here - Ayala

here - Ayala

here - Ayala

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Globe 2012 annual report<br />

financial report<br />

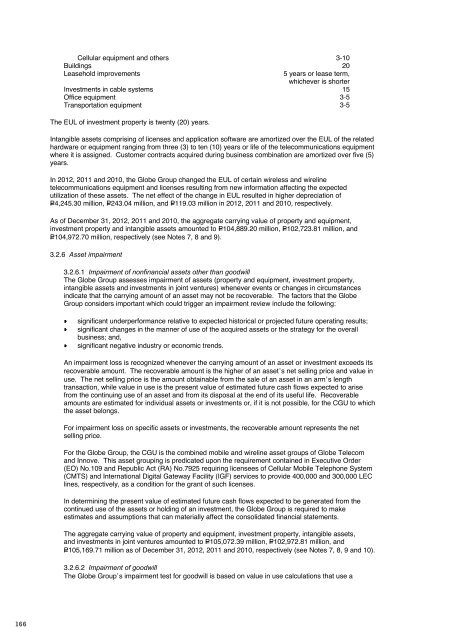

Cellular equipment and others 3-10<br />

Buildings 20<br />

Leasehold improvements<br />

5 years or lease term,<br />

whichever is shorter<br />

Investments in cable systems 15<br />

Office equipment 3-5<br />

Transportation equipment 3-5<br />

The EUL of investment property is twenty (20) years.<br />

Intangible assets comprising of licenses and application software are amortized over the EUL of the related<br />

hardware or equipment ranging from three (3) to ten (10) years or life of the telecommunications equipment<br />

w<strong>here</strong> it is assigned. Customer contracts acquired during business combination are amortized over five (5)<br />

years.<br />

In 2012, 2011 and 2010, the Globe Group changed the EUL of certain wireless and wireline<br />

telecommunications equipment and licenses resulting from new information affecting the expected<br />

utilization of these assets. The net effect of the change in EUL resulted in higher depreciation of<br />

P=4,245.30 million, P=243.04 million, and P=119.03 million in 2012, 2011 and 2010, respectively.<br />

As of December 31, 2012, 2011 and 2010, the aggregate carrying value of property and equipment,<br />

investment property and intangible assets amounted to P=104,889.20 million, P=102,723.81 million, and<br />

P=104,972.70 million, respectively (see Notes 7, 8 and 9).<br />

3.2.6 Asset impairment<br />

3.2.6.1 Impairment of nonfinancial assets other than goodwill<br />

The Globe Group assesses impairment of assets (property and equipment, investment property,<br />

intangible assets and investments in joint ventures) whenever events or changes in circumstances<br />

indicate that the carrying amount of an asset may not be recoverable. The factors that the Globe<br />

Group considers important which could trigger an impairment review include the following:<br />

significant underperformance relative to expected historical or projected future operating results;<br />

significant changes in the manner of use of the acquired assets or the strategy for the overall<br />

business; and,<br />

significant negative industry or economic trends.<br />

An impairment loss is recognized whenever the carrying amount of an asset or investment exceeds its<br />

recoverable amount. The recoverable amount is the higher of an asset’s net selling price and value in<br />

use. The net selling price is the amount obtainable from the sale of an asset in an arm’s length<br />

transaction, while value in use is the present value of estimated future cash flows expected to arise<br />

from the continuing use of an asset and from its disposal at the end of its useful life. Recoverable<br />

amounts are estimated for individual assets or investments or, if it is not possible, for the CGU to which<br />

the asset belongs.<br />

For impairment loss on specific assets or investments, the recoverable amount represents the net<br />

selling price.<br />

For the Globe Group, the CGU is the combined mobile and wireline asset groups of Globe Telecom<br />

and Innove. This asset grouping is predicated upon the requirement contained in Executive Order<br />

(EO) No.109 and Republic Act (RA) No.7925 requiring licensees of Cellular Mobile Telephone System<br />

(CMTS) and International Digital Gateway Facility (IGF) services to provide 400,000 and 300,000 LEC<br />

lines, respectively, as a condition for the grant of such licenses.<br />

In determining the present value of estimated future cash flows expected to be generated from the<br />

continued use of the assets or holding of an investment, the Globe Group is required to make<br />

estimates and assumptions that can materially affect the consolidated financial statements.<br />

The aggregate carrying value of property and equipment, investment property, intangible assets,<br />

and investments in joint ventures amounted to P=105,072.39 million, P=102,972.81 million, and<br />

P=105,169.71 million as of December 31, 2012, 2011 and 2010, respectively (see Notes 7, 8, 9 and 10).<br />

3.2.6.2 Impairment of goodwill<br />

The Globe Group’s impairment test for goodwill is based on value in use calculations that use a<br />

discounted cash flow model. The cash flows are derived from the budget for the next five years and do<br />

not include restructuring activities that the Group is not yet committed to or significant future<br />

investments that will enhance the asset base of the CGU being tested. The recoverable amount is<br />

most sensitive to the discount rate used for the discounted cash flow model as well, as the expected<br />

future cash inflows and the growth rate used for extrapolation purposes. As of December 31, 2012,<br />

2011 and 2010, the carrying value of goodwill amounted to P=327.13 million (see Note 9).<br />

Goodwill acquired through business combination with EGG Group was allocated to the mobile content<br />

and applications development services business CGU, which is part of the “Others” reporting segment<br />

(see Note 29).<br />

The recoverable amount of the CGU, which exceeds the carrying amount of the related goodwill by<br />

P=962.34 million, P=461.88 million, and P=165.30 million as of December 31, 2012, 2011 and 2010,<br />

respectively, has been determined based on value in use calculations using cash flow projections from<br />

financial budgets covering a five-year period. The pretax discount rate applied to cash flow projections<br />

was 11% in 2012 and 2011 and 12% in 2010, and cash flows beyond the five-year period are<br />

extrapolated using a 3% long-term growth rate in 2012, 2011 and 2010.<br />

3.2.7 Deferred income tax assets<br />

The carrying amounts of deferred income tax assets are reviewed at each reporting date and reduced to<br />

the extent that it is no longer probable that sufficient taxable income will be available to allow all or part of<br />

the deferred income tax assets to be utilized (see Note 24).<br />

As of December 31, 2012 and 2011, Innove, GXI and EGG Group has net deferred income tax assets<br />

amounting to P=765.59 million and P=765.67 million, respectively, while as of December 31, 2010, Innove and<br />

EGG Group has net deferred income tax assets amounting to P=670.59 million.<br />

As of December 31, 2012, 2011 and 2010, Globe Telecom has net deferred income tax liabilities amounting<br />

to P=2,473.12 million, P=3,929.41 million, and P=4,620.49 million, respectively (see Note 24). Globe Telecom<br />

and Innove have no unrecognized deferred income tax assets as of December 31, 2012, 2011 and 2010.<br />

As of December 31, 2012 and 2011, GXI recognized deferred income tax assets from NOLCO amounting<br />

to P=15.01 million and P=1.01 million, respectively (see Note 24).<br />

As of December 31, 2010, Innove and EGG Group’s recognized deferred income tax assets from NOLCO<br />

amounted to P=13.50 million and MCIT amounted to P=0.95 million (see Note 24).<br />

3.2.8 Financial assets and financial liabilities<br />

Globe Group carries certain financial assets and liabilities at fair value, which requires extensive use of<br />

accounting estimates and judgment. While significant components of fair value measurement were<br />

determined using verifiable objective evidence (i.e., foreign exchange rates, interest rates), the amount of<br />

changes in fair value would differ if the Globe Group utilized different valuation methodologies. Any<br />

changes in fair value of these financial assets and financial liabilities would affect the consolidated<br />

statements of comprehensive income and consolidated statements of changes in equity.<br />

Financial assets comprising AFS investments and derivative assets carried at fair values as of<br />

December 31, 2012, 2011 and 2010, amounted to P=141.87 million, P=109.09 million, and P=121.77 million,<br />

respectively, and financial liabilities comprising of derivative liabilities carried at fair values as of<br />

December 31, 2012, 2011 and 2010, amounted to P=240.65 million, P=266.62 million, and P=245.87 million,<br />

respectively (see Note 28.11).<br />

3.2.9 Pension and other employee benefits<br />

The determination of the obligation and cost of pension is dependent on the selection of certain<br />

assumptions used in calculating such amounts. Those assumptions include, among others, discount rates,<br />

expected returns on plan assets and salary rates increase (see Note 18). In accordance with PAS 19,<br />

actual results that differ from the Globe Group’s assumptions, subject to the 10% corridor test, are<br />

accumulated and amortized over future periods and t<strong>here</strong>fore, generally affect the recognized expense and<br />

recorded obligation in such future periods.<br />

As of December 31, 2012, 2011 and 2010, Globe Group has unrecognized net actuarial losses of<br />

P=1,512.30 million, P=1,215.69 million, and P=781.01 million, respectively (see Note 18.2). As of the same<br />

dates, net pension asset amounted to P=671.08 million, P=872.10 million and P=950.52 million, respectively.<br />

166 167