English - DFDS

English - DFDS

English - DFDS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

98 NOTEs<br />

<strong>DFDS</strong> annual report 2009<br />

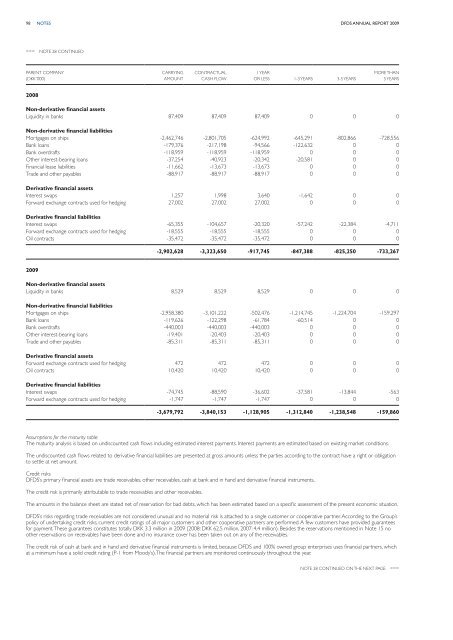

>>> Note 28 continued<br />

Parent Company<br />

(DKK ‘000)<br />

CARRYING<br />

AMOUNT<br />

CONTRACTUAL<br />

CASH FLOW<br />

1 YEAR<br />

OR LESS 1-3 YEARS 3-5 YEARS<br />

MORE THAN<br />

5 YEARS<br />

2008<br />

Non-derivative financial assets<br />

Liquidity in banks 87,409 87,409 87,409 0 0 0<br />

Non-derivative financial liabilities<br />

Mortgages on ships -2,462,746 -2,801,705 -624,992 -645,291 -802,866 -728,556<br />

Bank loans -179,376 -217,198 -94,566 -122,632 0 0<br />

Bank overdrafts -118,959 -118,959 -118,959 0 0 0<br />

Other interest-bearing loans -37,254 -40,923 -20,342 -20,581 0 0<br />

Financial lease liabilities -11,662 -13,673 -13,673 0 0 0<br />

Trade and other payables -88,917 -88,917 -88,917 0 0 0<br />

Derivative financial assets<br />

Interest swaps 1,257 1,998 3,640 -1,642 0 0<br />

Forward exchange contracts used for hedging 27,002 27,002 27,002 0 0 0<br />

Derivative financial liabilities<br />

Interest swaps -65,355 -104,657 -20,320 -57,242 -22,384 -4,711<br />

Forward exchange contracts used for hedging -18,555 -18,555 -18,555 0 0 0<br />

Oil contracts -35,472 -35,472 -35,472 0 0 0<br />

-2,902,628 -3,323,650 -917,745 -847,388 -825,250 -733,267<br />

2009<br />

Non-derivative financial assets<br />

Liquidity in banks 8,529 8,529 8,529 0 0 0<br />

Non-derivative financial liabilities<br />

Mortgages on ships -2,958,380 -3,101,222 -502,476 -1,214,745 -1,224,704 -159,297<br />

Bank loans -119,626 -122,298 -61,784 -60,514 0 0<br />

Bank overdrafts -440,003 -440,003 -440,003 0 0 0<br />

Other interest-bearing loans -19,401 -20,403 -20,403 0 0 0<br />

Trade and other payables -85,311 -85,311 -85,311 0 0 0<br />

Derivative financial assets<br />

Forward exchange contracts used for hedging 472 472 472 0 0 0<br />

Oil contracts 10,420 10,420 10,420 0 0 0<br />

Derivative financial liabilities<br />

Interest swaps -74,745 -88,590 -36,602 -37,581 -13,844 -563<br />

Forward exchange contracts used for hedging -1,747 -1,747 -1,747 0 0 0<br />

-3,679,792 -3,840,153 -1,128,905 -1,312,840 -1,238,548 -159,860<br />

Assumptions for the maturity table:<br />

The maturity analysis is based on undiscounted cash flows including estimated interest payments. Interest payments are estimated based on existing market conditions.<br />

The undiscounted cash flows related to derivative financial liabilities are presented at gross amounts unless the parties according to the contract have a right or obligation<br />

to settle at net amount.<br />

Credit risks<br />

<strong>DFDS</strong>’s primary financial assets are trade receivables, other receivables, cash at bank and in hand and derivative financial instruments..<br />

The credit risk is primarily attributable to trade receivables and other receivables.<br />

The amounts in the balance sheet are stated net of reservation for bad debts, which has been estimated based on a specific assessment of the present economic situation.<br />

<strong>DFDS</strong>’s risks regarding trade receivables are not considered unusual and no material risk is attached to a single customer or cooperative partner. According to the Group’s<br />

policy of undertaking credit risks, current credit ratings of all major customers and other cooperative partners are performed. A few customers have provided guarantees<br />

for payment. These guarantees constitutes totally DKK 3.3 million in 2009 (2008: DKK 62.5 million, 2007: 4,4 million). Besides the reservations mentioned in Note 15 no<br />

other reservations on receivables have been done and no insurance cover has been taken out on any of the receivables.<br />

The credit risk of cash at bank and in hand and derivative financial instruments is limited, because <strong>DFDS</strong> and 100% owned group enterprises uses financial partners, which<br />

at a minimum have a solid credit rating (P-1 from Moody’s). The financial partners are monitored continuously throughout the year.<br />

Note 28 continued on the next page >>>