here - Ayala

here - Ayala

here - Ayala

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Globe 2012 annual report<br />

financial report<br />

Independent Auditor's Report<br />

GLOBE TELECOM, INC. AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION<br />

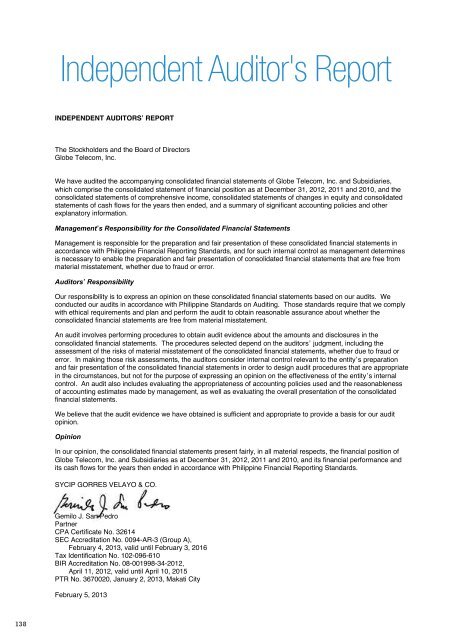

INDEPENDENT AUDITORS’ REPORT<br />

ASSETS<br />

December 31<br />

Notes 2012 2011 2010<br />

(In Thousand Pesos)<br />

The Stockholders and the Board of Directors<br />

Globe Telecom, Inc.<br />

We have audited the accompanying consolidated financial statements of Globe Telecom, Inc. and Subsidiaries,<br />

which comprise the consolidated statement of financial position as at December 31, 2012, 2011 and 2010, and the<br />

consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated<br />

statements of cash flows for the years then ended, and a summary of significant accounting policies and other<br />

explanatory information.<br />

Management’s Responsibility for the Consolidated Financial Statements<br />

Management is responsible for the preparation and fair presentation of these consolidated financial statements in<br />

accordance with Philippine Financial Reporting Standards, and for such internal control as management determines<br />

is necessary to enable the preparation and fair presentation of consolidated financial statements that are free from<br />

material misstatement, whether due to fraud or error.<br />

Auditors’ Responsibility<br />

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We<br />

conducted our audits in accordance with Philippine Standards on Auditing. Those standards require that we comply<br />

with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the<br />

consolidated financial statements are free from material misstatement.<br />

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the<br />

consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the<br />

assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or<br />

error. In making those risk assessments, the auditors consider internal control relevant to the entity’s preparation<br />

and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate<br />

in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal<br />

control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness<br />

of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated<br />

financial statements.<br />

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit<br />

opinion.<br />

Opinion<br />

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of<br />

Globe Telecom, Inc. and Subsidiaries as at December 31, 2012, 2011 and 2010, and its financial performance and<br />

its cash flows for the years then ended in accordance with Philippine Financial Reporting Standards.<br />

SYCIP GORRES VELAYO & CO.<br />

Gemilo J. San Pedro<br />

Partner<br />

CPA Certificate No. 32614<br />

SEC Accreditation No. 0094-AR-3 (Group A),<br />

February 4, 2013, valid until February 3, 2016<br />

Tax Identification No. 102-096-610<br />

BIR Accreditation No. 08-001998-34-2012,<br />

April 11, 2012, valid until April 10, 2015<br />

PTR No. 3670020, January 2, 2013, Makati City<br />

Current Assets<br />

Cash and cash equivalents 28, 30 P=6,759,755 P=5,159,046 P=5,868,986<br />

Receivables - net 4, 28 12,105,437 10,119,505 8,374,123<br />

Inventories and supplies 5 2,076,176 1,911,190 1,839,333<br />

Derivative assets 28 421 9,766 19,888<br />

Prepayments and other current assets - net 6, 28 12,308,248 5,586,419 4,704,198<br />

33,250,037 22,785,926 20,806,528<br />

Assets classified as held for sale 25.4 778,321 778,321 778,321<br />

34,028,358 23,564,247 21,584,849<br />

Noncurrent Assets<br />

Property and equipment - net 7, 8 101,422,364 99,267,780 101,837,254<br />

Investment property - net 8 – 191,645 214,192<br />

Intangible assets and goodwill - net 7, 9 3,793,958 3,591,514 3,248,376<br />

Investments in joint ventures 10 183,193 249,000 197,016<br />

Deferred income tax - net 24 765,585 765,670 670,594<br />

Other noncurrent assets - net 11, 18 8,239,618 3,209,477 2,875,686<br />

114,404,718 107,275,086 109,043,118<br />

Total Assets P=148,433,076 P=130,839,333 P=130,627,967<br />

LIABILITIES AND EQUITY<br />

Current Liabilities<br />

Accounts payable and accrued expenses 12, 18, 28 P=29,735,614 P=23,042,514 P=22,115,203<br />

Notes payable 14, 28 2,053,900 1,756,760 –<br />

Current portion of long-term debt 14, 28 9,294,888 9,597,367 8,677,209<br />

Unearned revenues 4 2,502,903 2,474,142 2,402,749<br />

Derivative liabilities 28 235,633 208,247 93,336<br />

Income tax payable 24 1,341,583 1,157,927 1,098,492<br />

Provisions 13 203,191 166,773 224,388<br />

45,367,712 38,403,730 34,611,377<br />

Liabilities directly associated with the assets<br />

classified as held for sale 25.4 459,760 583,365 697,729<br />

45,827,472 38,987,095 35,309,106<br />

Noncurrent Liabilities<br />

Deferred income tax - net 24 2,473,115 3,929,414 4,620,490<br />

Long-term debt - net of current portion 14, 28 50,430,632 37,324,579 41,694,261<br />

Derivative liabilities 28 5,021 58,370 152,529<br />

Other long-term liabilities - net of current portion 15, 28 2,942,152 2,111,719 1,982,453<br />

55,850,920 43,424,082 48,449,733<br />

Total Liabilities 101,678,392 82,411,177 83,758,839<br />

Equity<br />

Paid-up capital 17 34,095,976 33,967,476 33,946,004<br />

Cost of share-based payments 16, 18 472,911 573,436 544,794<br />

Other reserves 17, 28 (44,588) (124,902) (88,310)<br />

Retained earnings 17 12,230,385 14,012,146 12,466,640<br />

Total Equity 46,754,684 48,428,156 46,869,128<br />

Total Liabilities and Equity P=148,433,076 P=130,839,333 P=130,627,967<br />

See accompanying Notes to Consolidated Financial Statements.<br />

February 5, 2013<br />

138 139