here - Ayala

here - Ayala

here - Ayala

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Globe 2012 annual report<br />

financial report<br />

The Globe Group also determines the cost of equity-settled transactions using assumptions on the<br />

appropriate pricing model. Significant assumptions for the cost of share-based payments include, among<br />

others, share price, exercise price, option life, expected dividend and expected volatility rate.<br />

Cost of share-based payments in 2012, 2011 and 2010 amounted to P=11.50 million, P=49.34 million and<br />

P=104.79 million, respectively (see Notes 16.5 and 18.1).<br />

The Globe Group also estimates other employee benefit obligations and expenses, including cost of paid<br />

leaves based on historical leave availments of employees, subject to the Globe Group’s policy. These<br />

estimates may vary depending on the future changes in salaries and actual experiences during the year.<br />

The accrued balance of other employee benefits (included in the “Accounts payable and accrued<br />

expenses” account and in the “Other long-term liabilities” account in the consolidated statements of<br />

financial position) as of December 31, 2012, 2011 and 2010 amounted to P=484.60 million, P=434.04 million<br />

and P=406.14 million, respectively (see Notes 12 and 15).<br />

While the Globe Group believes that the assumptions are reasonable and appropriate, significant<br />

differences between actual experiences and assumptions may materially affect the cost of employee<br />

benefits and related obligations.<br />

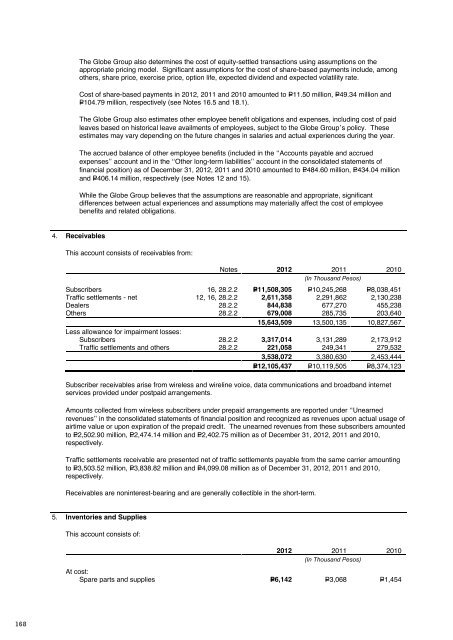

4. Receivables<br />

This account consists of receivables from:<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

Subscribers 16, 28.2.2 P=11,508,305 P=10,245,268 P=8,038,451<br />

Traffic settlements - net 12, 16, 28.2.2 2,611,358 2,291,862 2,130,238<br />

Dealers 28.2.2 844,838 677,270 455,238<br />

Others 28.2.2 679,008 285,735 203,640<br />

15,643,509 13,500,135 10,827,567<br />

Less allowance for impairment losses:<br />

Subscribers 28.2.2 3,317,014 3,131,289 2,173,912<br />

Traffic settlements and others 28.2.2 221,058 249,341 279,532<br />

3,538,072 3,380,630 2,453,444<br />

P=12,105,437 P=10,119,505 P=8,374,123<br />

Subscriber receivables arise from wireless and wireline voice, data communications and broadband internet<br />

services provided under postpaid arrangements.<br />

Amounts collected from wireless subscribers under prepaid arrangements are reported under “Unearned<br />

revenues” in the consolidated statements of financial position and recognized as revenues upon actual usage of<br />

airtime value or upon expiration of the prepaid credit. The unearned revenues from these subscribers amounted<br />

to P=2,502.90 million, P=2,474.14 million and P=2,402.75 million as of December 31, 2012, 2011 and 2010,<br />

respectively.<br />

Traffic settlements receivable are presented net of traffic settlements payable from the same carrier amounting<br />

to P=3,503.52 million, P=3,838.82 million and P=4,099.08 million as of December 31, 2012, 2011 and 2010,<br />

respectively.<br />

Receivables are noninterest-bearing and are generally collectible in the short-term.<br />

5. Inventories and Supplies<br />

This account consists of:<br />

2012 2011 2010<br />

(In Thousand Pesos)<br />

At cost:<br />

Spare parts and supplies P=6,142 P=3,068 P=1,454<br />

SIM cards and SIM packs 29 20 –<br />

Handsets, devices and accessories – 1,931 98<br />

Modems and accessories – – 592,709<br />

Call cards and others 508 2,905 22,244<br />

6,679 7,924 616,505<br />

At NRV:<br />

Handsets, devices and accessories 1,139,463 1,016,844 518,145<br />

Modems and accessories 375,037 451,727 240,578<br />

Spare parts and supplies 246,103 273,911 298,331<br />

Tattoo 62,639 31,140 27,738<br />

SIM cards and SIM packs 36,160 55,930 42,928<br />

Call cards and others 210,095 73,714 95,108<br />

2,069,497 1,903,266 1,222,828<br />

P=2,076,176 P=1,911,190 P=1,839,333<br />

Inventories recognized as expense during the year amounting to P=7,849.04 million, P=6,142.34 million and<br />

P=4,281.08 million in 2012, 2011 and 2010, respectively, are included as part of “Cost of sales” and “Impairment<br />

losses and others” accounts (see Note 23) in the consolidated statements of comprehensive income. An<br />

insignificant amount is included under “General, selling and administrative expenses” as part of “Utilities,<br />

supplies and other administrative expenses” account (see Note 21).<br />

Cost of sales incurred consists of:<br />

2012 2011 2010<br />

(In Thousand Pesos)<br />

Handsets, devices and accessories P=6,565,510 P=4,928,921 P=3,185,163<br />

Tattoo 561,310 545,354 597,430<br />

SIM cards and SIM packs 245,462 245,418 274,882<br />

Modems and accessories 73,407 89,423 141,272<br />

Spare parts and supplies 4,472 1,440 13,164<br />

Call cards and others 228,198 77,033 27,049<br />

P=7,678,359 P=5,887,589 P=4,238,960<br />

T<strong>here</strong> are no unusual purchase commitments and accrued net losses as of December 31, 2012.<br />

6. Prepayments and Other Current Assets<br />

This account consists of:<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

Advance payments to suppliers and<br />

contractors 25.3 P=8,815,534 P=1,674,923 P=764,699<br />

Prepayments 25.1 1,050,731 1,288,290 983,545<br />

Deferred input VAT 11 527,276 730,387 951,449<br />

Input VAT - net 638,626 844,089 954,636<br />

Miscellaneous receivables - net 16, 28.11 425,426 662,203 455,005<br />

Current portion of loan receivable from Bayan<br />

Telecommunications, Inc. (BTI) 11 347,910 – –<br />

Creditable withholding tax 300,680 295,102 494,942<br />

Other current assets 28.11 202,065 91,425 99,922<br />

P=12,308,248 P=5,586,419 P=4,704,198<br />

The “Prepayments” account includes prepaid insurance, rent, maintenance, and NTC spectrum users’ fee<br />

among others.<br />

Deferred input VAT pertains to various purchases of goods and services which cannot be claimed yet as credits<br />

against output VAT liabilities, pursuant to the existing VAT rules and regulations. However, these can be<br />

applied on future output VAT liabilities.<br />

168 169