2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

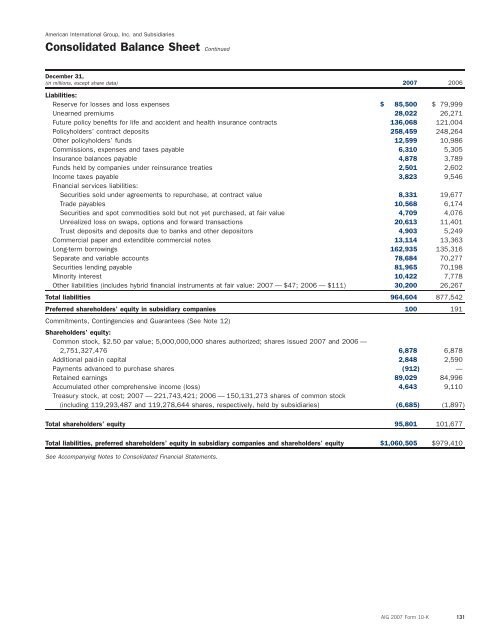

American International Group, Inc. and Subsidiaries<br />

Consolidated Balance Sheet Continued<br />

December 31,<br />

(in millions, except share data) <strong>2007</strong> 2006<br />

Liabilities:<br />

Reserve for losses and loss expenses $ 85,500 $ 79,999<br />

Unearned premiums 28,022 26,271<br />

Future policy benefits for life and accident and health insurance contracts 136,068 121,004<br />

Policyholders’ contract deposits 258,459 248,264<br />

Other policyholders’ funds 12,599 10,986<br />

Commissions, expenses and taxes payable 6,310 5,305<br />

Insurance balances payable 4,878 3,789<br />

Funds held by <strong>com</strong>panies under reinsurance treaties 2,501 2,602<br />

In<strong>com</strong>e taxes payable 3,823 9,546<br />

Financial services liabilities:<br />

Securities sold under agreements to repurchase, at contract value 8,331 19,677<br />

Trade payables 10,568 6,174<br />

Securities and spot <strong>com</strong>modities sold but not yet purchased, at fair value 4,709 4,076<br />

Unrealized loss on swaps, options and forward transactions 20,613 11,401<br />

Trust deposits and deposits due to banks and other depositors 4,903 5,249<br />

Commercial paper and extendible <strong>com</strong>mercial notes 13,114 13,363<br />

Long-term borrowings 162,935 135,316<br />

Separate and variable accounts 78,684 70,277<br />

Securities lending payable 81,965 70,198<br />

Minority interest 10,422 7,778<br />

Other liabilities (includes hybrid financial instruments at fair value: <strong>2007</strong> — $47; 2006 — $111) 30,200 26,267<br />

Total liabilities 964,604 877,542<br />

Preferred shareholders’ equity in subsidiary <strong>com</strong>panies 100 191<br />

Commitments, Contingencies and Guarantees (See Note 12)<br />

Shareholders’ equity:<br />

Common stock, $2.50 par value; 5,000,000,000 shares authorized; shares issued <strong>2007</strong> and 2006 —<br />

2,751,327,476 6,878 6,878<br />

Additional paid-in capital 2,848 2,590<br />

Payments advanced to purchase shares (912) —<br />

Retained earnings 89,029 84,996<br />

Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e (loss) 4,643 9,110<br />

Treasury stock, at cost; <strong>2007</strong> — 221,743,421; 2006 — 150,131,273 shares of <strong>com</strong>mon stock<br />

(including 119,293,487 and 119,278,644 shares, respectively, held by subsidiaries) (6,685) (1,897)<br />

Total shareholders’ equity 95,801 101,677<br />

Total liabilities, preferred shareholders’ equity in subsidiary <strong>com</strong>panies and shareholders’ equity $1,060,505 $979,410<br />

See Ac<strong>com</strong>panying Notes to Consolidated Financial Statements.<br />

<strong>AIG</strong> <strong>2007</strong> Form 10-K 131