2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

American International Group, Inc. and Subsidiaries<br />

17. Share-based Employee Compensation Plans<br />

proved at the 2003 <strong>Annual</strong> Meeting of Shareholders. The 1999<br />

Continued<br />

Plan superseded the 1991 Employee Stock Option Plan (the 1991<br />

Plan), although outstanding options granted under the 1991 Plan<br />

value recognition provisions of FAS 123R. FAS 123R requires that<br />

continue until exercise or expiration. Options granted under the<br />

<strong>com</strong>panies use a fair value method to value share-based pay-<br />

1999 Plan generally vest over four years (25 percent vesting per<br />

ments and recognize the related <strong>com</strong>pensation expense in net<br />

year) and expire 10 years from the date of grant. The <strong>2007</strong> Plan<br />

earnings. <strong>AIG</strong> adopted FAS 123R using the modified prospective<br />

supersedes the 1999 Plan.<br />

application method, and accordingly, financial statement amounts<br />

At December 31, <strong>2007</strong>, there were no shares reserved for<br />

for the prior periods presented have not been restated to reflect<br />

future grants under the 1999 Plan and 36,363,769 shares<br />

the fair value method of expensing share-based <strong>com</strong>pensation<br />

reserved for issuance under the 1999 and 1991 Plans.<br />

under FAS 123R. The modified prospective application method<br />

requires recognition of the fair value of share-based <strong>com</strong>pensation<br />

for shares subscribed for or granted on or after January 1, 2006<br />

Deferrals<br />

and all previously granted but unvested awards at January 1, At December 31, <strong>2007</strong>, <strong>AIG</strong> was obligated to issue<br />

2006. 12,521,342 shares in connection with previous exercises of<br />

The adoption of FAS 123R resulted in share-based <strong>com</strong>pensa- options with delivery deferred.<br />

tion expense of approximately $17 million during 2006, related to<br />

awards that were accounted for under Accounting Principles Board Valuation<br />

Opinion 25, ‘‘Accounting for Stock Issued to Employees.’’<br />

FAS 123R also requires <strong>AIG</strong> to estimate forfeitures in calculating<br />

<strong>AIG</strong> uses a binomial lattice model to calculate the fair value of<br />

the expense relating to share-based <strong>com</strong>pensation, rather than<br />

stock option grants. A more detailed description of the valuation<br />

recognizing these forfeitures and corresponding reductions in<br />

methodology is provided below.<br />

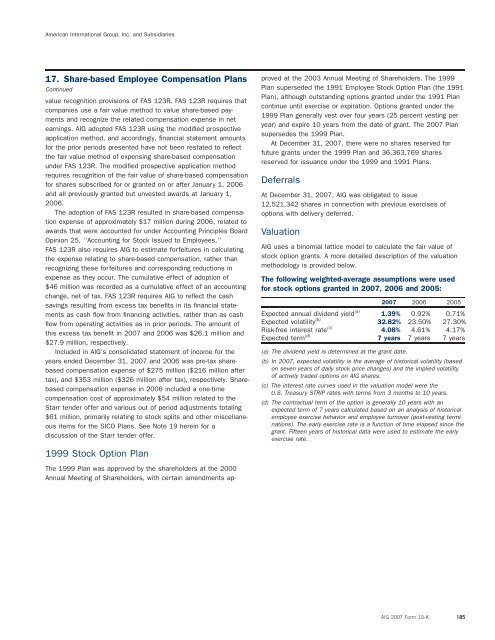

expense as they occur. The cumulative effect of adoption of The following weighted-average assumptions were used<br />

$46 million was recorded as a cumulative effect of an accounting for stock options granted in <strong>2007</strong>, 2006 and 2005:<br />

change, net of tax. FAS 123R requires <strong>AIG</strong> to reflect the cash<br />

savings resulting from excess tax benefits in its financial state-<br />

<strong>2007</strong> 2006 2005<br />

ments as cash flow from financing activities, rather than as cash Expected annual dividend yield (a) 1.39% 0.92% 0.71%<br />

flow from operating activities as in prior periods. The amount of Expected volatility (b) 32.82% 23.50% 27.30%<br />

this excess tax benefit in <strong>2007</strong> and 2006 was $26.1 million and<br />

Risk-free interest rate (c) 4.08% 4.61% 4.17%<br />

Expected term (d) 7 years 7 years 7 years<br />

$27.9 million, respectively.<br />

Included in <strong>AIG</strong>’s consolidated statement of in<strong>com</strong>e for the (a) The dividend yield is determined at the grant date.<br />

years ended December 31, <strong>2007</strong> and 2006 was pre-tax shareon<br />

(b) In <strong>2007</strong>, expected volatility is the average of historical volatility (based<br />

based <strong>com</strong>pensation expense of $275 million ($216 million after<br />

seven years of daily stock price changes) and the implied volatility<br />

of actively traded options on <strong>AIG</strong> shares.<br />

tax), and $353 million ($326 million after tax), respectively. Share-<br />

(c) The interest rate curves used in the valuation model were the<br />

based <strong>com</strong>pensation expense in 2006 included a one-time<br />

U.S. Treasury STRIP rates with terms from 3 months to 10 years.<br />

<strong>com</strong>pensation cost of approximately $54 million related to the<br />

(d) The contractual term of the option is generally 10 years with an<br />

Starr tender offer and various out of period adjustments totaling expected term of 7 years calculated based on an analysis of historical<br />

$61 million, primarily relating to stock splits and other miscellanenations).<br />

employee exercise behavior and employee turnover (post-vesting termious<br />

items for the SICO Plans. See Note 19 herein for a<br />

The early exercise rate is a function of time elapsed since the<br />

discussion of the Starr tender offer.<br />

grant. Fifteen years of historical data were used to estimate the early<br />

exercise rate.<br />

1999 Stock Option Plan<br />

The 1999 Plan was approved by the shareholders at the 2000<br />

<strong>Annual</strong> Meeting of Shareholders, with certain amendments ap-<br />

<strong>AIG</strong> <strong>2007</strong> Form 10-K 185