English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DFDS</strong> annual report 2009 Risk Factors 49<br />

consumption is related to passenger shipping, of which about 24 % is<br />

hedged. The majority of the remaining consumption by freight ships is<br />

hedged by commercial bunker surcharge agreements.<br />

All in all, it is estimated that a price change of 1 % compared to the<br />

price level at the end of 2009, which was approximately USD 450 per<br />

ton, will entail a profit impact of approximately DKK 2.4 million.<br />

Financial risks<br />

The most important financial risk factors for <strong>DFDS</strong> are currency and<br />

interest-rate fluctuations, both of which are managed by <strong>DFDS</strong>’ central<br />

finance department, in accordance with the policies adopted by the<br />

Supervisory Board.<br />

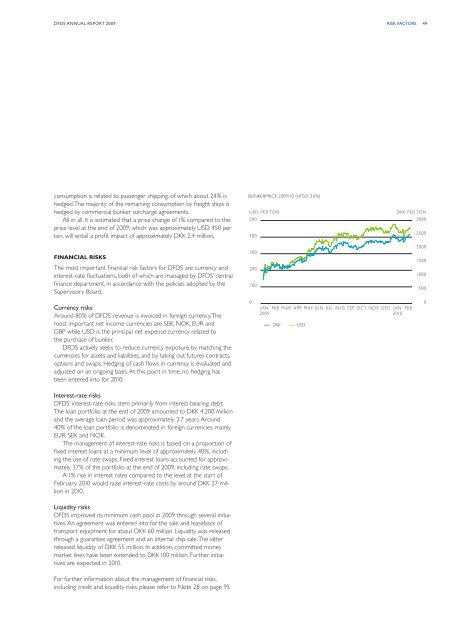

BUNKERPRICE 2009/10 (HFSO 3.5%)<br />

USD PER TON<br />

500<br />

400<br />

300<br />

200<br />

100<br />

DKK PER TON<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

Currency risks<br />

Around 80 % of <strong>DFDS</strong>’ revenue is invoiced in foreign currency. The<br />

most important net income currencies are SEK, NOK, EUR and<br />

GBP while USD is the principal net expense currency related to<br />

the purchase of bunker.<br />

<strong>DFDS</strong> actively seeks to reduce currency exposure by matching the<br />

currencies for assets and liabilities, and by taking out futures contracts,<br />

options and swaps. Hedging of cash flows in currency is evaluated and<br />

adjusted on an ongoing basis. At this point in time, no hedging has<br />

been entered into for 2010.<br />

0<br />

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB<br />

2009<br />

2010<br />

DKK<br />

USD<br />

0<br />

Interest-rate risks<br />

<strong>DFDS</strong>’ interest-rate risks stem primarily from interest-bearing debt.<br />

The loan portfolio at the end of 2009 amounted to DKK 4.200 million<br />

and the average loan period was approximately 3.7 years. Around<br />

40 % of the loan portfolio is denominated in foreign currencies, mainly<br />

EUR, SEK and NOK.<br />

The management of interest-rate risks is based on a proportion of<br />

fixed interest loans at a minimum level of approximately 40 %, including<br />

the use of rate swaps. Fixed interest loans accounted for approximately<br />

37 % of the portfolio at the end of 2009, including rate swaps.<br />

A 1 % rise in interest rates compared to the level at the start of<br />

February 2010 would raise interest-rate costs by around DKK 27 million<br />

in 2010.<br />

Liquidity risks<br />

<strong>DFDS</strong> improved its minimum cash pool in 2009 through several initiatives.<br />

An agreement was entered into for the sale and leaseback of<br />

transport equipment for about DKK 60 million. Liquidity was released<br />

through a guarantee agreement and an internal ship sale. The latter<br />

released liquidity of DKK 55 million. In addition, committed money<br />

market lines have been extended to DKK 100 million. Further initiatives<br />

are expected in 2010.<br />

For further information about the management of financial risks,<br />

including credit and liquidity risks, please refer to Note 28 on page 93.