2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

American International Group, Inc. and Subsidiaries<br />

Notes to Consolidated Financial Statements Continued<br />

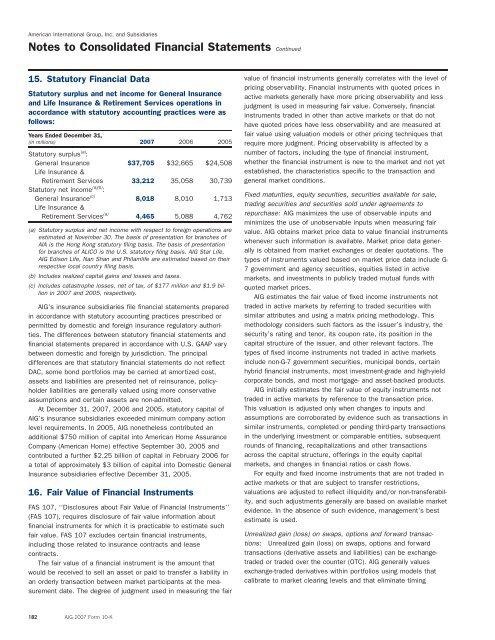

15. Statutory Financial Data<br />

value of financial instruments generally correlates with the level of<br />

pricing observability. Financial instruments with quoted prices in<br />

Statutory surplus and net in<strong>com</strong>e for General Insurance active markets generally have more pricing observability and less<br />

and Life Insurance & Retirement Services operations in judgment is used in measuring fair value. Conversely, financial<br />

accordance with statutory accounting practices were as instruments traded in other than active markets or that do not<br />

follows:<br />

have quoted prices have less observability and are measured at<br />

Years Ended December 31,<br />

fair value using valuation models or other pricing techniques that<br />

(in millions) <strong>2007</strong> 2006 2005 require more judgment. Pricing observability is affected by a<br />

Statutory surplus (a) :<br />

number of factors, including the type of financial instrument,<br />

General Insurance $37,705 $32,665 $24,508 whether the financial instrument is new to the market and not yet<br />

Life Insurance &<br />

established, the characteristics specific to the transaction and<br />

Retirement Services 33,212 35,058 30,739 general market conditions.<br />

Statutory net in<strong>com</strong>e (a)(b) :<br />

Fixed maturities, equity securities, securities available for sale,<br />

General Insurance (c) 8,018 8,010 1,713<br />

trading securities and securities sold under agreements to<br />

Life Insurance &<br />

Retirement Services (a) 4,465 5,088 4,762<br />

repurchase: <strong>AIG</strong> maximizes the use of observable inputs and<br />

minimizes the use of unobservable inputs when measuring fair<br />

(a) Statutory surplus and net in<strong>com</strong>e with respect to foreign operations are value. <strong>AIG</strong> obtains market price data to value financial instruments<br />

estimated at November 30. The basis of presentation for branches of<br />

whenever such information is available. Market price data gener-<br />

AIA is the Hong Kong statutory filing basis. The basis of presentation<br />

for branches of ALICO is the U.S. statutory filing basis. <strong>AIG</strong> Star Life, ally is obtained from market exchanges or dealer quotations. The<br />

<strong>AIG</strong> Edison Life, Nan Shan and Philamlife are estimated based on their types of instruments valued based on market price data include G-<br />

respective local country filing basis.<br />

7 government and agency securities, equities listed in active<br />

(b) Includes realized capital gains and losses and taxes.<br />

markets, and investments in publicly traded mutual funds with<br />

(c) Includes catastrophe losses, net of tax, of $177 million and $1.9 bil- quoted market prices.<br />

lion in <strong>2007</strong> and 2005, respectively.<br />

<strong>AIG</strong> estimates the fair value of fixed in<strong>com</strong>e instruments not<br />

<strong>AIG</strong>’s insurance subsidiaries file financial statements prepared traded in active markets by referring to traded securities with<br />

in accordance with statutory accounting practices prescribed or similar attributes and using a matrix pricing methodology. This<br />

permitted by domestic and foreign insurance regulatory authorisecurity’s<br />

methodology considers such factors as the issuer’s industry, the<br />

ties. The differences between statutory financial statements and<br />

rating and tenor, its coupon rate, its position in the<br />

financial statements prepared in accordance with U.S. GAAP vary capital structure of the issuer, and other relevant factors. The<br />

between domestic and foreign by jurisdiction. The principal<br />

types of fixed in<strong>com</strong>e instruments not traded in active markets<br />

differences are that statutory financial statements do not reflect include non-G-7 government securities, municipal bonds, certain<br />

DAC, some bond portfolios may be carried at amortized cost, hybrid financial instruments, most investment-grade and high-yield<br />

assets and liabilities are presented net of reinsurance, policy- corporate bonds, and most mortgage- and asset-backed products.<br />

holder liabilities are generally valued using more conservative<br />

<strong>AIG</strong> initially estimates the fair value of equity instruments not<br />

assumptions and certain assets are non-admitted.<br />

traded in active markets by reference to the transaction price.<br />

At December 31, <strong>2007</strong>, 2006 and 2005, statutory capital of This valuation is adjusted only when changes to inputs and<br />

<strong>AIG</strong>’s insurance subsidiaries exceeded minimum <strong>com</strong>pany action assumptions are corroborated by evidence such as transactions in<br />

level requirements. In 2005, <strong>AIG</strong> nonetheless contributed an similar instruments, <strong>com</strong>pleted or pending third-party transactions<br />

additional $750 million of capital into American Home Assurance in the underlying investment or <strong>com</strong>parable entities, subsequent<br />

Company (American Home) effective September 30, 2005 and rounds of financing, recapitalizations and other transactions<br />

contributed a further $2.25 billion of capital in February 2006 for across the capital structure, offerings in the equity capital<br />

a total of approximately $3 billion of capital into Domestic General markets, and changes in financial ratios or cash flows.<br />

Insurance subsidiaries effective December 31, 2005.<br />

For equity and fixed in<strong>com</strong>e instruments that are not traded in<br />

active markets or that are subject to transfer restrictions,<br />

16. Fair Value of Financial Instruments<br />

valuations are adjusted to reflect illiquidity and/or non-transferability,<br />

and such adjustments generally are based on available market<br />

FAS 107, ‘‘Disclosures about Fair Value of Financial Instruments’’<br />

evidence. In the absence of such evidence, management’s best<br />

(FAS 107), requires disclosure of fair value information about<br />

estimate is used.<br />

financial instruments for which it is practicable to estimate such<br />

fair value. FAS 107 excludes certain financial instruments,<br />

Unrealized gain (loss) on swaps, options and forward transac-<br />

including those related to insurance contracts and lease<br />

tions: Unrealized gain (loss) on swaps, options and forward<br />

contracts.<br />

transactions (derivative assets and liabilities) can be exchange-<br />

The fair value of a financial instrument is the amount that traded or traded over the counter (OTC). <strong>AIG</strong> generally values<br />

would be received to sell an asset or paid to transfer a liability in exchange-traded derivatives within portfolios using models that<br />

an orderly transaction between market participants at the measurement<br />

calibrate to market clearing levels and that eliminate timing<br />

date. The degree of judgment used in measuring the<br />

fair<br />

182 <strong>AIG</strong> <strong>2007</strong> Form 10-K