Advisory Committee on Tax Exempt and Government Entities (ACT ...

Advisory Committee on Tax Exempt and Government Entities (ACT ...

Advisory Committee on Tax Exempt and Government Entities (ACT ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

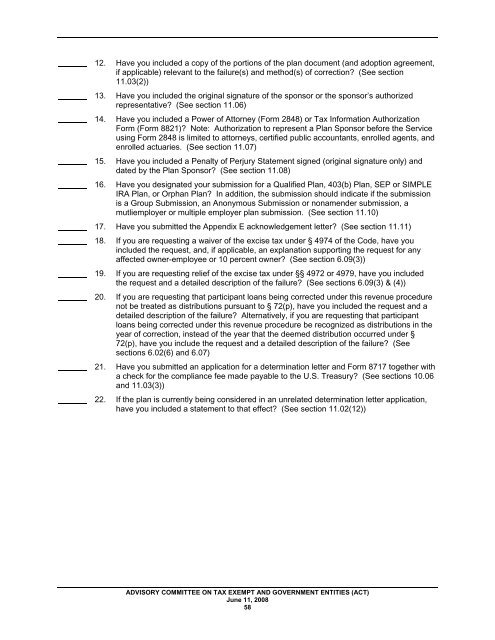

12. Have you included a copy of the porti<strong>on</strong>s of the plan document (<strong>and</strong> adopti<strong>on</strong> agreement,if applicable) relevant to the failure(s) <strong>and</strong> method(s) of correcti<strong>on</strong>? (See secti<strong>on</strong>11.03(2))13. Have you included the original signature of the sp<strong>on</strong>sor or the sp<strong>on</strong>sor’s authorizedrepresentative? (See secti<strong>on</strong> 11.06)14. Have you included a Power of Attorney (Form 2848) or <strong>Tax</strong> Informati<strong>on</strong> Authorizati<strong>on</strong>Form (Form 8821)? Note: Authorizati<strong>on</strong> to represent a Plan Sp<strong>on</strong>sor before the Serviceusing Form 2848 is limited to attorneys, certified public accountants, enrolled agents, <strong>and</strong>enrolled actuaries. (See secti<strong>on</strong> 11.07)15. Have you included a Penalty of Perjury Statement signed (original signature <strong>on</strong>ly) <strong>and</strong>dated by the Plan Sp<strong>on</strong>sor? (See secti<strong>on</strong> 11.08)16. Have you designated your submissi<strong>on</strong> for a Qualified Plan, 403(b) Plan, SEP or SIMPLEIRA Plan, or Orphan Plan? In additi<strong>on</strong>, the submissi<strong>on</strong> should indicate if the submissi<strong>on</strong>is a Group Submissi<strong>on</strong>, an An<strong>on</strong>ymous Submissi<strong>on</strong> or n<strong>on</strong>amender submissi<strong>on</strong>, amutliemployer or multiple employer plan submissi<strong>on</strong>. (See secti<strong>on</strong> 11.10)17. Have you submitted the Appendix E acknowledgement letter? (See secti<strong>on</strong> 11.11)18. If you are requesting a waiver of the excise tax under § 4974 of the Code, have youincluded the request, <strong>and</strong>, if applicable, an explanati<strong>on</strong> supporting the request for anyaffected owner-employee or 10 percent owner? (See secti<strong>on</strong> 6.09(3))19. If you are requesting relief of the excise tax under §§ 4972 or 4979, have you includedthe request <strong>and</strong> a detailed descripti<strong>on</strong> of the failure? (See secti<strong>on</strong>s 6.09(3) & (4))20. If you are requesting that participant loans being corrected under this revenue procedurenot be treated as distributi<strong>on</strong>s pursuant to § 72(p), have you included the request <strong>and</strong> adetailed descripti<strong>on</strong> of the failure? Alternatively, if you are requesting that participantloans being corrected under this revenue procedure be recognized as distributi<strong>on</strong>s in theyear of correcti<strong>on</strong>, instead of the year that the deemed distributi<strong>on</strong> occurred under §72(p), have you include the request <strong>and</strong> a detailed descripti<strong>on</strong> of the failure? (Seesecti<strong>on</strong>s 6.02(6) <strong>and</strong> 6.07)21. Have you submitted an applicati<strong>on</strong> for a determinati<strong>on</strong> letter <strong>and</strong> Form 8717 together witha check for the compliance fee made payable to the U.S. Treasury? (See secti<strong>on</strong>s 10.06<strong>and</strong> 11.03(3))22. If the plan is currently being c<strong>on</strong>sidered in an unrelated determinati<strong>on</strong> letter applicati<strong>on</strong>,have you included a statement to that effect? (See secti<strong>on</strong> 11.02(12))ADVISORY COMMITTEE ON TAX EXEMPT AND GOVERNMENT ENTITIES (<strong>ACT</strong>) June 11, 2008 58