2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

American International Group, Inc. and Subsidiaries<br />

Management’s Discussion and Analysis of<br />

Financial Condition and Results of Operations Continued<br />

interest rate and foreign currency exchange rate disruptions.<br />

<strong>Report</strong>ed results may be volatile due to certain hedges not<br />

qualifying for hedge accounting treatment.<br />

In the Institutional Asset Management business, carried interest,<br />

<strong>com</strong>puted in accordance with each fund’s governing agree-<br />

ment, is based on the investment’s performance over the life of<br />

each fund. Unrealized carried interest is recognized based on<br />

Consolidated Results<br />

each fund’s performance as of the balance sheet date. Future<br />

fund performance may negatively affect previously recognized<br />

carried interest.<br />

For a description of important factors that may affect the<br />

operations and initiatives described above, see Item 1A. Risk<br />

Factors.<br />

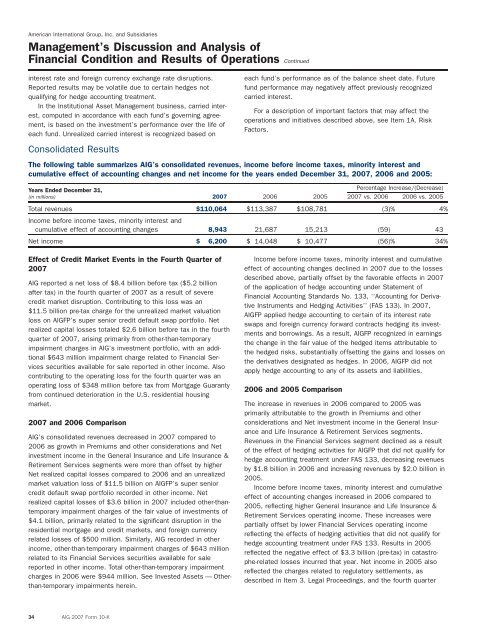

The following table summarizes <strong>AIG</strong>’s consolidated revenues, in<strong>com</strong>e before in<strong>com</strong>e taxes, minority interest and<br />

cumulative effect of accounting changes and net in<strong>com</strong>e for the years ended December 31, <strong>2007</strong>, 2006 and 2005:<br />

Years Ended December 31,<br />

Percentage Increase/(Decrease)<br />

(in millions) <strong>2007</strong> 2006 2005 <strong>2007</strong> vs. 2006 2006 vs. 2005<br />

Total revenues $110,064 $113,387 $108,781 (3)% 4%<br />

In<strong>com</strong>e before in<strong>com</strong>e taxes, minority interest and<br />

cumulative effect of accounting changes 8,943 21,687 15,213 (59) 43<br />

Net in<strong>com</strong>e $ 6,200 $ 14,048 $ 10,477 (56)% 34%<br />

In<strong>com</strong>e before in<strong>com</strong>e taxes, minority interest and cumulative<br />

effect of accounting changes declined in <strong>2007</strong> due to the losses<br />

described above, partially offset by the favorable effects in <strong>2007</strong><br />

of the application of hedge accounting under Statement of<br />

Financial Accounting Standards No. 133, ‘‘Accounting for Deriva-<br />

tive Instruments and Hedging Activities’’ (FAS 133). In <strong>2007</strong>,<br />

<strong>AIG</strong>FP applied hedge accounting to certain of its interest rate<br />

swaps and foreign currency forward contracts hedging its invest-<br />

ments and borrowings. As a result, <strong>AIG</strong>FP recognized in earnings<br />

the change in the fair value of the hedged items attributable to<br />

the hedged risks, substantially offsetting the gains and losses on<br />

the derivatives designated as hedges. In 2006, <strong>AIG</strong>FP did not<br />

apply hedge accounting to any of its assets and liabilities.<br />

2006 and 2005 Comparison<br />

The increase in revenues in 2006 <strong>com</strong>pared to 2005 was<br />

primarily attributable to the growth in Premiums and other<br />

considerations and Net investment in<strong>com</strong>e in the General Insurance<br />

and Life Insurance & Retirement Services segments.<br />

Revenues in the Financial Services segment declined as a result<br />

of the effect of hedging activities for <strong>AIG</strong>FP that did not qualify for<br />

hedge accounting treatment under FAS 133, decreasing revenues<br />

by $1.8 billion in 2006 and increasing revenues by $2.0 billion in<br />

2005.<br />

In<strong>com</strong>e before in<strong>com</strong>e taxes, minority interest and cumulative<br />

effect of accounting changes increased in 2006 <strong>com</strong>pared to<br />

2005, reflecting higher General Insurance and Life Insurance &<br />

Retirement Services operating in<strong>com</strong>e. These increases were<br />

partially offset by lower Financial Services operating in<strong>com</strong>e<br />

reflecting the effects of hedging activities that did not qualify for<br />

hedge accounting treatment under FAS 133. Results in 2005<br />

reflected the negative effect of $3.3 billion (pre-tax) in catastro-<br />

phe-related losses incurred that year. Net in<strong>com</strong>e in 2005 also<br />

reflected the charges related to regulatory settlements, as<br />

described in Item 3. Legal Proceedings, and the fourth quarter<br />

Effect of Credit Market Events in the Fourth Quarter of<br />

<strong>2007</strong><br />

<strong>AIG</strong> reported a net loss of $8.4 billion before tax ($5.2 billion<br />

after tax) in the fourth quarter of <strong>2007</strong> as a result of severe<br />

credit market disruption. Contributing to this loss was an<br />

$11.5 billion pre-tax charge for the unrealized market valuation<br />

loss on <strong>AIG</strong>FP’s super senior credit default swap portfolio. Net<br />

realized capital losses totaled $2.6 billion before tax in the fourth<br />

quarter of <strong>2007</strong>, arising primarily from other-than-temporary<br />

impairment charges in <strong>AIG</strong>’s investment portfolio, with an addi-<br />

tional $643 million impairment charge related to Financial Ser-<br />

vices securities available for sale reported in other in<strong>com</strong>e. Also<br />

contributing to the operating loss for the fourth quarter was an<br />

operating loss of $348 million before tax from Mortgage Guaranty<br />

from continued deterioration in the U.S. residential housing<br />

market.<br />

<strong>2007</strong> and 2006 Comparison<br />

<strong>AIG</strong>’s consolidated revenues decreased in <strong>2007</strong> <strong>com</strong>pared to<br />

2006 as growth in Premiums and other considerations and Net<br />

investment in<strong>com</strong>e in the General Insurance and Life Insurance &<br />

Retirement Services segments were more than offset by higher<br />

Net realized capital losses <strong>com</strong>pared to 2006 and an unrealized<br />

market valuation loss of $11.5 billion on <strong>AIG</strong>FP’s super senior<br />

credit default swap portfolio recorded in other in<strong>com</strong>e. Net<br />

realized capital losses of $3.6 billion in <strong>2007</strong> included other-thantemporary<br />

impairment charges of the fair value of investments of<br />

$4.1 billion, primarily related to the significant disruption in the<br />

residential mortgage and credit markets, and foreign currency<br />

related losses of $500 million. Similarly, <strong>AIG</strong> recorded in other<br />

in<strong>com</strong>e, other-than-temporary impairment charges of $643 million<br />

related to its Financial Services securities available for sale<br />

reported in other in<strong>com</strong>e. Total other-than-temporary impairment<br />

charges in 2006 were $944 million. See Invested Assets — Other-<br />

than-temporary impairments herein.<br />

34 <strong>AIG</strong> <strong>2007</strong> Form 10-K