here - Ayala

here - Ayala

here - Ayala

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Globe 2012 annual report<br />

financial report<br />

Tranche A is repayable semi-annually on a pari passu basis up to December 31, 2023 based on a table of debt<br />

reduction computed at certain percentages of the principal. Tranche B is a non-interest bearing convertible<br />

debt and to be repaid only if t<strong>here</strong> are sufficient future cash flows and upon full repayment of Tranche A. At the<br />

conclusion of the rehabilitation period, other than as the result of an event of default, Tranche B to the extent<br />

not previously converted is to be converted into new BTI shares. The conversion rights in relation to Tranche B<br />

are up to a maximum of 40% of the authorized share capital as at the effective date. The loans were initially<br />

accounted for at fair value, and the entire acquisition price was allocated to Tranche A.<br />

As of December 31, 2012, loans receivable from BTI amounted to P=4.90 billion comprising of principal and<br />

interest due until 2023, with quarterly interest payments and semi-annual principal payments.<br />

As of February 5, 2013, Globe Telecom did not exercise any of the conversion rights attached to Tranche B.<br />

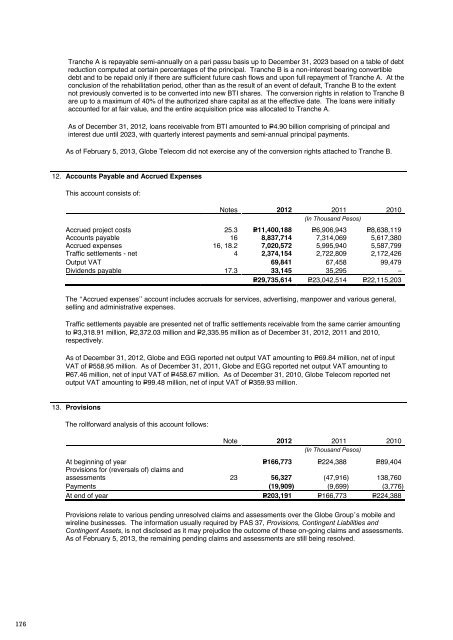

12. Accounts Payable and Accrued Expenses<br />

This account consists of:<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

Accrued project costs 25.3 P=11,400,188 P=6,906,943 P=8,638,119<br />

Accounts payable 16 8,837,714 7,314,069 5,617,380<br />

Accrued expenses 16, 18.2 7,020,572 5,995,940 5,587,799<br />

Traffic settlements - net 4 2,374,154 2,722,809 2,172,426<br />

Output VAT 69,841 67,458 99,479<br />

Dividends payable 17.3 33,145 35,295 –<br />

P=29,735,614 P=23,042,514 P=22,115,203<br />

The “Accrued expenses” account includes accruals for services, advertising, manpower and various general,<br />

selling and administrative expenses.<br />

Traffic settlements payable are presented net of traffic settlements receivable from the same carrier amounting<br />

to P=3,318.91 million, P=2,372.03 million and P=2,335.95 million as of December 31, 2012, 2011 and 2010,<br />

respectively.<br />

As of December 31, 2012, Globe and EGG reported net output VAT amounting to P=69.84 million, net of input<br />

VAT of P=558.95 million. As of December 31, 2011, Globe and EGG reported net output VAT amounting to<br />

P=67.46 million, net of input VAT of P=458.67 million. As of December 31, 2010, Globe Telecom reported net<br />

output VAT amounting to P=99.48 million, net of input VAT of P=359.93 million.<br />

13. Provisions<br />

The rollforward analysis of this account follows:<br />

Note 2012 2011 2010<br />

(In Thousand Pesos)<br />

At beginning of year P=166,773 P=224,388 P=89,404<br />

Provisions for (reversals of) claims and<br />

assessments 23 56,327 (47,916) 138,760<br />

Payments (19,909) (9,699) (3,776)<br />

At end of year P=203,191 P=166,773 P=224,388<br />

Provisions relate to various pending unresolved claims and assessments over the Globe Group’s mobile and<br />

wireline businesses. The information usually required by PAS 37, Provisions, Contingent Liabilities and<br />

Contingent Assets, is not disclosed as it may prejudice the outcome of these on-going claims and assessments.<br />

As of February 5, 2013, the remaining pending claims and assessments are still being resolved.<br />

14. Notes Payable and Long-term Debt<br />

Notes payable consist of short-term, unsecured US dollar and peso-denominated promissory notes from local<br />

banks for working capital requirements amounting to P=2,053.90 million, which bears interest ranging from 1.12%<br />

to 1.65% and P=1,756.76 million, which bears interest ranging from 1.57% to 1.91% as of December 31, 2012<br />

and 2011, respectively. T<strong>here</strong> is no outstanding notes payable as of December 31, 2010.<br />

Long-term debt consists of:<br />

2012 2011 2010<br />

(In Thousand Pesos)<br />

Banks:<br />

Local P=38,164,986 P=27,555,234 P=20,352,194<br />

Foreign 5,829,588 3,541,621 7,317,483<br />

Corporate notes 5,819,400 10,839,226 17,729,939<br />

Retail bonds 9,911,546 4,985,865 4,971,854<br />

59,725,520 46,921,946 50,371,470<br />

Less current portion 9,294,888 9,597,367 8,677,209<br />

P=50,430,632 P=37,324,579 P=41,694,261<br />

The maturities of long-term debt at nominal values, excluding unamortized debt issuance costs, as of<br />

December 31, 2012 follow (amounts in thousands):<br />

Due in:<br />

2013 P=9,731,079<br />

2014 6,737,634<br />

2015 8,497,945<br />

2016 2,669,850<br />

2017 and t<strong>here</strong>after 32,403,080<br />

P=60,039,588<br />

Unamortized debt issuance costs included in the above long-term debt as of December 31, 2012, 2011 and<br />

2010 amounted to P=314.07 million, P=212.03 million and P=279.24 million, respectively (see Note 28.2.3).<br />

Total interest expense recognized, excluding the capitalized interest, amounted to P=2,086.08 million,<br />

P=2,059.66 million and P=1,981.79 million in 2012, 2011 and 2010, respectively (see Notes 7 and 22).<br />

The interest rates and maturities of the above debt are as follows:<br />

Maturities<br />

Interest Rates<br />

Banks:<br />

Local 2013–2022 1.19% to 7.03% in 2012<br />

1.42% to 7.03% in 2011<br />

5.26% to 7.03% in 2010<br />

Foreign 2013–2022 1.83% to 4.19% in 2012<br />

0.68% to 3.86% in 2011<br />

0.74% to 4.13% in 2010<br />

Corporate notes 2013–2016 1.83% to 8.43% in 2012<br />

2.78% to 8.43% in 2011<br />

5.52% to 8.38% in 2010<br />

Retail bonds 2017–2019 5.75% to 6.00% in 2012<br />

7.50% to 8.00% in 2011<br />

7.50% to 8.00% in 2010<br />

176 177