here - Ayala

here - Ayala

here - Ayala

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Globe 2012 annual report<br />

management discussion and analysis<br />

Globe offers a full range of fixed line communications<br />

services, wired and wireless broadband access, and endto-end<br />

connectivity solutions customized for consumers,<br />

SMEs (Small & Medium Enterprises), large corporations and<br />

businesses.<br />

Globe Telecom’s fixed line voice services include local,<br />

national and international long distance calling services in<br />

postpaid and prepaid packages through its Globelines brand.<br />

Subscribers get to enjoy toll-free rates for national long<br />

distance calls with other Globelines subscribers nationwide.<br />

Additionally, postpaid fixed line voice consumers enjoy free<br />

unlimited dial-up internet from their Globelines subscriptions.<br />

Low-MSF (monthly service fee) fixed line voice services<br />

bundled with internet plans are available nationwide and can<br />

be customized with value-added services including multicalling,<br />

call waiting and forwarding, special numbers and<br />

voice mail. For corporate and enterprise customers, Globe<br />

offers voice solutions that include regular and premium<br />

conferencing, enhanced voice mail, IP-PBX solutions and<br />

domestic or international toll free services.<br />

The Company’s fixed line data services include end-toend<br />

data solutions customized according to the needs of<br />

businesses. Globe Telecom's product offerings include<br />

international and domestic leased line services, wholesale<br />

and corporate internet access, data center services and<br />

other connectivity solutions tailored to the needs of specific<br />

industries.<br />

Globe offers wired, fixed wireless, and fully mobile<br />

internet-on-the-go services across various technologies<br />

and connectivity speeds for its residential and business<br />

customers. Tattoo@Home consists of wired or DSL<br />

broadband packages bundled with voice, or broadband<br />

data-only services which are available at download speeds<br />

ranging from 1 mbps up to 15 mbps. In selected areas<br />

w<strong>here</strong> DSL is not yet available, Globe offers Tattoo WiMAX,<br />

a fixed wireless broadband service using its WiMAX network.<br />

Meanwhile, for consumers who require a fully mobile,<br />

internet-on-the-go broadband connection, Tattoo On-the-Go<br />

allows subscribers to access the internet using LTE, HSPA+,<br />

3G with HSDPA, EDGE, GPRS or Wi-Fi at various hotspots<br />

nationwide using a plug-and-play USB modem. This service<br />

is available in both postpaid and prepaid packages. In<br />

addition, consumers in selected urban areas who require<br />

faster connections have the option to subscribe to Tattoo<br />

Torque broadband plans using leading edge GPON (Gigabit<br />

Passive Optical Network) technology with speeds of up to<br />

100 mbps.<br />

In 2012, the Company officially launched its Long-Term<br />

Evolution (LTE) broadband service with the Tattoo Black<br />

Postpaid Plans. The nomadic broadband plans are equipped<br />

with an LTE dongle and LTE superstick that deliver browsing<br />

speeds of up to 42 Mbps and come with personalized<br />

customer handling services such as a dedicated hotline, a<br />

relationship manager, and many other perks.<br />

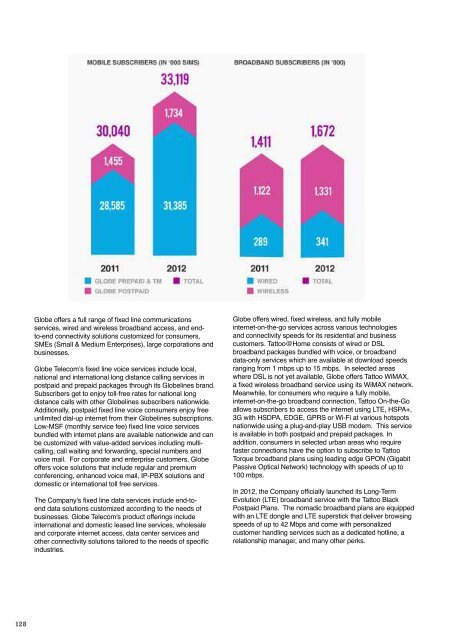

The fixed line and broadband business registered significant<br />

gains in 2012, with revenues rising by 9% from ₱14.2 billion<br />

in 2011 to about ₱15.6 billion on account of increasing<br />

demand for data and internet connectivity.<br />

Full year broadband revenues were up 16% to ₱8.7 billion<br />

as the year marked another milestone for the business<br />

with the commercial launch of its broadband LTE service<br />

that provided subscribers with alternative tools to improve<br />

their overall internet experience. The broadband business<br />

likewise continued to ride on the popularity of social<br />

networking sites and benefited from declining prices of<br />

access devices such as PCs, tablets, and laptops. Full year<br />

2012 cumulative broadband subscribers stood at about 1.7<br />

million, up by 18% from 1.4 million in 2011.<br />

The fixed line data also contributed to the Company’s<br />

overall top line growth with revenues of almost ₱4.2 billion,<br />

10% higher than the ₱3.8 billion booked in 2011. This<br />

was accomplished by the Company’s innovative business<br />

solutions and products that capitalized on demand for highspeed<br />

data nodes, transmission links, bandwidth capacity<br />

and reliable service. Globe Business’ products include M2M<br />

(machine-to-machine) solutions, cloud computing services,<br />

domestic and international data services, leased lines and<br />

managed services among other solutions for improving a<br />

business’ productivity and IT security.<br />

On the other hand, subscription to traditional landline service<br />

was slightly revived through low call rate offers and together<br />

with DUO & SUPERDUO’s continued popularity lifted<br />

cumulative voice subscriber base 6% to 711,429 customers.<br />

However, revenues still fell 9% to ₱2.7 million as the strategy<br />

lowered MSF and consequently ARPU.<br />

Financial Performance<br />

Full year 2012 consolidated service revenues soared to a<br />

historic-high of ₱82.7 billion, up 6% from 2011 results of<br />

₱77.8 billion. The mobile business sustained its strong<br />

growth momentum by delivering a 6% year-on-year increase<br />

in revenues on account of the record gross acquisitions in<br />

the postpaid segment, expansion in mobile browsing usage<br />

as well as unlimited and bulk voice services. Incremental<br />

revenues compensated for the decline in IDD revenues<br />

which were partly weighed down by an appreciating Peso,<br />

and also helped to counter market challenges underscored<br />

by peaking penetration levels resulting from increasing<br />

incidence of multi-SIM, declining yields from unlimited and<br />

value promotions, and intensifying competition. Fixed line<br />

and broadband revenues likewise contributed additional<br />

revenues and registered 9% year-on-year growth with<br />

sustained expansion in total broadband subscriber base and<br />

steady demand for data services from the corporate sector.<br />

Operating expenses and subsidy increased by 12% yearon-year<br />

from ₱42.7 billion to ₱47.7 billion as 2012 was a<br />

period of investment in terms of acquiring and retaining<br />

subscribers as well as beefing up capacity with the network<br />

modernization and IT transformation programs. Marketing<br />

and subsidy costs increased substantially following the<br />

aggressive acquisition of new postpaid subscribers who<br />

opted to get the higher-end gadgets such as the Apple<br />

iPhone. Marketing costs also increased to support the<br />

various brand-building initiatives such as product and service<br />

launches for the mobile and broadband business. As a<br />

result, marketing and subsidy as a percentage of service<br />

revenues rose to 13% in 2012 from 9% in 2011. Networkrelated<br />

costs, which included lease, utilities, and repairs<br />

and maintenance, were also higher in 2012 as a result of<br />

the continued expansion of the 2G, 3G, and broadband<br />

networks. Operating expenses in 2012 likewise included<br />

charges for various outsourced and contracted services, as<br />

well as professional fees resulting from the various projects<br />

being undertaken by the Company, including our network<br />

and IT modernization initiatives. Interconnect costs, on the<br />

other hand, were down year-on-year driven by the NTCmandated<br />

reduction in access charges implemented in late<br />

2011.<br />

Consolidated EBITDA of ₱35.0 billion was lower by about<br />

₱93 million from previous year’s total of ₱35.1 billion as<br />

the overall growth in expenses outpaced the increase in<br />

revenues. As a result, EBITDA margin declined from 45% in<br />

2011 to 42% in 2012.<br />

Meanwhile, total depreciation expense grew 25% year-onyear<br />

from ₱18.9 billion to ₱23.6 billion with the increase<br />

attributed mainly to charges related to the network<br />

modernization and IT transformation programs. As the<br />

Company had disclosed in the past, the carrying value of<br />

the old, non-useable assets will impact Globe Telecom’s<br />

profitability through an acceleration of depreciation over<br />

its remaining useful life and until such time when the new,<br />

replacement assets are ready for service. Accelerated<br />

depreciation charges increased further towards the last<br />

quarter of the year to bring full year total to ₱5.1 billion.<br />

Excluding this item, total depreciation expense would have<br />

declined by 2% against previous year to about ₱18.5 billion.<br />

Globe closed the year with core net income of about ₱10.3<br />

billion, up 2% from ₱10.0 billion in 2011. Core net income<br />

excludes foreign exchange and mark-to-market gains<br />

and losses as well as non-recurring items such as the<br />

accelerated depreciation charges related to transformation<br />

initiatives. Reported net income after tax, on the other hand,<br />

was down 30% year-on-year from ₱9.8 billion to ₱6.9 billion<br />

as revenue gains were offset by the impact of accelerated<br />

depreciation charges as well as sustained investments in<br />

subscriber postpaid acquisitions.<br />

128 129