2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

2007 Annual Report - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

American International Group, Inc. and Subsidiaries<br />

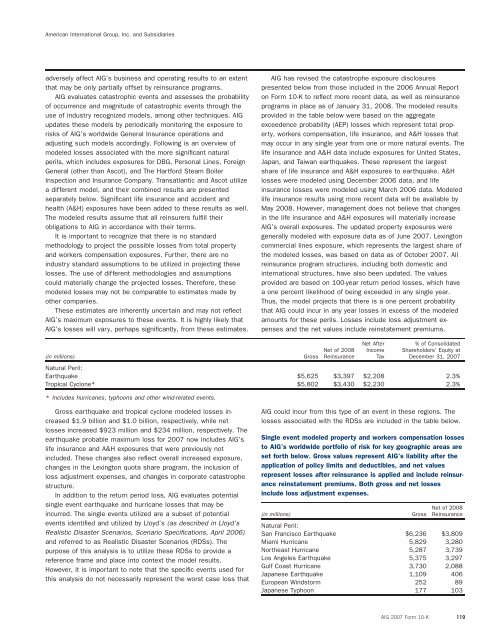

<strong>AIG</strong> has revised the catastrophe exposure disclosures<br />

presented below from those included in the 2006 <strong>Annual</strong> <strong>Report</strong><br />

on Form 10-K to reflect more recent data, as well as reinsurance<br />

programs in place as of January 31, 2008. The modeled results<br />

provided in the table below were based on the aggregate<br />

exceedence probability (AEP) losses which represent total prop-<br />

erty, workers <strong>com</strong>pensation, life insurance, and A&H losses that<br />

may occur in any single year from one or more natural events. The<br />

life insurance and A&H data include exposures for United States,<br />

Japan, and Taiwan earthquakes. These represent the largest<br />

share of life insurance and A&H exposures to earthquake. A&H<br />

losses were modeled using December 2006 data, and life<br />

insurance losses were modeled using March 2006 data. Modeled<br />

life insurance results using more recent data will be available by<br />

May 2008. However, management does not believe that changes<br />

in the life insurance and A&H exposures will materially increase<br />

<strong>AIG</strong>’s overall exposures. The updated property exposures were<br />

generally modeled with exposure data as of June <strong>2007</strong>. Lexington<br />

<strong>com</strong>mercial lines exposure, which represents the largest share of<br />

the modeled losses, was based on data as of October <strong>2007</strong>. All<br />

reinsurance program structures, including both domestic and<br />

international structures, have also been updated. The values<br />

provided are based on 100-year return period losses, which have<br />

a one percent likelihood of being exceeded in any single year.<br />

Thus, the model projects that there is a one percent probability<br />

that <strong>AIG</strong> could incur in any year losses in excess of the modeled<br />

amounts for these perils. Losses include loss adjustment expenses<br />

and the net values include reinstatement premiums.<br />

adversely affect <strong>AIG</strong>’s business and operating results to an extent<br />

that may be only partially offset by reinsurance programs.<br />

<strong>AIG</strong> evaluates catastrophic events and assesses the probability<br />

of occurrence and magnitude of catastrophic events through the<br />

use of industry recognized models, among other techniques. <strong>AIG</strong><br />

updates these models by periodically monitoring the exposure to<br />

risks of <strong>AIG</strong>’s worldwide General Insurance operations and<br />

adjusting such models accordingly. Following is an overview of<br />

modeled losses associated with the more significant natural<br />

perils, which includes exposures for DBG, Personal Lines, Foreign<br />

General (other than Ascot), and The Hartford Steam Boiler<br />

Inspection and Insurance Company. Transatlantic and Ascot utilize<br />

a different model, and their <strong>com</strong>bined results are presented<br />

separately below. Significant life insurance and accident and<br />

health (A&H) exposures have been added to these results as well.<br />

The modeled results assume that all reinsurers fulfill their<br />

obligations to <strong>AIG</strong> in accordance with their terms.<br />

It is important to recognize that there is no standard<br />

methodology to project the possible losses from total property<br />

and workers <strong>com</strong>pensation exposures. Further, there are no<br />

industry standard assumptions to be utilized in projecting these<br />

losses. The use of different methodologies and assumptions<br />

could materially change the projected losses. Therefore, these<br />

modeled losses may not be <strong>com</strong>parable to estimates made by<br />

other <strong>com</strong>panies.<br />

These estimates are inherently uncertain and may not reflect<br />

<strong>AIG</strong>’s maximum exposures to these events. It is highly likely that<br />

<strong>AIG</strong>’s losses will vary, perhaps significantly, from these estimates.<br />

Net After<br />

% of Consolidated<br />

Net of 2008 In<strong>com</strong>e Shareholders’ Equity at<br />

(in millions) Gross Reinsurance Tax December 31, <strong>2007</strong><br />

Natural Peril:<br />

Earthquake $5,625 $3,397 $2,208 2.3%<br />

Tropical Cyclone* $5,802 $3,430 $2,230 2.3%<br />

* Includes hurricanes, typhoons and other wind-related events.<br />

Gross earthquake and tropical cyclone modeled losses in- <strong>AIG</strong> could incur from this type of an event in these regions. The<br />

creased $1.9 billion and $1.0 billion, respectively, while net losses associated with the RDSs are included in the table below.<br />

losses increased $923 million and $234 million, respectively. The<br />

earthquake probable maximum loss for <strong>2007</strong> now includes <strong>AIG</strong>’s Single event modeled property and workers <strong>com</strong>pensation losses<br />

life insurance and A&H exposures that were previously not<br />

to <strong>AIG</strong>’s worldwide portfolio of risk for key geographic areas are<br />

included. These changes also reflect overall increased exposure, set forth below. Gross values represent <strong>AIG</strong>’s liability after the<br />

changes in the Lexington quota share program, the inclusion of application of policy limits and deductibles, and net values<br />

loss adjustment expenses, and changes in corporate catastrophe represent losses after reinsurance is applied and include reinsur-<br />

structure.<br />

ance reinstatement premiums. Both gross and net losses<br />

In addition to the return period loss, <strong>AIG</strong> evaluates potential include loss adjustment expenses.<br />

single event earthquake and hurricane losses that may be<br />

Net of 2008<br />

incurred. The single events utilized are a subset of potential (in millions) Gross Reinsurance<br />

events identified and utilized by Lloyd’s (as described in Lloyd’s Natural Peril:<br />

Realistic Disaster Scenarios, Scenario Specifications, April 2006) San Francisco Earthquake $6,236 $3,809<br />

and referred to as Realistic Disaster Scenarios (RDSs). The Miami Hurricane 5,829 3,280<br />

purpose of this analysis is to utilize these RDSs to provide a Northeast Hurricane 5,287 3,739<br />

reference frame and place into context the model results.<br />

Los Angeles Earthquake 5,375 3,297<br />

Gulf Coast Hurricane 3,730 2,088<br />

However, it is important to note that the specific events used for<br />

Japanese Earthquake 1,109 406<br />

this analysis do not necessarily represent the worst case loss that<br />

European Windstorm 252 89<br />

Japanese Typhoon 177 103<br />

<strong>AIG</strong> <strong>2007</strong> Form 10-K 119