2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

American International Group, Inc. and Subsidiaries<br />

Management’s Discussion and Analysis of<br />

Financial Condition and Results of Operations Continued<br />

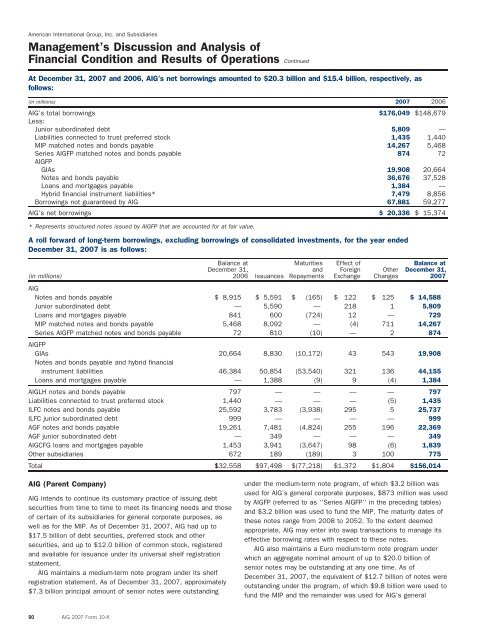

At December 31, <strong>2007</strong> and 2006, <strong>AIG</strong>’s net borrowings amounted to $20.3 billion and $15.4 billion, respectively, as<br />

follows:<br />

(in millions) <strong>2007</strong> 2006<br />

<strong>AIG</strong>’s total borrowings $176,049 $148,679<br />

Less:<br />

Junior subordinated debt 5,809 —<br />

Liabilities connected to trust preferred stock 1,435 1,440<br />

MIP matched notes and bonds payable 14,267 5,468<br />

Series <strong>AIG</strong>FP matched notes and bonds payable 874 72<br />

<strong>AIG</strong>FP<br />

GIAs 19,908 20,664<br />

Notes and bonds payable 36,676 37,528<br />

Loans and mortgages payable 1,384 —<br />

Hybrid financial instrument liabilities* 7,479 8,856<br />

Borrowings not guaranteed by <strong>AIG</strong> 67,881 59,277<br />

<strong>AIG</strong>’s net borrowings $ 20,336 $ 15,374<br />

* Represents structured notes issued by <strong>AIG</strong>FP that are accounted for at fair value.<br />

A roll forward of long-term borrowings, excluding borrowings of consolidated investments, for the year ended<br />

December 31, <strong>2007</strong> is as follows:<br />

Balance at Maturities Effect of Balance at<br />

December 31, and Foreign Other December 31,<br />

(in millions) 2006 Issuances Repayments Exchange Changes <strong>2007</strong><br />

<strong>AIG</strong><br />

Notes and bonds payable $ 8,915 $ 5,591 $ (165) $ 122 $ 125 $ 14,588<br />

Junior subordinated debt — 5,590 — 218 1 5,809<br />

Loans and mortgages payable 841 600 (724) 12 — 729<br />

MIP matched notes and bonds payable 5,468 8,092 — (4) 711 14,267<br />

Series <strong>AIG</strong>FP matched notes and bonds payable 72 810 (10) — 2 874<br />

<strong>AIG</strong>FP<br />

GIAs 20,664 8,830 (10,172) 43 543 19,908<br />

Notes and bonds payable and hybrid financial<br />

instrument liabilities 46,384 50,854 (53,540) 321 136 44,155<br />

Loans and mortgages payable — 1,388 (9) 9 (4) 1,384<br />

<strong>AIG</strong>LH notes and bonds payable 797 — — — — 797<br />

Liabilities connected to trust preferred stock 1,440 — — — (5) 1,435<br />

ILFC notes and bonds payable 25,592 3,783 (3,938) 295 5 25,737<br />

ILFC junior subordinated debt 999 — — — — 999<br />

AGF notes and bonds payable 19,261 7,481 (4,824) 255 196 22,369<br />

AGF junior subordinated debt — 349 — — — 349<br />

<strong>AIG</strong>CFG loans and mortgages payable 1,453 3,941 (3,647) 98 (6) 1,839<br />

Other subsidiaries 672 189 (189) 3 100 775<br />

Total $132,558 $97,498 $(77,218) $1,372 $1,804 $156,014<br />

<strong>AIG</strong> (Parent Company)<br />

<strong>AIG</strong> intends to continue its customary practice of issuing debt<br />

securities from time to time to meet its financing needs and those<br />

of certain of its subsidiaries for general corporate purposes, as<br />

well as for the MIP. As of December 31, <strong>2007</strong>, <strong>AIG</strong> had up to<br />

$17.5 billion of debt securities, preferred stock and other<br />

securities, and up to $12.0 billion of <strong>com</strong>mon stock, registered<br />

and available for issuance under its universal shelf registration<br />

statement.<br />

<strong>AIG</strong> maintains a medium-term note program under its shelf<br />

registration statement. As of December 31, <strong>2007</strong>, approximately<br />

$7.3 billion principal amount of senior notes were outstanding<br />

under the medium-term note program, of which $3.2 billion was<br />

used for <strong>AIG</strong>’s general corporate purposes, $873 million was used<br />

by <strong>AIG</strong>FP (referred to as ‘‘Series <strong>AIG</strong>FP’’ in the preceding tables)<br />

and $3.2 billion was used to fund the MIP. The maturity dates of<br />

these notes range from 2008 to 2052. To the extent deemed<br />

appropriate, <strong>AIG</strong> may enter into swap transactions to manage its<br />

effective borrowing rates with respect to these notes.<br />

<strong>AIG</strong> also maintains a Euro medium-term note program under<br />

which an aggregate nominal amount of up to $20.0 billion of<br />

senior notes may be outstanding at any one time. As of<br />

December 31, <strong>2007</strong>, the equivalent of $12.7 billion of notes were<br />

outstanding under the program, of which $9.8 billion were used to<br />

fund the MIP and the remainder was used for <strong>AIG</strong>’s general<br />

90 <strong>AIG</strong> <strong>2007</strong> Form 10-K