here - Ayala

here - Ayala

here - Ayala

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Globe 2012 annual report<br />

financial report<br />

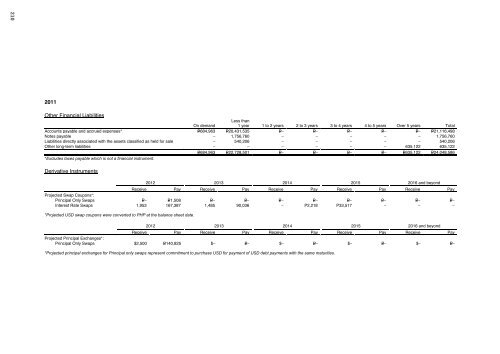

2011<br />

Other Financial Liabilities<br />

On demand<br />

Less than<br />

1 year 1 to 2 years 2 to 3 years 3 to 4 years 4 to 5 years Over 5 years Total<br />

Accounts payable and accrued expenses* P=684,963 P=20,431,535 P=– P=– P=– P=– P=– P=21,116,498<br />

Notes payable – 1,756,760 – – – – – 1,756,760<br />

Liabilities directly associated with the assets classified as held for sale – 540,206 – – – – – 540,206<br />

Other long-term liabilities – – – – – – 635,122 635,122<br />

P=684,963 P=22,728,501 P=– P=– P=– P=– P=635,122 P=24,048,586<br />

*Excludes taxes payable which is not a financial instrument.<br />

Derivative Instruments<br />

2012 2013 2014 2015 2016 and beyond<br />

Receive Pay Receive Pay Receive Pay Receive Pay Receive Pay<br />

Projected Swap Coupons*:<br />

Principal Only Swaps P=– P=1,508 P=– P=– P=– P=– P=– P=– P=– P=–<br />

Interest Rate Swaps 1,953 167,387 1,485 90,036 – P2,218 P33,517 – – –<br />

*Projected USD swap coupons were converted to PHP at the balance sheet date.<br />

2012 2013 2014 2015 2016 and beyond<br />

Receive Pay Receive Pay Receive Pay Receive Pay Receive Pay<br />

Projected Principal Exchanges*:<br />

Principal Only Swaps $2,500 P=140,825 $– P=– $– P=– $– P=– $– P=–<br />

*Projected principal exchanges for Principal only swaps represent commitment to purchase USD for payment of USD debt payments with the same maturities.<br />

2010<br />

Other Financial Liabilities<br />

On demand<br />

Less than<br />

1 year 1 to 2 years 2 to 3 years 3 to 4 years 4 to 5 years Over 5 years Total<br />

Accounts payable and accrued expenses* P=426,696 P=19,906,644 P=– P=– P=– P=– P=– P=20,333,340<br />

Liabilities directly associated with the assets classified as held for sale – 642,313 – – – – – 642,313<br />

Other long-term liabilities – – – – – – 640,927 640,927<br />

P=426,696 P=20,548,957 P=– P=– P=– P=– P=640,927 P=21,616,580<br />

*Excludes taxes payable which is not a financial instrument.<br />

Derivative Instruments<br />

2011 2012 2013 2014 2015 and beyond<br />

Receive Pay Receive Pay Receive Pay Receive Pay Receive Pay<br />

Projected Swap Coupons*:<br />

Principal Only Swaps P=– P=4,048 P=– P=2,572 P=– P=– P=– P=– P=– P=–<br />

Interest Rate Swaps – 146,821 4,065 51,911 16,745 – 19,889 – 11,388 –<br />

*Projected USD swap coupons were converted to PHP at the balance sheet rate. Further, it was assumed that 3m Libor, 3m PDSTF, and 6m PDSTF would stay at December 31, 2010 levels.<br />

2011 2012 2013 2014 2015 and beyond<br />

Receive Pay Receive Pay Receive Pay Receive Pay Receive Pay<br />

Projected Principal Exchanges*:<br />

Principal Only Swaps** $– P=– $2,500 P=140,825 $– P=– $– P=– $– P=–<br />

Forward Sale of USD** P=1,539,082 $35,000 – – – – – – – –<br />

**Projected principal exchanges represent commitments to purchase USD for payment of USD debts with the same maturities.<br />

**Nondeliverable<br />

210 211