Advisory Committee on Tax Exempt and Government Entities (ACT ...

Advisory Committee on Tax Exempt and Government Entities (ACT ...

Advisory Committee on Tax Exempt and Government Entities (ACT ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

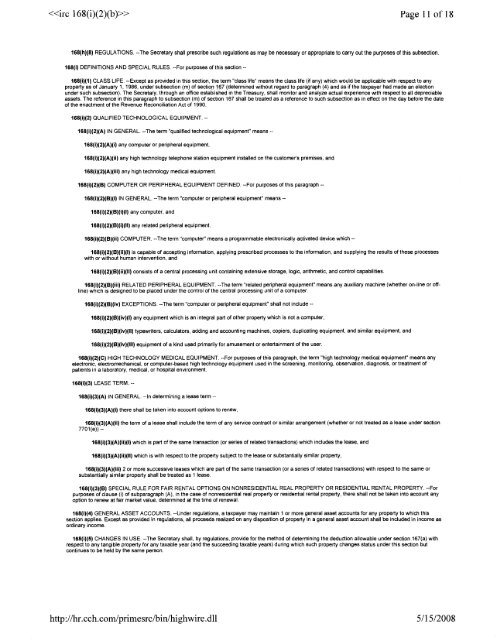

Page 11 of 18168(h)(8) REGULATIONS. --The Secretary shall prescribe such regulati<strong>on</strong>s as may be necessary or appropriate to carry out the purposes of this subsecti<strong>on</strong>.168(i) DEFINITIONS AND SPECIAL RULES. --For purposes of this secti<strong>on</strong> --168(i)(l) CLASS LIFE. --Except as provided in this secti<strong>on</strong>, the term "class life" means the class life (if any) which would be applicable with respect to anyproperty as of January 1, 1986, under subsecti<strong>on</strong> (m) of secti<strong>on</strong> 167 (determined without regard to paragraph (4) <strong>and</strong> as if the taxpayer had made an electi<strong>on</strong>under such subsecti<strong>on</strong>). The Secretary, through an oftice established In the Treasury, shall m<strong>on</strong>itor <strong>and</strong> analyze actual experience with respect to all depreciableassets. The reference in this paragraph to subsecti<strong>on</strong> (m) of secti<strong>on</strong> 167 shall be treated as a reference to such subsecti<strong>on</strong> as in effect <strong>on</strong> the day before the dateof the enactment of the Revenue Rec<strong>on</strong>ciliati<strong>on</strong> Act of 1990.168(i)(2) QUALIFIED TECHNOLOGICAL EQUIPMENT. --168(i)(2)(A) IN GENERAL. --The term "qualified technological equipment" means --168(i)(2)(A)(i) any computer or peripheral equipment, 168(i)(2)(A)(ii) any high technology teleph<strong>on</strong>e statl<strong>on</strong> equipment installed <strong>on</strong> the customer's premises, <strong>and</strong> 168(i)(2)(A)(iii) any high technology medical equipment 168(i)(2)(B) COMPUTER OR PERIPHERAL EQUIPMENT DEFINED. --For purposes of this paragraph --168(i)(2)(B)(i) IN GENERAL. --The term "computer or peripheral equipment" means --168(i)(2)(B)(i)(l) any computer, <strong>and</strong>168(i)(2)(B)(i)(ll) any related peripheral equipment.168(i)(2)(B)(ii) COMPUTER. --The term "computer" means a programmable electr<strong>on</strong>ically activated device which --168(i)(2)(B)(ii)(l) is capable of accepting informati<strong>on</strong>, applying prescribed processes to the informati<strong>on</strong>, <strong>and</strong> supplying the results of these processeswith or without human interventi<strong>on</strong>, <strong>and</strong>168(i)(2)(B)(ii)(ll) c<strong>on</strong>sists of a central processing unit c<strong>on</strong>taining extensive storage, loglc, arithmetic, <strong>and</strong> c<strong>on</strong>trol capabilities.168(i)(2)(B)(iii) RELATED PERIPHERAL EQUIPMENT. --The term "related peripheral equipment" means any auxiliary machine (whether <strong>on</strong>-line or offline)which IS designed to be placed under the c<strong>on</strong>trol of the central processing unit of a computer.168(i)(2)(B)(iv) EXCEPTIONS. --The term "computer or peripheral equipment" shall not include --168(i)(2)(B)(iv)(l) any equipment which is an integral part of other property which is not a computer. 168(i)(2)(B)(iv)(ll) typewriters, calculators, adding <strong>and</strong> accounting machines, copiers, duplicating equipment, <strong>and</strong> similar equipment, <strong>and</strong> 168(i)(2)(B)(iv)(lIl) equipment of a kind used primarily for amusement or entertainment of the user. 168(i)(2)(C) HIGH TECHNOLOGY MEDICAL EQUIPMENT. --For purposes of this paragraph, the term "high technology medical equipment" means any electr<strong>on</strong>ic,electromechanical, or computer-based high technology equipment used in the screening, m<strong>on</strong>itoring, observati<strong>on</strong>, diagnosis, or treatment of patients in a laboratory, medical, or hospital envir<strong>on</strong>ment. 168(i)(3) LEASE TERM. --168(i)(3)(A) IN GENERAL. --In determining a lease term --168(i)(3)(A)(i) there shall be taken into account opti<strong>on</strong>s to renew.168(i)(3)(A)(ii) the term of a lease shall Include the term of any servlce c<strong>on</strong>tract or stmllar arrangement (whether or not treated as a lease under sectl<strong>on</strong>7701 (e)) --168(i)(3)(A)(ii)(l) which is part of the same transacti<strong>on</strong> (or series of related transacti<strong>on</strong>s) which includes the lease, <strong>and</strong>168(i)(3)(A)(ii)(ll) which is with respect to the property subject to the lease or substantially similar property,168(i)(3)(A)(iii) 2 or more successive leases which are part of the same transacti<strong>on</strong> (or a series of related transacti<strong>on</strong>s) wlth respect to the same orsubstantially similar property shall be treated as 1 lease.168(i)(3)(B) SPECIAL RULE FOR FAIR RENTAL OPTIONS ON NONRESIDENTIAL REAL PROPERTY OR RESIDENTIAL RENTAL PROPERTY. --Forpurposes of clause (i) of subparagraph (A), in the case of n<strong>on</strong>residential real property or residential rental property, there shall not be taken into account anyopti<strong>on</strong> to renew at fair market value, determined at the time of renewal.168(i)(4) GENERAL ASSET ACCOUNTS. --Under regulati<strong>on</strong>s, a taxpayer may malntain 1 or more general asset accounts for any property to which thissecti<strong>on</strong> applies. Except as provided in regulati<strong>on</strong>s, all proceeds realized <strong>on</strong> any dispositi<strong>on</strong> of properly in a general asset account shall be included in income asordinary Income.168(i)(S) CHANGES IN USE. --The Secretary shall, by regulati<strong>on</strong>s, provide for the method of determining the deducti<strong>on</strong> allowable under secti<strong>on</strong> 167(a) with respect to any tangible property for any taxable year (<strong>and</strong> the succeeding taxable years) during which such property changes status under this secti<strong>on</strong> but c<strong>on</strong>tinues to be held by the same pers<strong>on</strong>.