2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

American International Group, Inc. and Subsidiaries<br />

Management’s Discussion and Analysis of<br />

Financial Condition and Results of Operations Continued<br />

Arrangements with Variable Interest Entities<br />

<strong>AIG</strong> enters into various off-balance-sheet (unconsolidated) arrange-<br />

ments with variable interest entities (VIEs) in the normal course of<br />

business. <strong>AIG</strong>’s involvement with VIEs ranges from being a<br />

passive investor to designing and structuring, warehousing and<br />

managing the collateral of VIEs. <strong>AIG</strong> engages in transactions with<br />

VIEs as part of its investment activities to obtain funding and to<br />

facilitate client needs. <strong>AIG</strong> purchases debt securities (rated and<br />

unrated) and equity interests issued by VIEs, makes loans and<br />

provides other credit support to VIEs, enters into insurance,<br />

reinsurance and derivative transactions and leasing arrangements<br />

with VIEs, and acts as the warehouse agent and collateral<br />

manager for VIEs.<br />

Under FIN 46(R), <strong>AIG</strong> consolidates a VIE when it is the primary<br />

beneficiary of the entity. The primary beneficiary is the party that<br />

either (i) absorbs a majority of the VIE’s expected losses;<br />

(ii) receives a majority of the VIE’s expected residual returns; or<br />

(iii) both. For a further discussion of <strong>AIG</strong>’s involvement with VIEs,<br />

see Note 7 of Notes to Consolidated Financial Statements.<br />

A significant portion of <strong>AIG</strong>’s overall exposure to VIEs results<br />

from <strong>AIG</strong> Investment’s real estate and investment funds.<br />

In certain instances, <strong>AIG</strong> Investments acts as the collateral<br />

manager or general partner of an investment fund, private equity<br />

fund or hedge fund. Such entities are typically registered invest-<br />

ment <strong>com</strong>panies or qualify for the specialized investment <strong>com</strong>pany<br />

accounting in accordance with the AICPA Investment Company<br />

Audit and Accounting Guide. For investment partnerships, hedge<br />

funds and private equity funds, <strong>AIG</strong> acts as the general partner or<br />

manager of the fund and is responsible for carrying out the<br />

investment mandate of the VIE. Often, <strong>AIG</strong>’s insurance operations<br />

participate in these <strong>AIG</strong> managed structures as a passive investor<br />

in the debt or equity issued by the VIE. Typically, <strong>AIG</strong> does not<br />

provide any guarantees to the investors in the VIE.<br />

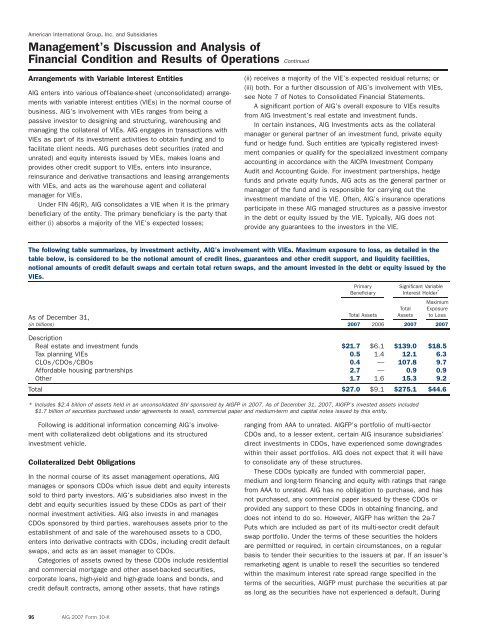

The following table summarizes, by investment activity, <strong>AIG</strong>’s involvement with VIEs. Maximum exposure to loss, as detailed in the<br />

table below, is considered to be the notional amount of credit lines, guarantees and other credit support, and liquidity facilities,<br />

notional amounts of credit default swaps and certain total return swaps, and the amount invested in the debt or equity issued by the<br />

VIEs.<br />

Primary<br />

Significant Variable<br />

Beneficiary Interest Holder *<br />

Maximum<br />

Total Exposure<br />

As of December 31,<br />

Total Assets Assets to Loss<br />

(in billions) <strong>2007</strong> 2006 <strong>2007</strong> <strong>2007</strong><br />

Description<br />

Real estate and investment funds $21.7 $6.1 $139.0 $18.5<br />

Tax planning VIEs 0.5 1.4 12.1 6.3<br />

CLOs/CDOs/CBOs 0.4 — 107.8 9.7<br />

Affordable housing partnerships 2.7 — 0.9 0.9<br />

Other 1.7 1.6 15.3 9.2<br />

Total $27.0 $9.1 $275.1 $44.6<br />

* Includes $2.4 billion of assets held in an unconsolidated SIV sponsored by <strong>AIG</strong>FP in <strong>2007</strong>. As of December 31, <strong>2007</strong>, <strong>AIG</strong>FP’s invested assets included<br />

$1.7 billion of securities purchased under agreements to resell, <strong>com</strong>mercial paper and medium-term and capital notes issued by this entity.<br />

Following is additional information concerning <strong>AIG</strong>’s involvement<br />

with collateralized debt obligations and its structured<br />

investment vehicle.<br />

Collateralized Debt Obligations<br />

In the normal course of its asset management operations, <strong>AIG</strong><br />

manages or sponsors CDOs which issue debt and equity interests<br />

sold to third party investors. <strong>AIG</strong>’s subsidiaries also invest in the<br />

debt and equity securities issued by these CDOs as part of their<br />

normal investment activities. <strong>AIG</strong> also invests in and manages<br />

CDOs sponsored by third parties, warehouses assets prior to the<br />

establishment of and sale of the warehoused assets to a CDO,<br />

enters into derivative contracts with CDOs, including credit default<br />

swaps, and acts as an asset manager to CDOs.<br />

Categories of assets owned by these CDOs include residential<br />

and <strong>com</strong>mercial mortgage and other asset-backed securities,<br />

corporate loans, high-yield and high-grade loans and bonds, and<br />

credit default contracts, among other assets, that have ratings<br />

ranging from AAA to unrated. <strong>AIG</strong>FP’s portfolio of multi-sector<br />

CDOs and, to a lesser extent, certain <strong>AIG</strong> insurance subsidiaries’<br />

direct investments in CDOs, have experienced some downgrades<br />

within their asset portfolios. <strong>AIG</strong> does not expect that it will have<br />

to consolidate any of these structures.<br />

These CDOs typically are funded with <strong>com</strong>mercial paper,<br />

medium and long-term financing and equity with ratings that range<br />

from AAA to unrated. <strong>AIG</strong> has no obligation to purchase, and has<br />

not purchased, any <strong>com</strong>mercial paper issued by these CDOs or<br />

provided any support to these CDOs in obtaining financing, and<br />

does not intend to do so. However, <strong>AIG</strong>FP has written the 2a-7<br />

Puts which are included as part of its multi-sector credit default<br />

swap portfolio. Under the terms of these securities the holders<br />

are permitted or required, in certain circumstances, on a regular<br />

basis to tender their securities to the issuers at par. If an issuer’s<br />

remarketing agent is unable to resell the securities so tendered<br />

within the maximum interest rate spread range specified in the<br />

terms of the securities, <strong>AIG</strong>FP must purchase the securities at par<br />

as long as the securities have not experienced a default. During<br />

96 <strong>AIG</strong> <strong>2007</strong> Form 10-K