here - Ayala

here - Ayala

here - Ayala

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Globe 2012 annual report<br />

financial report<br />

These combinations of net liability movements and peso rate depreciation/appreciation resulted in foreign<br />

exchange loss in 2011 and foreign exchange gains in 2010, respectively (see Note 22).<br />

The “Others” account includes insurance claims and other items that are individually immaterial.<br />

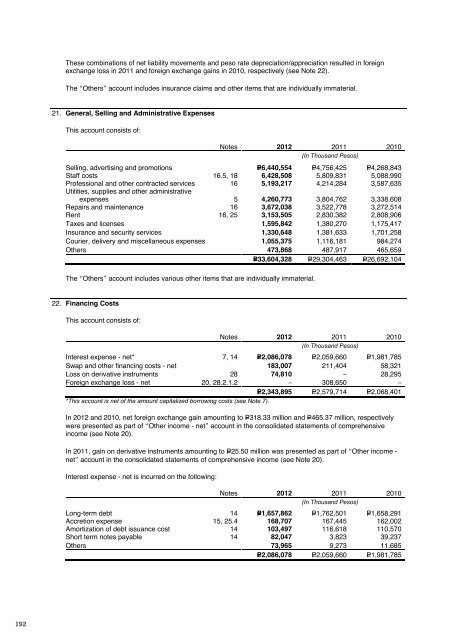

21. General, Selling and Administrative Expenses<br />

This account consists of:<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

Selling, advertising and promotions P=6,440,554 P=4,756,425 P=4,268,843<br />

Staff costs 16.5, 18 6,428,508 5,809,831 5,088,990<br />

Professional and other contracted services 16 5,193,217 4,214,284 3,587,635<br />

Utilities, supplies and other administrative<br />

expenses 5 4,260,773 3,804,762 3,338,608<br />

Repairs and maintenance 16 3,672,038 3,522,778 3,272,514<br />

Rent 16, 25 3,153,505 2,830,382 2,808,906<br />

Taxes and licenses 1,595,842 1,380,270 1,175,417<br />

Insurance and security services 1,330,648 1,381,633 1,701,258<br />

Courier, delivery and miscellaneous expenses 1,055,375 1,116,181 984,274<br />

Others 473,868 487,917 465,659<br />

P=33,604,328 P=29,304,463 P=26,692,104<br />

The “Others” account includes various other items that are individually immaterial.<br />

22. Financing Costs<br />

This account consists of:<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

Interest expense - net* 7, 14 P=2,086,078 P=2,059,660 P=1,981,785<br />

Swap and other financing costs - net 183,007 211,404 58,321<br />

Loss on derivative instruments 28 74,810 – 28,295<br />

Foreign exchange loss - net 20, 28.2.1.2 – 308,650 –<br />

P=2,343,895 P=2,579,714 P=2,068,401<br />

*This account is net of the amount capitalized borrowing costs (see Note 7).<br />

In 2012 and 2010, net foreign exchange gain amounting to P=318.33 million and P=465.37 million, respectively<br />

were presented as part of “Other income - net” account in the consolidated statements of comprehensive<br />

income (see Note 20).<br />

In 2011, gain on derivative instruments amounting to P=25.50 million was presented as part of “Other income -<br />

net” account in the consolidated statements of comprehensive income (see Note 20).<br />

Interest expense - net is incurred on the following:<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

Long-term debt 14 P=1,657,862 P=1,762,501 P=1,658,291<br />

Accretion expense 15, 25.4 168,707 167,445 162,002<br />

Amortization of debt issuance cost 14 103,497 116,618 110,570<br />

Short term notes payable 14 82,047 3,823 39,237<br />

Others 73,965 9,273 11,685<br />

P=2,086,078 P=2,059,660 P=1,981,785<br />

23. Impairment Losses and Others<br />

This account consists of:<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

Impairment loss on:<br />

Receivables 4, 6, 28.2.2 P=1,377,317 P=1,599,967 P=1,285,533<br />

Property and equipment and intangible<br />

assets 259,262 128,614 63,126<br />

Provisions for (reversal of):<br />

Inventory obsolescence and market<br />

decline 5 170,678 237,918 42,115<br />

Other claims and assessments 13 56,327 (47,916) 138,760<br />

P=1,863,584 P=1,918,583 P=1,529,534<br />

24. Income Tax<br />

The significant components of the deferred income tax assets and liabilities of the Globe Group represent the<br />

deferred income tax effects of the following:<br />

2012 2011 2010<br />

(In Thousand Pesos)<br />

Deferred income tax assets on:<br />

Allowance for impairment losses on receivables P=1,081,543 P=1,033,282 P=737,311<br />

Unearned revenues already subjected to income tax 730,079 760,762 744,504<br />

ARO 440,857 406,953 374,106<br />

Accumulated impairment losses on property<br />

and equipment 183,072 126,247 98,389<br />

Accrued rent expense under PAS 17 109,237 112,842 120,753<br />

Inventory obsolescence and market decline 103,196 98,752 43,265<br />

Accrued vacation leave 103,110 90,788 84,168<br />

Unrealized loss on derivative transactions 72,070 77,056 67,793<br />

Provisions for claims and assessments 68,496 56,632 73,592<br />

Cost of share-based payments 44,236 13,208 5,819<br />

NOLCO (see Note 3.2.7) 15,005 1,012 13,499<br />

Allowance for doubtful accounts for long-outstanding<br />

net advances 12,654 8,980 –<br />

MCIT (see Note 3.2.7) 2,176 – 954<br />

Unrealized foreign exchange losses 1,108 125 125<br />

Others 25,672 – –<br />

2,992,511 2,786,639 2,364,278<br />

Deferred income tax liabilities on:<br />

Excess of accumulated depreciation and<br />

amortization of Globe Telecom equipment for<br />

tax reporting (a) over financial reporting (b) 2,946,566 4,382,211 4,799,099<br />

Undepreciated capitalized borrowing costs already<br />

claimed as deduction for tax reporting 1,553,478 1,324,137 1,166,689<br />

Unrealized foreign exchange gain 144,476 167,834 279,037<br />

Prepaid pension 24,981 33,658 23,059<br />

Unamortized discount on noninterest bearing liability 7,910 22,277 39,718<br />

Interest accretion 6,382 – –<br />

Customer contracts of acquired company 858 4,870 6,572<br />

Others 15,390 15,396 –<br />

4,700,041 5,950,383 6,314,174<br />

Net deferred income tax liabilities P=1,707,530 P=3,163,744 P=3,949,896<br />

(a) Sum-of-the-years digit method<br />

(b) Straight-line method<br />

Net deferred tax assets and liabilities presented in the consolidated statements of financial position on a net<br />

basis by entity are as follows:<br />

192 193