2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

American International Group, Inc. and Subsidiaries<br />

Notes to Consolidated Financial Statements Continued<br />

3. Investments<br />

Continued<br />

(g) Other Invested Assets:<br />

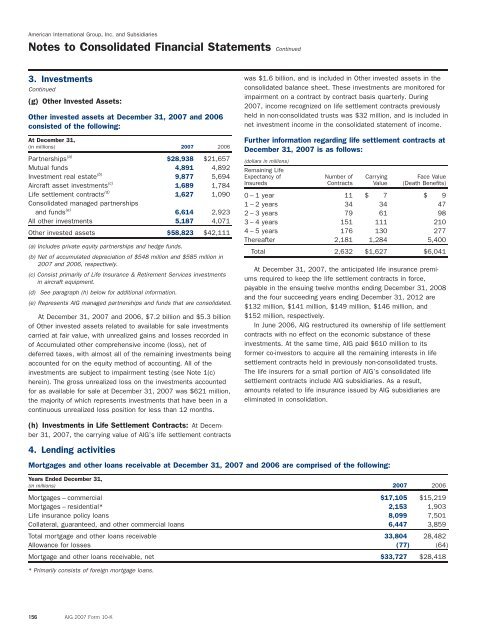

Other invested assets at December 31, <strong>2007</strong> and 2006<br />

consisted of the following:<br />

was $1.6 billion, and is included in Other invested assets in the<br />

consolidated balance sheet. These investments are monitored for<br />

impairment on a contract by contract basis quarterly. During<br />

<strong>2007</strong>, in<strong>com</strong>e recognized on life settlement contracts previously<br />

held in non-consolidated trusts was $32 million, and is included in<br />

net investment in<strong>com</strong>e in the consolidated statement of in<strong>com</strong>e.<br />

At December 31,<br />

Further information regarding life settlement contracts at<br />

(in millions) <strong>2007</strong> 2006<br />

December 31, <strong>2007</strong> is as follows:<br />

Partnerships (a) $28,938 $21,657 (dollars in millions)<br />

Mutual funds 4,891 4,892 Remaining Life<br />

Investment real estate (b) 9,877 5,694 Expectancy of Number of Carrying Face Value<br />

Aircraft asset investments (c) 1,689 1,784 Insureds Contracts Value (Death Benefits)<br />

Life settlement contracts (d) 1,627 1,090 0 – 1 year 11 $ 7 $ 9<br />

Consolidated managed partnerships 1 – 2 years 34 34 47<br />

and funds (e) 6,614 2,923 2 – 3 years 79 61 98<br />

All other investments 5,187 4,071 3 – 4 years 151 111 210<br />

Other invested assets $58,823 $42,111 4 – 5 years 176 130 277<br />

Thereafter 2,181 1,284 5,400<br />

(a) Includes private equity partnerships and hedge funds.<br />

(b) Net of accumulated depreciation of $548 million and $585 million in<br />

Total 2,632 $1,627 $6,041<br />

<strong>2007</strong> and 2006, respectively.<br />

At December 31, <strong>2007</strong>, the anticipated life insurance premi-<br />

(c) Consist primarily of Life Insurance & Retirement Services investments<br />

ums required to keep the life settlement contracts in force,<br />

in aircraft equipment.<br />

payable in the ensuing twelve months ending December 31, 2008<br />

(d) See paragraph (h) below for additional information.<br />

and the four succeeding years ending December 31, 2012 are<br />

(e) Represents <strong>AIG</strong> managed partnerships and funds that are consolidated.<br />

$132 million, $141 million, $149 million, $146 million, and<br />

At December 31, <strong>2007</strong> and 2006, $7.2 billion and $5.3 billion $152 million, respectively.<br />

of Other invested assets related to available for sale investments In June 2006, <strong>AIG</strong> restructured its ownership of life settlement<br />

carried at fair value, with unrealized gains and losses recorded in contracts with no effect on the economic substance of these<br />

of Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e (loss), net of<br />

investments. At the same time, <strong>AIG</strong> paid $610 million to its<br />

deferred taxes, with almost all of the remaining investments being former co-investors to acquire all the remaining interests in life<br />

accounted for on the equity method of accounting. All of the settlement contracts held in previously non-consolidated trusts.<br />

investments are subject to impairment testing (see Note 1(c) The life insurers for a small portion of <strong>AIG</strong>’s consolidated life<br />

herein). The gross unrealized loss on the investments accounted settlement contracts include <strong>AIG</strong> subsidiaries. As a result,<br />

for as available for sale at December 31, <strong>2007</strong> was $621 million, amounts related to life insurance issued by <strong>AIG</strong> subsidiaries are<br />

the majority of which represents investments that have been in a eliminated in consolidation.<br />

continuous unrealized loss position for less than 12 months.<br />

(h) Investments in Life Settlement Contracts: At December<br />

31, <strong>2007</strong>, the carrying value of <strong>AIG</strong>’s life settlement contracts<br />

4. Lending activities<br />

Mortgages and other loans receivable at December 31, <strong>2007</strong> and 2006 are <strong>com</strong>prised of the following:<br />

Years Ended December 31,<br />

(in millions) <strong>2007</strong> 2006<br />

Mortgages – <strong>com</strong>mercial $17,105 $15,219<br />

Mortgages – residential* 2,153 1,903<br />

Life insurance policy loans 8,099 7,501<br />

Collateral, guaranteed, and other <strong>com</strong>mercial loans 6,447 3,859<br />

Total mortgage and other loans receivable 33,804 28,482<br />

Allowance for losses (77) (64)<br />

Mortgage and other loans receivable, net $33,727 $28,418<br />

* Primarily consists of foreign mortgage loans.<br />

156 <strong>AIG</strong> <strong>2007</strong> Form 10-K