here - Ayala

here - Ayala

here - Ayala

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Globe 2012 annual report<br />

financial report<br />

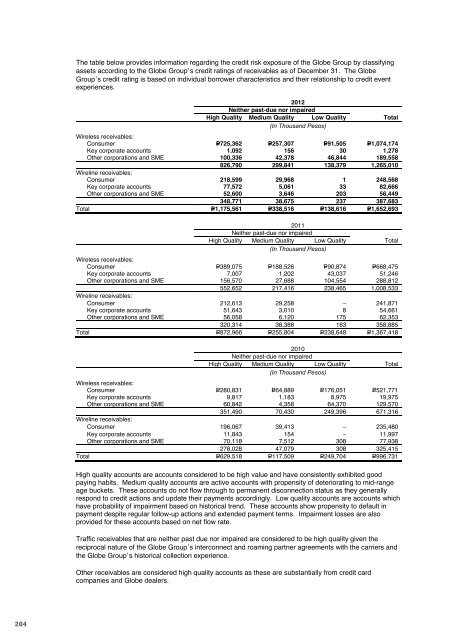

The table below provides information regarding the credit risk exposure of the Globe Group by classifying<br />

assets according to the Globe Group’s credit ratings of receivables as of December 31. The Globe<br />

Group’s credit rating is based on individual borrower characteristics and their relationship to credit event<br />

experiences.<br />

2012<br />

Neither past-due nor impaired<br />

High Quality Medium Quality Low Quality Total<br />

(In Thousand Pesos)<br />

Wireless receivables:<br />

Consumer P=725,362 P=257,307 P=91,505 P=1,074,174<br />

Key corporate accounts 1,092 156 30 1,278<br />

Other corporations and SME 100,336 42,378 46,844 189,558<br />

826,790 299,841 138,379 1,265,010<br />

Wireline receivables:<br />

Consumer 218,599 29,968 1 248,568<br />

Key corporate accounts 77,572 5,061 33 82,666<br />

Other corporations and SME 52,600 3,646 203 56,449<br />

348,771 38,675 237 387,683<br />

Total P=1,175,561 P=338,516 P=138,616 P=1,652,693<br />

2011<br />

Neither past-due nor impaired<br />

High Quality Medium Quality Low Quality Total<br />

(In Thousand Pesos)<br />

Wireless receivables:<br />

Consumer P=389,075 P=188,526 P=90,874 P=668,475<br />

Key corporate accounts 7,007 1,202 43,037 51,246<br />

Other corporations and SME 156,570 27,688 104,554 288,812<br />

552,652 217,416 238,465 1,008,533<br />

Wireline receivables:<br />

Consumer 212,613 29,258 – 241,871<br />

Key corporate accounts 51,643 3,010 8 54,661<br />

Other corporations and SME 56,058 6,120 175 62,353<br />

320,314 38,388 183 358,885<br />

Total P=872,966 P=255,804 P=238,648 P=1,367,418<br />

2010<br />

Neither past-due nor impaired<br />

High Quality Medium Quality Low Quality Total<br />

(In Thousand Pesos)<br />

Wireless receivables:<br />

Consumer P=280,831 P=64,889 P=176,051 P=521,771<br />

Key corporate accounts 9,817 1,183 8,975 19,975<br />

Other corporations and SME 60,842 4,358 64,370 129,570<br />

351,490 70,430 249,396 671,316<br />

Wireline receivables:<br />

Consumer 196,067 39,413 – 235,480<br />

Key corporate accounts 11,843 154 – 11,997<br />

Other corporations and SME 70,118 7,512 308 77,938<br />

278,028 47,079 308 325,415<br />

Total P=629,518 P=117,509 P=249,704 P=996,731<br />

The following is a reconciliation of the changes in the allowance for impairment losses for receivables as of<br />

December 31 (in thousand pesos) (see Notes 4 and 23):<br />

Subscribers<br />

Other<br />

corporations<br />

and SME<br />

2012<br />

Traffic<br />

Settlements<br />

and Others<br />

Consumer<br />

Key corporate<br />

accounts<br />

Non-trade<br />

(Note 6) Total<br />

At beginning of year P=2,433,222 P=263,464 P=434,603 P=249,341 P=88,356 P=3,468,986<br />

Charges for the year 1,121,634 85,006 173,994 (20,485) 17,168 1,377,317<br />

Reversals/write offs/ adjustments (1,101,590) (28,066) (65,253) (7,798) 18,558 (1,184,149)<br />

At end of year P=2,453,266 P=320,404 P=543,344 P=221,058 P=124,082 P=3,662,154<br />

Subscribers<br />

Other<br />

corporations<br />

and SME<br />

2011<br />

Traffic<br />

Settlements<br />

and Others<br />

Consumer<br />

Key corporate<br />

accounts<br />

Non-trade<br />

(Note 6)<br />

Total<br />

At beginning of year P=1,677,691 P=245,622 P=250,599 P=279,532 P=21,045 P=2,474,489<br />

Charges for the year 1,093,575 57,449 235,782 84,306 102,540 1,573,652<br />

Reversals/write offs/ adjustments (338,044) (39,607) (51,778) (114,497) (35,229) (579,155)<br />

At end of year P=2,433,222 P=263,464 P=434,603 P=249,341 P=88,356 P=3,468,986<br />

Subscribers<br />

Other<br />

corporations<br />

and SME<br />

2010<br />

Traffic<br />

Settlements<br />

and Others<br />

Consumer<br />

Key corporate<br />

accounts<br />

Non-trade<br />

(Note 6)<br />

Total<br />

At beginning of year P=820,403 P=176,973 P=165,416 P=188,199 P=34,776 P=1,385,767<br />

Charges for the year 987,636 81,395 124,549 91,333 620 1,285,533<br />

Reversals/write offs/ adjustments (130,348) (12,746) (39,366) – (14,351) (196,811)<br />

At end of year P=1,677,691 P=245,622 P=250,599 P=279,532 P=21,045 P=2,474,489<br />

28.2.3 Liquidity Risk<br />

The Globe Group seeks to manage its liquidity profile to be able to finance capital expenditures and service<br />

maturing debts. To cover its financing requirements, the Company intends to use internally generated<br />

funds and available long-term and short-term credit facilities. As of December 31, 2012, 2011 and 2010,<br />

Globe Group has available uncommitted short-term credit facilities of USD36.40 million and P=10,720.00<br />

million, USD76.00 million and P=8,170.00 million, and USD59.00 million and P=11,017.40 million,<br />

respectively.<br />

As of December 31, 2012, the Globe Group has fully drawn all of its committed long-term facilities.<br />

As part of its liquidity risk management, the Globe Group regularly evaluates its projected and actual cash<br />

flows. It also continuously assesses conditions in the financial markets for opportunities to pursue fund<br />

raising activities, in case any requirements arise. Fund raising activities may include bank loans, export<br />

credit agency facilities and capital market issues.<br />

High quality accounts are accounts considered to be high value and have consistently exhibited good<br />

paying habits. Medium quality accounts are active accounts with propensity of deteriorating to mid-range<br />

age buckets. These accounts do not flow through to permanent disconnection status as they generally<br />

respond to credit actions and update their payments accordingly. Low quality accounts are accounts which<br />

have probability of impairment based on historical trend. These accounts show propensity to default in<br />

payment despite regular follow-up actions and extended payment terms. Impairment losses are also<br />

provided for these accounts based on net flow rate.<br />

Traffic receivables that are neither past due nor impaired are considered to be high quality given the<br />

reciprocal nature of the Globe Group’s interconnect and roaming partner agreements with the carriers and<br />

the Globe Group’s historical collection experience.<br />

Other receivables are considered high quality accounts as these are substantially from credit card<br />

companies and Globe dealers.<br />

204 205