Attachments - City of Busselton

Attachments - City of Busselton

Attachments - City of Busselton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

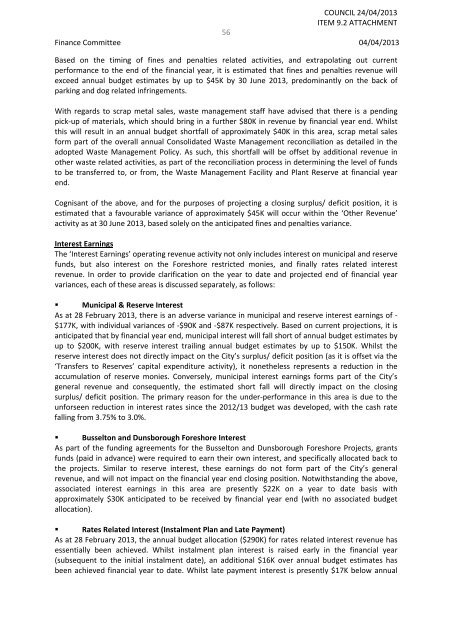

COUNCIL 24/04/2013<br />

ITEM 9.2 ATTACHMENT<br />

56<br />

Finance Committee 04/04/2013<br />

Based on the timing <strong>of</strong> fines and penalties related activities, and extrapolating out current<br />

performance to the end <strong>of</strong> the financial year, it is estimated that fines and penalties revenue will<br />

exceed annual budget estimates by up to $45K by 30 June 2013, predominantly on the back <strong>of</strong><br />

parking and dog related infringements.<br />

With regards to scrap metal sales, waste management staff have advised that there is a pending<br />

pick‐up <strong>of</strong> materials, which should bring in a further $80K in revenue by financial year end. Whilst<br />

this will result in an annual budget shortfall <strong>of</strong> approximately $40K in this area, scrap metal sales<br />

form part <strong>of</strong> the overall annual Consolidated Waste Management reconciliation as detailed in the<br />

adopted Waste Management Policy. As such, this shortfall will be <strong>of</strong>fset by additional revenue in<br />

other waste related activities, as part <strong>of</strong> the reconciliation process in determining the level <strong>of</strong> funds<br />

to be transferred to, or from, the Waste Management Facility and Plant Reserve at financial year<br />

end.<br />

Cognisant <strong>of</strong> the above, and for the purposes <strong>of</strong> projecting a closing surplus/ deficit position, it is<br />

estimated that a favourable variance <strong>of</strong> approximately $45K will occur within the ‘Other Revenue’<br />

activity as at 30 June 2013, based solely on the anticipated fines and penalties variance.<br />

Interest Earnings<br />

The ‘Interest Earnings’ operating revenue activity not only includes interest on municipal and reserve<br />

funds, but also interest on the Foreshore restricted monies, and finally rates related interest<br />

revenue. In order to provide clarification on the year to date and projected end <strong>of</strong> financial year<br />

variances, each <strong>of</strong> these areas is discussed separately, as follows:<br />

• Municipal & Reserve Interest<br />

As at 28 February 2013, there is an adverse variance in municipal and reserve interest earnings <strong>of</strong> ‐<br />

$177K, with individual variances <strong>of</strong> ‐$90K and ‐$87K respectively. Based on current projections, it is<br />

anticipated that by financial year end, municipal interest will fall short <strong>of</strong> annual budget estimates by<br />

up to $200K, with reserve interest trailing annual budget estimates by up to $150K. Whilst the<br />

reserve interest does not directly impact on the <strong>City</strong>’s surplus/ deficit position (as it is <strong>of</strong>fset via the<br />

‘Transfers to Reserves’ capital expenditure activity), it nonetheless represents a reduction in the<br />

accumulation <strong>of</strong> reserve monies. Conversely, municipal interest earnings forms part <strong>of</strong> the <strong>City</strong>’s<br />

general revenue and consequently, the estimated short fall will directly impact on the closing<br />

surplus/ deficit position. The primary reason for the under‐performance in this area is due to the<br />

unforseen reduction in interest rates since the 2012/13 budget was developed, with the cash rate<br />

falling from 3.75% to 3.0%.<br />

• <strong>Busselton</strong> and Dunsborough Foreshore Interest<br />

As part <strong>of</strong> the funding agreements for the <strong>Busselton</strong> and Dunsborough Foreshore Projects, grants<br />

funds (paid in advance) were required to earn their own interest, and specifically allocated back to<br />

the projects. Similar to reserve interest, these earnings do not form part <strong>of</strong> the <strong>City</strong>’s general<br />

revenue, and will not impact on the financial year end closing position. Notwithstanding the above,<br />

associated interest earnings in this area are presently $22K on a year to date basis with<br />

approximately $30K anticipated to be received by financial year end (with no associated budget<br />

allocation).<br />

• Rates Related Interest (Instalment Plan and Late Payment)<br />

As at 28 February 2013, the annual budget allocation ($290K) for rates related interest revenue has<br />

essentially been achieved. Whilst instalment plan interest is raised early in the financial year<br />

(subsequent to the initial instalment date), an additional $16K over annual budget estimates has<br />

been achieved financial year to date. Whilst late payment interest is presently $17K below annual