 -36,519 -57,009 0 0<br />

Trade and other payables -411,484 -411,484 -411,484 0 0 0<br />

Derivative financial assets<br />

Interest swaps 21,602 28,049 8,279 12,454 5,566 1,750<br />

Forward exchange contracts used for hedging 2,843 2,843 2,778 65 0 0<br />

Derivative financial liabilities<br />

Interest swaps -33,244 -41,860 -8,471 -14,448 -11,352 -7,589<br />

Forward exchange contracts used for hedging -16,130 -16,130 -16,130 0 0 0<br />

-4,683,886 -5,020,607 -1,187,204 -1,472,188 -815,962 -1,545,253<br />

2008<br />

Non-derivative financial assets<br />

Liquidity in banks 87,409 87,409 87,409 0 0 0<br />

Non-derivative financial liabilities<br />

Mortgages on ships -3,155,435 -3,614,317 -886,864 -828,491 -974,066 -924,896<br />

Bank loans -252,441 -262,190 -94,566 -167,624 0 0<br />

Bank overdrafts -124,469 -124,469 -124,469 0 0 0<br />

Other interest-bearing loans -134,453 -160,561 -50,123 -40,694 -13,120 -56,624<br />

Financial lease liabilities -54,373 -57,009 -35,341 -21,668 0 0<br />

Trade and other payables -308,317 -308,317 -308,317 0 0 0<br />

Derivative financial assets<br />

Interest swaps 1,257 1,998 3,640 -1,642 0 0<br />

Forward exchange contracts used for hedging 27,002 27,002 27,002 0 0 0<br />

Derivative financial liabilities<br />

Interest swaps -69,495 -110,188 -20,950 -61,675 -22,852 -4,711<br />

Forward exchange contracts used for hedging -44,022 -44,022 -44,022 0 0 0<br />

Oil contracts -35,472 -35,472 -35,472 0 0 0<br />

-4,062,809 -4,600,136 -1,482,073 -1,121,794 -1,010,038 -986,231<br />

Note 28 continued on the next page >>>