2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

American International Group, Inc. and Subsidiaries<br />

lines. Group life/health operating in<strong>com</strong>e increased in <strong>2007</strong> $30 million of increased amortization due to DAC unlocking to<br />

<strong>com</strong>pared to 2006. Operating in<strong>com</strong>e in <strong>2007</strong> included a<br />

reflect lower in-force amounts.<br />

$52 million decrease in policy benefits from additional reinsurance<br />

recoveries associated with Superior National, offset by an in- 2006 and 2005 Comparison<br />

crease of $45 million in DAC amortization related to SOP 05-1.<br />

Premiums and other considerations for Domestic Life Insurance<br />

The operating loss in 2006 included a $125 million charge<br />

increased in 2006 <strong>com</strong>pared to 2005 and were primarily driven by<br />

resulting from the loss of the Superior National arbitration, a<br />

growth in the life insurance business in-force and payout annuity<br />

$66 million loss related to exiting the financial institutions credit<br />

premiums, partially offset by declining in-force business in the<br />

business and a $25 million charge for litigation reserves.<br />

home service and group life/health lines. Domestic Life Insurance<br />

Payout annuities premiums and other considerations increased<br />

operating in<strong>com</strong>e declined in 2006 <strong>com</strong>pared to 2005 due to net<br />

in <strong>2007</strong> <strong>com</strong>pared to 2006 reflecting increased sales of strucrealized<br />

capital losses and several significant transactions detured<br />

settlements and terminal funding annuities. Net investment<br />

scribed below in 2006, partially offset by continued growth in life<br />

in<strong>com</strong>e increased in <strong>2007</strong> reflecting growth in insurance reserves<br />

insurance and payout annuity business. Operating in<strong>com</strong>e in 2006<br />

and an increase in call and tender in<strong>com</strong>e on fixed in<strong>com</strong>e<br />

included a $125 million charge resulting from the loss of the<br />

securities. Payout annuities operating in<strong>com</strong>e decreased slightly in<br />

Superior National arbitration and a $66 million loss related to<br />

<strong>2007</strong> as growth in the business was more than offset by higher<br />

exiting the financial institutions credit business both within the<br />

net realized capital losses and by a $30 million out of period<br />

group life/health business. In addition, Domestic Life Insurance<br />

adjustment to increase group annuity reserves for payout annuioperating<br />

in<strong>com</strong>e was negatively affected by $55 million in<br />

ties. Operating in<strong>com</strong>e in 2006 included a $24 million increase in<br />

litigation accruals, an increase in reserves of $24 million related<br />

reserves as various methodologies and assumptions were ento<br />

various methodologies and assumptions which were enhanced<br />

hanced for payout annuity reserves.<br />

in the payout annuity business and a DAC unlocking charge of<br />

Individual fixed and runoff annuities net investment in<strong>com</strong>e and<br />

$30 million in the individual fixed and runoff annuities line to<br />

operating in<strong>com</strong>e decreased in <strong>2007</strong> <strong>com</strong>pared to 2006 reflecting<br />

reflect lower in-force amounts.<br />

declining insurance reserves. Operating in<strong>com</strong>e in 2006 included<br />

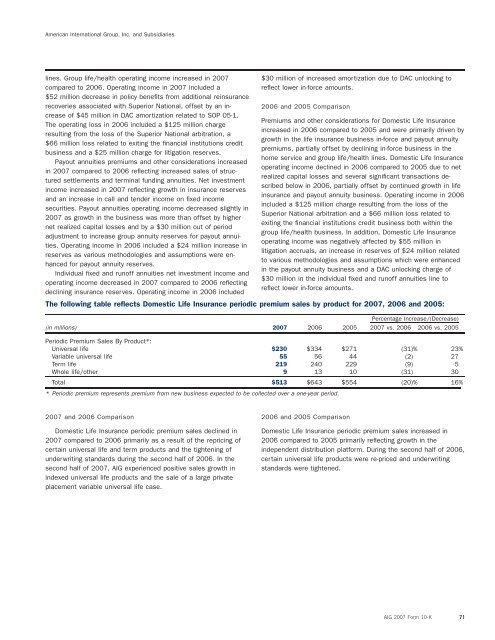

The following table reflects Domestic Life Insurance periodic premium sales by product for <strong>2007</strong>, 2006 and 2005:<br />

Percentage Increase/(Decrease)<br />

(in millions) <strong>2007</strong> 2006 2005 <strong>2007</strong> vs. 2006 2006 vs. 2005<br />

Periodic Premium Sales By Product*:<br />

Universal life $230 $334 $271 (31)% 23%<br />

Variable universal life 55 56 44 (2) 27<br />

Term life 219 240 229 (9) 5<br />

Whole life/other 9 13 10 (31) 30<br />

Total $513 $643 $554 (20)% 16%<br />

* Periodic premium represents premium from new business expected to be collected over a one-year period.<br />

<strong>2007</strong> and 2006 Comparison 2006 and 2005 Comparison<br />

Domestic Life Insurance periodic premium sales declined in Domestic Life Insurance periodic premium sales increased in<br />

<strong>2007</strong> <strong>com</strong>pared to 2006 primarily as a result of the repricing of 2006 <strong>com</strong>pared to 2005 primarily reflecting growth in the<br />

certain universal life and term products and the tightening of independent distribution platform. During the second half of 2006,<br />

underwriting standards during the second half of 2006. In the certain universal life products were re-priced and underwriting<br />

second half of <strong>2007</strong>, <strong>AIG</strong> experienced positive sales growth in standards were tightened.<br />

indexed universal life products and the sale of a large private<br />

placement variable universal life case.<br />

<strong>AIG</strong> <strong>2007</strong> Form 10-K 71