here - Ayala

here - Ayala

here - Ayala

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Globe 2012 annual report<br />

financial report<br />

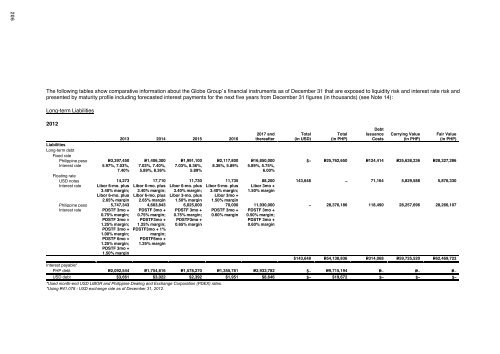

The following tables show comparative information about the Globe Group’s financial instruments as of December 31 that are exposed to liquidity risk and interest rate risk and<br />

presented by maturity profile including forecasted interest payments for the next five years from December 31 figures (in thousands) (see Note 14):<br />

Long-term Liabilities<br />

2012<br />

2013 2014 2015 2016<br />

2017 and<br />

t<strong>here</strong>after<br />

Total<br />

(in USD)<br />

Total<br />

(in PHP)<br />

Debt<br />

Issuance<br />

Costs<br />

Carrying Value<br />

(in PHP)<br />

Liabilities<br />

Long-term debt<br />

Fixed rate<br />

Philippine peso P=3,397,450 P=1,406,300 P=1,991,100 P=2,117,800 P=16,850,000 $– P=25,762,650 P=124,414 P=25,638,236 P=28,327,286<br />

Interest rate 5.97%, 7.03%,<br />

7.40%<br />

7.03%, 7.40%,<br />

5.89%, 8.36%<br />

7.03%, 8.36%,<br />

5.89%<br />

8.36%, 5.89% 5.89%, 5.75%,<br />

6.00%<br />

Floating rate<br />

USD notes 14,273 17,710 11,730 11,735 88,200 143,648 – 71,164 5,829,588 5,876,330<br />

Interest rate Libor 6-mo. plus<br />

3.40% margin;<br />

Libor 6-mo. plus<br />

2.65% margin<br />

Libor 6-mo. plus<br />

3.40% margin;<br />

Libor 6-mo. plus<br />

2.65% margin<br />

Libor 6-mo. plus<br />

3.40% margin;<br />

Libor 3-mo. plus<br />

1.50% margin<br />

Libor 6-mo. plus<br />

3.40% margin;<br />

Libor 3mo +<br />

1.50% margin<br />

Libor 3mo +<br />

1.50% margin<br />

Fair Value<br />

(in PHP)<br />

Philippine peso 5,747,343 4,603,843 6,025,000 70,000 11,930,000 – 28,376,186 118,490 28,257,696 28,266,107<br />

Interest rate PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF 3mo +<br />

1.25% margin;<br />

PDSTF 3mo +<br />

1.00% margin;<br />

PDSTF 6mo +<br />

1.25% margin;<br />

PDSTF 3mo +<br />

1.50% margin<br />

PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF3mo +<br />

1.25% margin;<br />

PDSTF3mo + 1%<br />

margin;<br />

PDSTF6mo +<br />

1.25% margin<br />

PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF3mo +<br />

0.65% margin<br />

PDSTF 3mo +<br />

0.60% margin<br />

PDSTF 3mo +<br />

0.50% margin;<br />

PDSTF 3mo +<br />

0.60% margin<br />

$143,648 P=54,138,836 P=314,068 P=59,725,520 P=62,469,723<br />

Interest payable*<br />

PHP debt P=2,092,544 P=1,754,816 P=1,578,270 P=1,355,781 P=2,933,782 $– P=9,715,194 P=– P=– P=–<br />

USD debt $3,661 $3,022 $2,392 $1,951 $8,646 $– $19,672 $– $– $–<br />

*Used month-end USD LIBOR and Philippine Dealing and Exchange Corporation (PDEX) rates.<br />

*Using P=41.078 - USD exchange rate as of December 31, 2012.<br />

2011<br />

2012 2013 2014 2015<br />

2016 and<br />

t<strong>here</strong>after<br />

Total<br />

(in USD)<br />

Total<br />

(in PHP)<br />

Debt<br />

Issuance<br />

Costs<br />

Carrying Value<br />

(in PHP)<br />

Liabilities<br />

Long-term debt<br />

Fixed rate<br />

Philippine peso P=7,033,150 P=3,397,450 P=4,381,850 P=1,941,100 P=2,067,800 $– P=18,821,350 P=38,718 P=18,782,632 P=20,270,049<br />

Interest rate 5.97%, 7.03%,<br />

7.4%, 7.5%<br />

5.97%, 7.03%,<br />

7.4%<br />

7.03%, 7.4%,<br />

8%, 8.36%<br />

7.03%, 8.36% 8.36%<br />

Floating rate<br />

USD notes $28,643 $14,273 $17,710 $10,830 $10,834 82,290 – 72,474 3,541,621 3,618,373<br />

Interest rate Libor 6-mo. plus<br />

3.4% margin;<br />

Libor 6-mo. plus<br />

2.65% margin;<br />

3mo or 6mo<br />

LIBOR + .43%<br />

margin (rounded<br />

to 1/16%); 6mo<br />

LIBOR + 3%<br />

margin<br />

Libor 6-mo. plus<br />

3.4% margin;<br />

Libor 6-mo. plus<br />

2.65% margin<br />

Libor 6-mo. plus<br />

3.4% margin;<br />

Libor 6-mo. plus<br />

2.65% margin<br />

Libor 6-mo.plus<br />

3.4% margin<br />

Libor 6-mo.plus<br />

3.4% margin<br />

Philippine peso P=1,322,343 P=5,747,343 P=4,603,843 P=6,025,000 P=7,000,000 – 24,698,529 100,836 24,597,693 24,608,340<br />

Interest rate PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF3mo +<br />

1.25% margin;<br />

PDSTF6mo +<br />

1.25% margin;<br />

PDSTF 3mo + 1%<br />

margin<br />

PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF3mo +<br />

1.25% margin;<br />

PDSTF6mo +<br />

1.25% margin;<br />

PDSTF 3mo + 1%<br />

margin<br />

PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF3mo +<br />

1.25% margin;<br />

PDSTF6mo +<br />

1.25% margin;<br />

PDSTF 3mo + 1%<br />

margin<br />

PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF-3 month +<br />

0.65% margin<br />

PDSTF 3mo +<br />

0.75% margin;<br />

PDSTF 3mo +<br />

.35% margin<br />

Fair Value<br />

(in PHP)<br />

$82,290 P=43,519,879 P=212,028 P=46,921,946 P=48,496,762<br />

Interest payable*<br />

PHP debt P=1,711,349 P=1,376,164 P=813,874 P=525,410 P=423,967 $– P=4,850,764 P=– P=– P=–<br />

USD debt $2,718 $2,104 $1,483 $810 $348 $– $7,463 $– $– $–<br />

*Used month-end USD LIBOR and Philippine Dealing and Exchange Corporation (PDEX) rates.<br />

*Using P=43.92 - USD exchange rate as of December 31, 2011.<br />

206 207