2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

American International Group, Inc. and Subsidiaries<br />

Notes to Consolidated Financial Statements Continued<br />

17. Share-based Employee Compensation Plans<br />

Continued<br />

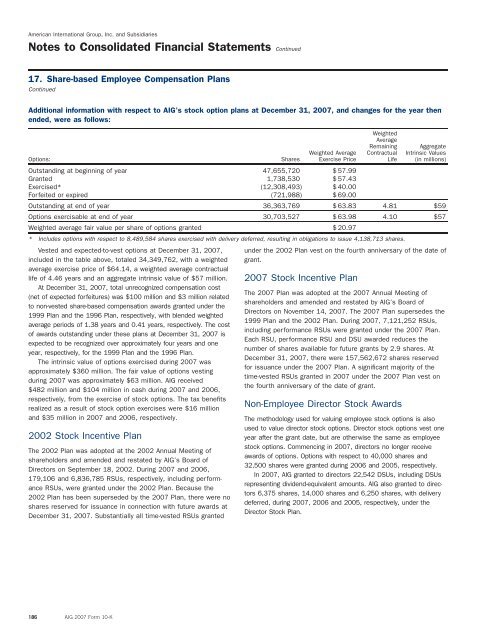

Additional information with respect to <strong>AIG</strong>’s stock option plans at December 31, <strong>2007</strong>, and changes for the year then<br />

ended, were as follows:<br />

Weighted<br />

Average<br />

Remaining Aggregate<br />

Weighted Average Contractual Intrinsic Values<br />

Options: Shares Exercise Price Life (in millions)<br />

Outstanding at beginning of year 47,655,720 $ 57.99<br />

Granted 1,738,530 $ 57.43<br />

Exercised* (12,308,493) $ 40.00<br />

Forfeited or expired (721,988) $ 69.00<br />

Outstanding at end of year 36,363,769 $ 63.83 4.81 $59<br />

Options exercisable at end of year 30,703,527 $ 63.98 4.10 $57<br />

Weighted average fair value per share of options granted $ 20.97<br />

* Includes options with respect to 8,489,584 shares exercised with delivery deferred, resulting in obligations to issue 4,138,713 shares.<br />

Vested and expected-to-vest options at December 31, <strong>2007</strong>, under the 2002 Plan vest on the fourth anniversary of the date of<br />

included in the table above, totaled 34,349,762, with a weighted grant.<br />

average exercise price of $64.14, a weighted average contractual<br />

life of 4.46 years and an aggregate intrinsic value of $57 million. <strong>2007</strong> Stock Incentive Plan<br />

At December 31, <strong>2007</strong>, total unrecognized <strong>com</strong>pensation cost<br />

The <strong>2007</strong> Plan was adopted at the <strong>2007</strong> <strong>Annual</strong> Meeting of<br />

(net of expected forfeitures) was $100 million and $3 million related<br />

shareholders and amended and restated by <strong>AIG</strong>’s Board of<br />

to non-vested share-based <strong>com</strong>pensation awards granted under the<br />

Directors on November 14, <strong>2007</strong>. The <strong>2007</strong> Plan supersedes the<br />

1999 Plan and the 1996 Plan, respectively, with blended weighted<br />

1999 Plan and the 2002 Plan. During <strong>2007</strong>, 7,121,252 RSUs,<br />

average periods of 1.38 years and 0.41 years, respectively. The cost<br />

including performance RSUs were granted under the <strong>2007</strong> Plan.<br />

of awards outstanding under these plans at December 31, <strong>2007</strong> is<br />

Each RSU, performance RSU and DSU awarded reduces the<br />

expected to be recognized over approximately four years and one<br />

number of shares available for future grants by 2.9 shares. At<br />

year, respectively, for the 1999 Plan and the 1996 Plan.<br />

December 31, <strong>2007</strong>, there were 157,562,672 shares reserved<br />

The intrinsic value of options exercised during <strong>2007</strong> was<br />

for issuance under the <strong>2007</strong> Plan. A significant majority of the<br />

approximately $360 million. The fair value of options vesting<br />

time-vested RSUs granted in <strong>2007</strong> under the <strong>2007</strong> Plan vest on<br />

during <strong>2007</strong> was approximately $63 million. <strong>AIG</strong> received<br />

the fourth anniversary of the date of grant.<br />

$482 million and $104 million in cash during <strong>2007</strong> and 2006,<br />

respectively, from the exercise of stock options. The tax benefits<br />

realized as a result of stock option exercises were $16 million<br />

and $35 million in <strong>2007</strong> and 2006, respectively.<br />

Non-Employee Director Stock Awards<br />

The methodology used for valuing employee stock options is also<br />

used to value director stock options. Director stock options vest one<br />

2002 Stock Incentive Plan year after the grant date, but are otherwise the same as employee<br />

The 2002 Plan was adopted at the 2002 <strong>Annual</strong> Meeting of<br />

shareholders and amended and restated by <strong>AIG</strong>’s Board of<br />

Directors on September 18, 2002. During <strong>2007</strong> and 2006,<br />

179,106 and 6,836,785 RSUs, respectively, including performance<br />

RSUs, were granted under the 2002 Plan. Because the<br />

2002 Plan has been superseded by the <strong>2007</strong> Plan, there were no<br />

shares reserved for issuance in connection with future awards at<br />

December 31, <strong>2007</strong>. Substantially all time-vested RSUs granted<br />

stock options. Commencing in <strong>2007</strong>, directors no longer receive<br />

awards of options. Options with respect to 40,000 shares and<br />

32,500 shares were granted during 2006 and 2005, respectively.<br />

In <strong>2007</strong>, <strong>AIG</strong> granted to directors 22,542 DSUs, including DSUs<br />

representing dividend-equivalent amounts. <strong>AIG</strong> also granted to direc-<br />

tors 6,375 shares, 14,000 shares and 6,250 shares, with delivery<br />

deferred, during <strong>2007</strong>, 2006 and 2005, respectively, under the<br />

Director Stock Plan.<br />

186 <strong>AIG</strong> <strong>2007</strong> Form 10-K