80 NOTEs <strong>DFDS</strong> annual report 2009 >>> Note 12 continued Parent Company DKK ‘000 BUILDINGS TERMINALS SHIPS EQUIPMENT, ETC. WORK IN PROGRESS AND PREPAYMENTS TOTAL Balance at 1 January 2008 16,236 71,930 5,655,457 160,844 24,170 5,928,637 Transfer to/from other items 3,537 0 47,921 4,747 -56,205 0 Addition 378 0 40,764 32,790 285,654 359,586 Disposal 0 0 -33,755 -926 -21,081 -55,762 Assets held for sale 0 0 -576,577 0 0 -576,577 Cost at 31 December 2008 20,151 71,930 5,133,810 197,455 232,538 5,655,884 Balance at 1 January 2008 6,015 43,761 1,809,727 91,052 0 1,950,555 Depreciation 1,515 1,971 271,411 18,500 0 293,397 Depreciation on disposal 0 0 -28,427 -926 0 -29,353 Assets held for sale 0 0 -391,606 0 0 -391,606 Impairment and depreciation at 31 December 2008 7,530 45,732 1,661,105 108,626 0 1,822,993 Carrying amount at 31 December 2008 12,621 26,198 3,472,705 88,829 232,538 3,832,891 Of this, financial leased assets 7,294 2,443 9,737 Interest recognised in cost at 1 January 2008 26,631 0 26,631 Recognised interest for the year 0 7,599 7,599 Interest recognised in cost at 31 December 2008 26,631 7,599 34,230 Balance at 1 January 2009 20,151 71,930 5,133,810 197,455 232,538 5,655,884 Transfer to/from other items 130 0 152,183 298 -152,611 0 Addition 646 875 35,508 10,907 110,045 157,981 Disposal 0 0 -399,204 -804 -182,901 -582,909 Transferred to assets held to sale 0 0 -23,988 0 0 -23,988 Transferred from assets held to sale 0 0 576,577 0 0 576,577 Cost at 31 December 2009 20,927 72,805 5,474,886 207,856 7,071 5,783,545 Balance at 1 January 2009 7,530 45,732 1,661,105 108,626 0 1,822,993 Depreciation 1,815 1,860 262,894 20,709 0 287,278 Impairment 0 0 6,161 0 0 6,161 Depreciation on disposal 0 0 -144,885 -303 0 -145,188 Transferred to assets held to sale 0 0 -23,988 0 0 -23,988 Transferred from assets held to sale 0 0 444,606 0 0 444,606 Impairment and depreciation at 31 December 2009 9,345 47,592 2,205,893 129,032 0 2,391,862 Carrying amount at 31 December 2009 11,582 25,213 3,268,993 78,824 7,071 3,391,683 Of this, financial leased assets 0 0 0 Interest recognised in cost at 1 January 2009 26,631 7,599 34,230 Recognised interest for the year 1,910 0 1,910 Transferred to/from other items 442 -442 0 Disposal 0 -7,157 -7,157 Interest recognised in cost at 31 December 2009 28,983 0 28,983 Carrying amount of assets pledged as securities 3,266,287 The carrying amount of ships includes passenger ships, DKK 1,624 million (2008: DKK 1,787 million, 2007: DKK 2,228 million) of which components with high decrease on value amounts to DKK 442 million (2008: DKK 505 million, 2007: DKK 623 million) and components with minor decrease in value amounts to DKK 1,182 million (2008: DKK 1,282 million, 2007: DKK 1,605 million). Interest rates included in costs for the Parent Company are calculated by using an interest rate based on the general borrowing. The applied interest rate is 2.0 – 5.5%. The interest rate for capitalized interest is 5.5% in 2009 (2008: 5.5%, 2007: no capitalized interests). On the basis of the impairment tests performed in 2009 an impairment loss on a ship classified as an asset held for sale, DKK 53.0, million, and on improvements on a ship chartered from an affiliated company, DKK 6.1 million, is recognised (2008 and 2007: no impairment). For further information see Note 39.

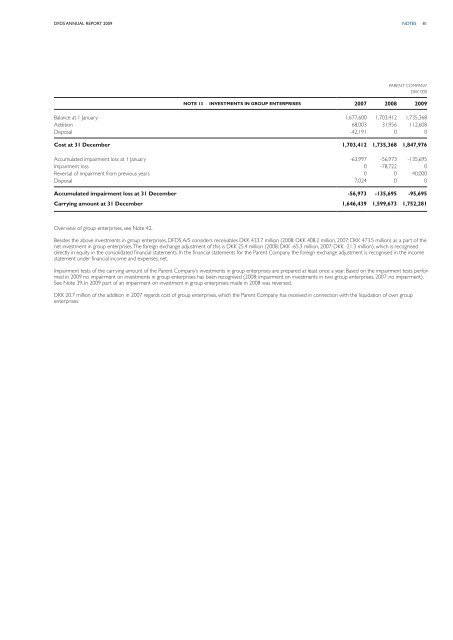

<strong>DFDS</strong> annual report 2009 NOTEs 81 Parent Company DKK ‘000 Note 13 Investments in group enterprises 2007 2008 2009 Balance at 1 January 1,677,600 1,703,412 1,735,368 Addition 68,003 31,956 112,608 Disposal -42,191 0 0 Cost at 31 December 1,703,412 1,735,368 1,847,976 Accumulated impairment loss at 1 January -63,997 -56,973 -135,695 Impairment loss 0 -78,722 0 Reversal of impairment from previous years 0 0 40,000 Disposal 7,024 0 0 Accumulated impairment loss at 31 December -56,973 -135,695 -95,695 Carrying amount at 31 December 1,646,439 1,599,673 1,752,281 Overview of group enterprises, see Note 42. Besides the above investments in group enterprises, <strong>DFDS</strong> A/S considers receivables DKK 433.7 million (2008: DKK 408.2 million, 2007: DKK 473.5 million) as a part of the net investment in group enterprises. The foreign exchange adjustment of this is DKK 25.4 million (2008: DKK -65.3 million, 2007: DKK -21.3 million), which is recognised directly in equity in the consolidated financial statements. In the financial statements for the Parent Company the foreign exchange adjustment is recognised in the income statement under financial income and expenses, net. Impairment tests of the carrying amount of the Parent Company’s investments in group enterprises are prepared at least once a year. Based on the impairment tests performed in 2009 no impairment on investments in group enterprises has been recognised (2008: impairment on investments in two group enterprises, 2007: no impairment). See Note 39. In 2009 part of an impairment on investment in group enterprises made in 2008 was reversed. DKK 20.7 million of the addition in 2007 regards cost of group enterprises, which the Parent Company has received in connection with the liquidation of own group enterprises.