here - Ayala

here - Ayala

here - Ayala

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Globe 2012 annual report<br />

corporate governance<br />

T<strong>here</strong> were no disagreements with the Company’s<br />

independent auditors on any matter of accounting principles<br />

or practices, financial statement disclosures, or auditing<br />

scope or procedures.<br />

Fees approved in connection with the audit and audit-related<br />

services rendered by SGV & Co. and other EY Firms,<br />

pursuant to the regulatory and statutory requirements for<br />

the years ended 31 December 2012 and 2011 amounted<br />

to ₱16.55 million and ₱15.95 million, respectively, inclusive<br />

of 10% out-of-pocket expenses (OPE). In addition to<br />

performing the audit of Globe Group’s financial statements,<br />

SGV & Co. and other EY Firms were also selected, in<br />

accordance with established procurement policies, to provide<br />

other services in 2012 and 2011.<br />

The Audit Committee has an existing policy to review and to<br />

pre-approve the audit and non-audit services rendered by the<br />

Company’s independent auditors. It does not allow the Globe<br />

Group to engage the independent auditors for certain nonaudit<br />

services expressly prohibited by SEC regulations to<br />

be performed by an independent auditor for its audit clients.<br />

This is to ensure that the independent auditors maintain the<br />

highest level of independence from the Company, both in<br />

fact and appearance.<br />

The Audit Committee has reviewed the nature of all nonaudit<br />

services rendered by SGV & Co., EY India and EY US<br />

and the corresponding fees, and concluded that these do<br />

not impair their independence. SGV & Co. has confirmed to<br />

the Audit Committee that the non-audit services rendered by<br />

them and the other EY Firms are services that are allowed<br />

to be provided to an audit client under existing regulations<br />

and the Code of Ethics of Professional Accountants in the<br />

Philippines and does not conflict with their existing role as<br />

external auditors of the Company.<br />

DEALINGS IN SECURITIES<br />

Globe has adopted strict policies and guidelines for trades involving the Company’s shares made by key officers and those<br />

with access to material non-public information. Key officers and those with access to the quarterly results in the course of<br />

its review are prohibited from trading in Globe Telecom’s shares starting from the time when quarterly results are internally<br />

reviewed until after Globe publicly discloses its results. Notices of trading blackouts are regularly issued to the officers<br />

concerned and compliance is monitored by the Corporate and Legal Services Group. Also, all key officers are required<br />

to submit a report on their trades to the compliance officer, for submission to the SEC in accordance with the Securities<br />

Regulation Code.<br />

Stockholders<br />

<strong>Ayala</strong> Corp.<br />

SingTel<br />

Common<br />

Shares<br />

40,319,263<br />

62,646,487<br />

% of<br />

Common<br />

30.5%<br />

47.3%<br />

Preferred<br />

Shares<br />

-<br />

-<br />

% of<br />

Preferred<br />

Shares<br />

0.0%<br />

0.0%<br />

Total<br />

40,319,263<br />

62,646,487<br />

% of<br />

Total<br />

13.9%<br />

21.5%<br />

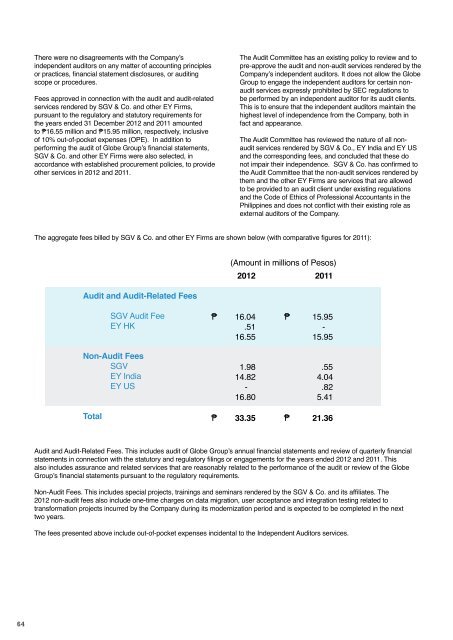

The aggregate fees billed by SGV & Co. and other EY Firms are shown below (with comparative figures for 2011):<br />

Asiacom<br />

-<br />

0.0%<br />

158,515,021<br />

100.0%<br />

158,515,021<br />

54.5%<br />

Public *<br />

29,440,068<br />

22.2%<br />

-<br />

0.0%<br />

29,440,068<br />

10.1%<br />

(Amount in millions of Pesos)<br />

2012<br />

2011<br />

Total<br />

132,405,818<br />

100.0%<br />

158,515,021<br />

100.0%<br />

290,920,839<br />

100.0%<br />

Audit and Audit-Related Fees<br />

*Includes shares held by Globe directors, officers and employees through ESOP (Executive Stock Option Plan)<br />

SGV Audit Fee<br />

EY HK<br />

Non-Audit Fees<br />

SGV<br />

EY India<br />

EY US<br />

₱ 16.04<br />

.51<br />

16.55<br />

1.98<br />

14.82<br />

-<br />

16.80<br />

₱ 15.95<br />

-<br />

15.95<br />

.55<br />

4.04<br />

.82<br />

5.41<br />

OWNERSHIP STRUCTURE<br />

Globe Telecom regularly discloses the top 100 shareholders of the common and preferred equity securities of the Company.<br />

Disclosure is also made of the security ownership of certain record and beneficial owners who hold more than 5% of the<br />

Company’s common and preferred shares. Finally, the shareholdings and percentage ownership of the directors and key officers<br />

are disclosed in the Definitive Information Statement sent to the shareholders prior to the ASM.<br />

As of December 31, 2012, public float was at 22.13%. See Public Ownership Report on page 135.<br />

Total<br />

₱ 33.35<br />

₱ 21.36<br />

Audit and Audit-Related Fees. This includes audit of Globe Group’s annual financial statements and review of quarterly financial<br />

statements in connection with the statutory and regulatory filings or engagements for the years ended 2012 and 2011. This<br />

also includes assurance and related services that are reasonably related to the performance of the audit or review of the Globe<br />

Group’s financial statements pursuant to the regulatory requirements.<br />

Non-Audit Fees. This includes special projects, trainings and seminars rendered by the SGV & Co. and its affiliates. The<br />

2012 non-audit fees also include one-time charges on data migration, user acceptance and integration testing related to<br />

transformation projects incurred by the Company during its modernization period and is expected to be completed in the next<br />

two years.<br />

The fees presented above include out-of-pocket expenses incidental to the Independent Auditors services.<br />

64 65