2012 Registration document and annual financial report - BNP Paribas

2012 Registration document and annual financial report - BNP Paribas

2012 Registration document and annual financial report - BNP Paribas

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

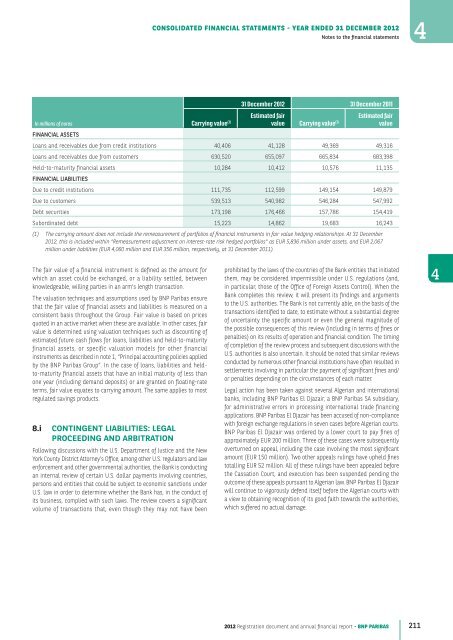

CONSOLIDATED FINANCIAL STATEMENTS - YEAR ENDED 31 DECEMBER <strong>2012</strong>Notes to the <strong>financial</strong> statements4In millions of eurosCarrying value (1)31 December <strong>2012</strong> 31 December 2011Estimated fairEstimated fairvalue Carrying value (1) valueFINANCIAL ASSETSLoans <strong>and</strong> receivables due from credit institutions 40,406 41,128 49,369 49,316Loans <strong>and</strong> receivables due from customers 630,520 655,097 665,834 683,398Held-to-maturity <strong>financial</strong> assets 10,284 10,412 10,576 11,135FINANCIAL LIABILITIESDue to credit institutions 111,735 112,599 149,154 149,879Due to customers 539,513 540,982 546,284 547,992Debt securities 173,198 176,466 157,786 154,419Subordinated debt 15,223 14,862 19,683 16,243(1) The carrying amount does not include the remeasurement of portfolios of <strong>financial</strong> instruments in fair value hedging relationships. At 31 December<strong>2012</strong>, this is included within “Remeasurement adjustment on interest-rate risk hedged portfolios” as EUR 5, 836 million under assets, <strong>and</strong> EUR 2, 067million under liabilities (EUR 4, 060 million <strong>and</strong> EUR 356 million, respectively, at 31 December 2011 ).The fair value of a <strong>financial</strong> instrument is defined as the amount forwhich an asset could be exchanged, or a liability settled, betweenknowledgeable, willing parties in an arm’s length transaction.The valuation techniques <strong>and</strong> assumptions used by <strong>BNP</strong> <strong>Paribas</strong> ensurethat the fair value of <strong>financial</strong> assets <strong>and</strong> liabilities is measured on aconsistent basis throughout the Group. Fair value is based on pricesquoted in an active market when these are available. In other cases, fairvalue is determined using valuation techniques such as discounting ofestimated future cash flows for loans, liabilities <strong>and</strong> held-to-maturity<strong>financial</strong> assets, or specific valuation models for other <strong>financial</strong>instruments as described in note 1, “Principal accounting policies appliedby the <strong>BNP</strong> <strong>Paribas</strong> Group”. In the case of loans, liabilities <strong>and</strong> heldto-maturity<strong>financial</strong> assets that have an initial maturity of less thanone year (including dem<strong>and</strong> deposits) or are granted on floating-rateterms, fair value equates to carrying amount. The same applies to mostregulated savings products.8.i CONTINGENT LIABILITIES: LEGALPROCEEDING AND ARBITRATIONFollowing discussions with the U.S. Department of Justice <strong>and</strong> the NewYork County District Attorney’s Office, among other U.S. regulators <strong>and</strong> lawenforcement <strong>and</strong> other governmental authorities, the Bank is conductingan internal review of certain U.S. dollar payments involving countries,persons <strong>and</strong> entities that could be subject to economic sanctions underU.S. law in order to determine whether the Bank has, in the conduct ofits business, complied with such laws. The review covers a significantvolume of transactions that, even though they may not have beenprohibited by the laws of the countries of the Bank entities that initiatedthem, may be considered impermissible under U.S. regulations (<strong>and</strong>,in particular, those of the Office of Foreign Assets Control). When theBank completes this review, it will present its findings <strong>and</strong> argumentsto the U.S. authorities. The Bank is not currently able, on the basis of thetransactions identified to date, to estimate without a substantial degreeof uncertainty the specific amount or even the general magnitude ofthe possible consequences of this review (including in terms of fines orpenalties) on its results of operation <strong>and</strong> <strong>financial</strong> condition. The timingof completion of the review process <strong>and</strong> subsequent discussions with theU.S. authorities is also uncertain. It should be noted that similar reviewsconducted by numerous other <strong>financial</strong> institutions have often resulted insettlements involving in particular the payment of significant fines <strong>and</strong>/or penalties depending on the circumstances of each matter.Legal action has been taken against several Algerian <strong>and</strong> internationalbanks, including <strong>BNP</strong> <strong>Paribas</strong> El Djazair, a <strong>BNP</strong> <strong>Paribas</strong> SA subsidiary,for administrative errors in processing international trade financingapplications. <strong>BNP</strong> <strong>Paribas</strong> El Djazair has been accused of non-compliancewith foreign exchange regulations in seven cases before Algerian courts.<strong>BNP</strong> <strong>Paribas</strong> El Djazair was ordered by a lower court to pay fines ofapproximately EUR 200 million. Three of these cases were subsequentlyoverturned on appeal, including the case involving the most significantamount (EUR 150 million). Two other appeals rulings have upheld finestotalling EUR 52 million. All of these rulings have been appealed beforethe Cassation Court, <strong>and</strong> execution has been suspended pending theoutcome of these appeals pursuant to Algerian law. <strong>BNP</strong> <strong>Paribas</strong> El Djazairwill continue to vigorously defend itself before the Algerian courts witha view to obtaining recognition of its good faith towards the authorities,which suffered no actual damage.4<strong>2012</strong> <strong>Registration</strong> <strong>document</strong> <strong>and</strong> <strong>annual</strong> <strong>financial</strong> <strong>report</strong> - <strong>BNP</strong> PARIBAS 211