here - Ayala

here - Ayala

here - Ayala

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Globe 2012 annual report<br />

financial report<br />

2. Summary of Significant Accounting and Financial Reporting Policies<br />

2.1 Basis of Financial Statement Preparation<br />

The accompanying consolidated financial statements of Globe Telecom, Inc. and Subsidiaries, collectively<br />

referred to as the “Globe Group”, have been prepared under the historical cost convention method, except for<br />

derivative financial instruments and available-for-sale (AFS) investments that are measured at fair value.<br />

The consolidated financial statements of the Globe Group are presented in Philippine Peso (P=), Globe<br />

Telecom’s functional currency, and rounded to the nearest thousands, except when otherwise indicated.<br />

On February 5, 2013, the Board of Directors (BOD) approved and authorized the release of the consolidated<br />

financial statements of Globe Telecom, Inc. and Subsidiaries as of and for the years ended December 31, 2012,<br />

2011 and 2010.<br />

2.2 Statement of Compliance<br />

The consolidated financial statements of the Globe Group have been prepared in compliance with Philippine<br />

Financial Reporting Standards (PFRS).<br />

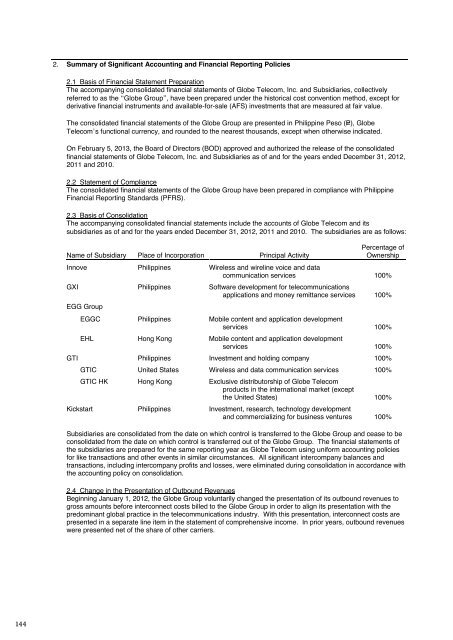

2.3 Basis of Consolidation<br />

The accompanying consolidated financial statements include the accounts of Globe Telecom and its<br />

subsidiaries as of and for the years ended December 31, 2012, 2011 and 2010. The subsidiaries are as follows:<br />

Name of Subsidiary Place of Incorporation Principal Activity<br />

Percentage of<br />

Ownership<br />

Innove Philippines Wireless and wireline voice and data<br />

communication services 100%<br />

GXI Philippines Software development for telecommunications<br />

applications and money remittance services 100%<br />

EGG Group<br />

EGGC Philippines Mobile content and application development<br />

services 100%<br />

EHL Hong Kong Mobile content and application development<br />

services 100%<br />

GTI Philippines Investment and holding company 100%<br />

GTIC United States Wireless and data communication services 100%<br />

GTIC HK Hong Kong Exclusive distributorship of Globe Telecom<br />

products in the international market (except<br />

the United States) 100%<br />

Kickstart Philippines Investment, research, technology development<br />

and commercializing for business ventures 100%<br />

Subsidiaries are consolidated from the date on which control is transferred to the Globe Group and cease to be<br />

consolidated from the date on which control is transferred out of the Globe Group. The financial statements of<br />

the subsidiaries are prepared for the same reporting year as Globe Telecom using uniform accounting policies<br />

for like transactions and other events in similar circumstances. All significant intercompany balances and<br />

transactions, including intercompany profits and losses, were eliminated during consolidation in accordance with<br />

the accounting policy on consolidation.<br />

2.4 Change in the Presentation of Outbound Revenues<br />

Beginning January 1, 2012, the Globe Group voluntarily changed the presentation of its outbound revenues to<br />

gross amounts before interconnect costs billed to the Globe Group in order to align its presentation with the<br />

predominant global practice in the telecommunications industry. With this presentation, interconnect costs are<br />

presented in a separate line item in the statement of comprehensive income. In prior years, outbound revenues<br />

were presented net of the share of other carriers.<br />

The change was accounted for retrospectively, and accordingly, the Globe Group restated its comparative<br />

statements of comprehensive income. The change has no impact on consolidated net income, earnings per<br />

share, cash flows and statements of financial position. The table below shows the affected line items in our<br />

financial information for the year ended December 31, 2011 and 2010:<br />

As restated<br />

December 31, 2011 December 31, 2010<br />

As previously<br />

presented Change As restated<br />

(In Thousand Pesos)<br />

As previously<br />

presented<br />

Change<br />

Revenues P=77,764,964 P=67,811,301 P=9,953,663 P=72,742,090 P=62,554,689 P=10,187,401<br />

Expenses 68,612,584 58,658,921 9,953,663 62,805,207 52,617,806 10,187,401<br />

2.5 Changes in Accounting Policies<br />

The accounting policies adopted are consistent with those of the previous financial year, except for the following<br />

new and amended Philippine Accounting Standards (PAS) and PFRS effective as of January 1, 2012. Except<br />

as otherwise indicated, the adoption of the new and amended Standards and Interpretations, did not have a<br />

significant impact on the consolidated financial statements.<br />

PAS 12, Income Taxes, Deferred Tax: Recovery of Underlying Assets<br />

This Amendment to PAS 12 is effective for annual periods beginning on or after January 1, 2012. The<br />

Amendment clarifies the determination of deferred tax on investment property measured at fair value. The<br />

amendment introduces a rebuttable presumption that deferred tax on investment property measured using<br />

the fair value model in PAS 40, Investment Property, should be determined on the basis that its carrying<br />

amount will be recovered through sale. Furthermore, it introduces the requirement that deferred tax on nondepreciable<br />

assets that are measured using the revaluation model in PAS 16, Property, Plant and<br />

Equipment, always be measured on a sale basis of the asset. The Globe Group accounts for its property<br />

and equipment and investment properties at cost, thus, the Amendment does not have an effect to the<br />

Globe Group.<br />

PFRS 7, Financial Instruments: Disclosures – Enhanced Derecognition Disclosure Requirements<br />

The Amendments to PFRS 7 are effective for annual periods beginning on or after July 1, 2011. The<br />

amendments require additional disclosure about financial assets that have been transferred but not<br />

derecognized to enable the user of the entity’s financial statements to understand the relationship with<br />

those assets that have not been derecognized and their associated liabilities. In addition, the amendments<br />

require disclosures about continuing involvement in derecognized assets to enable the user to evaluate the<br />

nature of, and risks associated with, the entity’s continuing involvement in those derecognized assets.<br />

2.6 Future Changes in Accounting Policies<br />

The Globe Group will adopt the following new and amended standards enumerated below when these become<br />

effective. Except as otherwise indicated, the Globe Group does not expect the adoption of these new and<br />

amended PAS and PFRS to have significant impact on the consolidated financial statements.<br />

Effective January 1, 2013<br />

Amendments to PAS 1, Financial Statement Presentation, Presentation of Items of Other Comprehensive<br />

Income<br />

The Amendment changed the grouping of items presented in other comprehensive income. Items that<br />

could be reclassified (or ‘recycled’) to profit or loss at a future point in time (for example, upon<br />

derecognition or settlement) would be presented separately from items that will never be reclassified.<br />

PFRS 7, Financial Instruments: Disclosures – Offsetting Financial Assets and Financial Liabilities<br />

The Amendments to PFRS 7 are to be retrospectively applied for annual periods beginning on or after<br />

January 1, 2013. These Amendments require an entity to disclose information about rights of set-off and<br />

related arrangements (such as collateral agreements). The new disclosures are required for all recognized<br />

financial instruments that are set off in accordance with PAS 32, Financial Instruments: Presentation.<br />

These disclosures also apply to recognized financial instruments that are subject to an enforceable master<br />

netting arrangement or ‘similar agreement’, irrespective of whether they are set-off in accordance with<br />

PAS 32. The amendments require entities to disclose, in a tabular format unless another format is more<br />

appropriate, certain minimum quantitative information.<br />

PFRS 10, Consolidated Financial Statements<br />

PFRS 10 replaces the portion of PAS 27, Consolidated and Separate Financial Statements, that addresses<br />

the accounting for consolidated financial statements. It also includes the issues raised in SIC 12,<br />

Consolidation - Special Purpose Entities.<br />

144 145