2012 Registration document and annual financial report - BNP Paribas

2012 Registration document and annual financial report - BNP Paribas

2012 Registration document and annual financial report - BNP Paribas

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

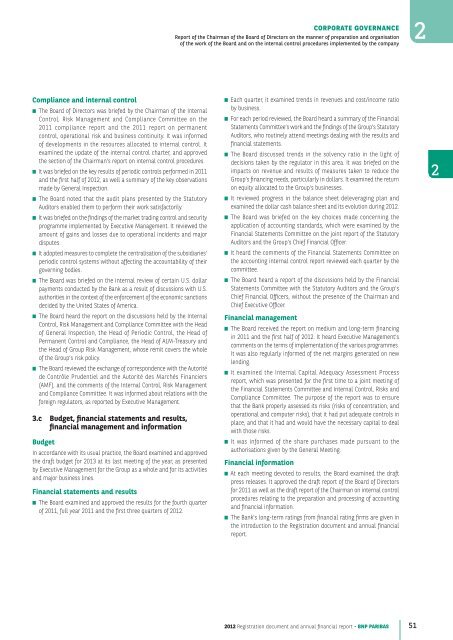

CORPORATE GOVERNANCEReport of the Chairman of the Board of Directors on the manner of preparation <strong>and</strong> organisationof the work of the Board <strong>and</strong> on the internal control procedures implemented by the c ompany2Compliance <strong>and</strong> internal control■ The Board of Directors was briefed by the Chairman of the InternalControl, Risk Management <strong>and</strong> Compliance Committee on the2011 compliance <strong>report</strong> <strong>and</strong> the 2011 <strong>report</strong> on permanentcontrol, operational risk <strong>and</strong> business continuity. It was informedof developments in the resources allocated to internal control. Itexamined the update of the internal control charter, <strong>and</strong> approvedthe section of the Chairman’s <strong>report</strong> on internal control procedures.■ It was briefed on the key results of periodic controls performed in 2011<strong>and</strong> the first half of <strong>2012</strong>, as well a summary of the key observationsmade by General Inspection .■ The Board noted that the audit plans presented by the StatutoryAuditors enabled them to perform their work satisfactorily.■ It was briefed on the findings of the market trading control <strong>and</strong> securityprogramme implemented by Executive Management. It reviewed theamount of gains <strong>and</strong> losses due to operational incidents <strong>and</strong> majordisputes.■ It adopted measures to complete the centralisation of the subsidiaries’periodic control systems without affecting the accountability of theirgoverning bodies.■ The Board was briefed on the internal review of certain U.S. dollarpayments conducted by the Bank as a result of discussions with U.S.authorities in the context of the enforcement of the economic sanctionsdecided by the United States of America .■ The Board heard the <strong>report</strong> on the discussions held by the InternalControl, Risk Management <strong>and</strong> Compliance Committee with the Headof General Inspection , the Head of Periodic Control, the Head ofPermanent Control <strong>and</strong> Compliance, the Head of ALM-Treasury <strong>and</strong>the Head of Group Risk Management, whose remit covers the wholeof the Group’s risk policy.■ The Board reviewed the exchange of correspondence with the Autoritéde Contrôle Prudentiel <strong>and</strong> the Autorité des Marchés Financiers(AMF), <strong>and</strong> the comments of the Internal Control, Risk Management<strong>and</strong> Compliance Committee. It was informed about relations with theforeign regulators, as <strong>report</strong>ed by Executive Management.3.c Budget, <strong>financial</strong> statements <strong>and</strong> results,<strong>financial</strong> management <strong>and</strong> informationBudgetIn accordance with its usual practice, the Board examined <strong>and</strong> approvedthe draft budget for 2013 at its last meeting of the year, as presentedby Executive Management for the Group as a whole <strong>and</strong> for its activities<strong>and</strong> major business lines.Financial statements <strong>and</strong> results■ The Board examined <strong>and</strong> approved the results for the fourth quarterof 2011, full year 2011 <strong>and</strong> the first three quarters of <strong>2012</strong>.■ Each quarter, it examined trends in revenues <strong>and</strong> cost/income ratioby business.■ For each period reviewed, the Board heard a summary of the FinancialStatements Committee’s work <strong>and</strong> the findings of the Group’s StatutoryAuditors, who routinely attend meetings dealing with the results <strong>and</strong><strong>financial</strong> statements.■ The Board discussed trends in the solvency ratio in the light ofdecisions taken by the regulator in this area. It was briefed on theimpacts on revenue <strong>and</strong> results of measures taken to reduce theGroup’s financing needs, particularly in dollars. It examined the returnon equity allocated to the Group’s businesses.■ It reviewed progress in the balance sheet deleverag ing plan <strong>and</strong>examined the dollar cash balance sheet <strong>and</strong> its evolution during <strong>2012</strong>.■ The Board was briefed on the key choices made concerning theapplication of accounting st<strong>and</strong>ards, which were examined by theFinancial Statements Committee on the joint <strong>report</strong> of the StatutoryAuditors <strong>and</strong> the Group’s Chief Financial Officer.■ It heard the comments of the Financial Statements Committee onthe accounting internal control <strong>report</strong> reviewed each quarter by thecommittee.■ The Board heard a <strong>report</strong> of the discussions held by the FinancialStatements Committee with the Statutory Auditors <strong>and</strong> the Group’sChief Financial Officers, without the presence of the Chairman <strong>and</strong>Chief Executive Officer.Financial management■ The Board received the <strong>report</strong> on medium <strong>and</strong> long-term financingin 2011 <strong>and</strong> the first half of <strong>2012</strong>. It heard Executive Management’scomments on the terms of implementation of the various programmes.It was also regularly informed of the net margins generated on newlending.■ It examined the Internal Capital Adequacy Assessment Process<strong>report</strong>, which was presented for the first time to a joint meeting ofthe Financial Statements Committee <strong>and</strong> Internal Control, Risks <strong>and</strong>Compliance Committee. The purpose of the <strong>report</strong> was to ensurethat the Bank properly assessed its risks (risks of concentration, <strong>and</strong>operational <strong>and</strong> computer risks), that it had put adequate controls inplace, <strong>and</strong> that it had <strong>and</strong> would have the necessary capital to dealwith those risks.■ It was informed of the share purchases made pursuant to theauthorisations given by the General Meeting.Financial information■ At each meeting devoted to results, the Board examined the draftpress releases. It approved the draft <strong>report</strong> of the Board of Directorsfor 2011 as well as the draft <strong>report</strong> of the Chairman on internal controlprocedures relating to the preparation <strong>and</strong> processing of accounting<strong>and</strong> <strong>financial</strong> information.■ The Bank’s long-term ratings from <strong>financial</strong> rating firms are given inthe introduction to the <strong>Registration</strong> <strong>document</strong> <strong>and</strong> <strong>annual</strong> <strong>financial</strong><strong>report</strong>.2<strong>2012</strong> <strong>Registration</strong> <strong>document</strong> <strong>and</strong> <strong>annual</strong> <strong>financial</strong> <strong>report</strong> - <strong>BNP</strong> PARIBAS 51