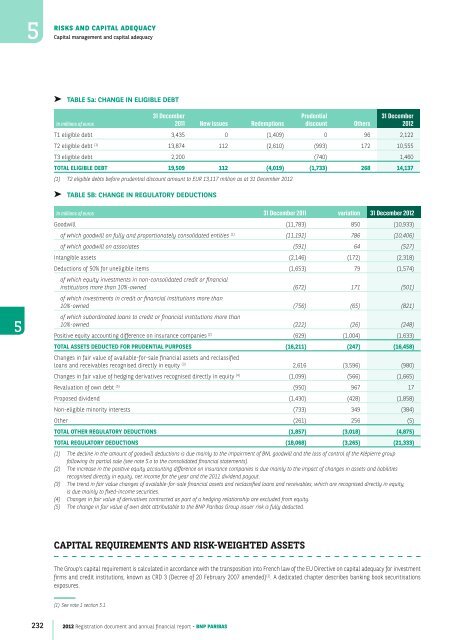

5RISKSAND CAPITAL ADEQUACYCapital management <strong>and</strong> capital adequacy➤ TABLE 5a: CHANGE IN ELIGIBLE DEBTIn millions of euros31 December2011 New issues RedemptionsPrudentialdiscountOthers31 December<strong>2012</strong>T1 eligible debt 3,435 0 (1,409) 0 96 2,122T2 eligible debt (1) 13,874 112 (2,610) (993) 172 10,555T3 eligible debt 2,200 (740) 1,460TOTAL ELIGIBLE DEBT 19,509 112 (4,019) (1,733) 268 14,137(1) T2 eligible debts before prudential discount amount to EUR 13,117 million as at 31 December <strong>2012</strong>.➤ TABLE 5B: CHANGE IN REGULATORY DEDUCTIONSIn millions of euros 31 December 2011 variation 31 December <strong>2012</strong>Goodwill ( 11,783 ) 850 ( 10,933 )of which goodwill on fully <strong>and</strong> proportionately consolidated entities (1) ( 11,192 ) 786 ( 10,406 )of which goodwill on associates ( 591 ) 64 ( 527 )Intangible assets ( 2,146 ) ( 172 ) ( 2,318 )D eductions of 50% for uneligible items ( 1,653 ) 79 ( 1,574 )of which equity investments in non-consolidated credit or <strong>financial</strong>institutions more than 10%-owned ( 672 ) 171 ( 501 )of which investments in credit or <strong>financial</strong> institutions more than10%-owned ( 756 ) ( 65 ) ( 821 )5of which subordinated loans to credit or <strong>financial</strong> institutions more than10%-owned ( 222 ) ( 26 ) ( 248 )Positive equity accounting difference on insurance companies (2) ( 629 ) ( 1,004 ) ( 1,633 )TOTAL ASSETS DEDUCTED FOR PRUDENTIAL PURPOSES ( 16,211 ) ( 247) ( 16,458 )Changes in fair value of available-for-sale <strong>financial</strong> assets <strong>and</strong> reclassifiedloans <strong>and</strong> receivables recognised directly in equity (3) 2,616 ( 3,596 ) ( 980 )Changes in fair value of hedging derivatives recognised directly in equity (4) ( 1,099 ) ( 566 ) ( 1,665 )Revaluation of own debt (5) ( 950 ) 967 17Proposed dividend ( 1,430 ) ( 428 ) ( 1,858 )Non-eligible minority interests ( 733 ) 349 ( 384 )Other ( 261 ) 256 ( 5 )TOTAL OTHER REGULATORY DEDUCTIONS ( 1,857 ) ( 3,018 ) ( 4,875 )TOTAL REGULATORY DEDUCTIONS ( 18,068 ) ( 3,265 ) ( 21,333 )(1) The decline in the amount of goodwill deductions is due mainly to the impairment of BNL goodwill <strong>and</strong> the loss of control of the Klépierre groupfollowing its partial sale (see note 5.o to the consolidated <strong>financial</strong> statements).(2) The increase in the positive equity accounting difference on insurance companies is due mainly to the impact of changes in assets <strong>and</strong> liabilitiesrecognised directly in equity, net income for the year <strong>and</strong> the 2011 dividend payout.(3) The trend in fair value changes of available-for-sale <strong>financial</strong> assets <strong>and</strong> reclassified loans <strong>and</strong> receivables, which are recognised directly in equity,is due mainly to fixed-income securities.(4) Changes in fair value of derivatives contracted as part of a hedging relationship are excluded from equity.(5) The change in fair value of own debt attributable to the <strong>BNP</strong> <strong>Paribas</strong> Group issuer risk is fully deducted .CAPITAL REQUIREMENTS AND RISK -WEIGHTED ASSETSThe Group’s capital requirement is calculated in accordance with the transposition into French law of the EU Directive on capital adequacy for investmentfirms <strong>and</strong> credit institutions, known as CRD 3 (Decree of 20 February 2007 amended) (1) . A dedicated chapter describes banking book securitisationsexposures.(1) See note 1 section 5.1.232<strong>2012</strong> <strong>Registration</strong> <strong>document</strong> <strong>and</strong> <strong>annual</strong> <strong>financial</strong> <strong>report</strong> - <strong>BNP</strong> PARIBAS

RISKS AND CAPITAL ADEQUACYCapital management <strong>and</strong> capital adequacy5At 31 December <strong>2012</strong>, the total amount of Basel 2 Pillar 1 risk-weighted assets was EUR 552 billion, versus EUR 614 billion at 31 December 2011, brokendown as follows by type of risk, calculation approach, <strong>and</strong> asset class:➤ TABLE 6: PILLAR 1 RISK-WEIGHTED ASSETS AND CAPITAL REQUIREMENTSIn millions of euros31 December <strong>2012</strong> 31 December 2011 VariationCapitalRequirementCapitalRequirementRiskweightedassetsRiskweightedassetsRiskweightedassetsCapitalRequirementCredit risk 411,151 32,892 446,674 35,734 (35,523) (2,842)Credit risk - IRB approach 172,409 13,793 192,852 15,428 (20,443) (1,635)Central governments <strong>and</strong> central banks 3,244 260 4,310 345 (1,066) (85)Corporates 121,986 9,759 136,889 10,951 (14,903) (1,192)Institutions 10,326 826 13,391 1,071 (3,065) (245)Retail 36,749 2,940 38,127 3,050 (1,378) (110)Real estate loans 10,772 862 10,311 825 461 37Revolving exposures 5,851 468 6,530 522 (679) (54)Other exposures 20,126 1,610 21,286 1,703 (1,160) (93)Other non credit-obligation assets 104 8 134 11 (30) (3)Credit risk - St<strong>and</strong>ardised approach 238,742 19,099 253,822 20,306 (15,080) (1,207)Central governments <strong>and</strong> central banks 3,742 299 3,458 277 284 22Corporates 112,909 9,033 117,083 9,367 (4,174) (334)Institutions 8,508 681 7,282 582 1,226 99Retail 80,589 6,447 82,922 6,634 (2,333) (187)Real estate loans 26,276 2,102 26,818 2,145 (542) (43)Revolving exposures 3,137 251 4,295 344 (1,158) (93)Other exposures 51,176 4,094 51,810 4,145 (634) (51)Other non credit-obligation assets 32,994 2,639 43,077 3,446 (10,083) (807)Securitisation positions 19,076 1,526 24,376 1,950 (5,300) (424)Securitisation positions - IRB approach 17,153 1,372 22,665 1,813 (5,512) (441)Securitisation positions - St<strong>and</strong>ardised approach 1,923 154 1,712 137 211 17Counterparty risk 20,533 1,643 23,624 1,890 (3,091) (247)Counterparty risk - IRB approach 18,633 1,491 20,863 1,669 (2,230) (178)Central governments <strong>and</strong> central banks 222 18 180 14 42 4Corporates 15,117 1,209 16,344 1,308 (1,227) (99)Institutions 3,294 264 4,339 347 (1,045) (83)Counterparty risk - St<strong>and</strong>ardised approach 1,900 152 2,761 221 (861) (69)Central governments <strong>and</strong> central banks 27 2 1 0 26 2Corporates 1,610 129 2,426 194 (816) (65)Institutions 254 20 320 26 (66) (6)Retail 9 1 14 1 (5) 0Other exposures 9 1 14 1 (5) 0Equity risk 24,377 1,950 25,775 2,062 (1,398) (112)Internal model 21,496 1,720 23,461 1,877 (1,965) (157)Listed equities 7,734 619 8,670 694 (395) (32)Other equity exposures 7,321 586 8,576 686 (1,796) (143)Private equity exposures in diversified portfolios 6,441 515 6,215 497 226 18Simple weighting method 1,733 138 1,248 100 485 38Listed equities 21 2 14 1 7 1Other equity exposures 468 37 125 10 343 27Private equity exposures in diversified portfolios 1,244 99 1,109 89 135 10St<strong>and</strong>ardised approach 1,148 92 1,066 85 82 7Market risk 25,548 2,044 38,501 3,080 (12,953) (1,036)Internal model 22,633 1,811 35,338 2,827 (12,705) (1,016)VaR 5,440 435 8,230 659 (2,790) (224)Stressed VaR 11,179 894 16,605 1,328 (5,426) (434)Incremental Risk Charge 3,421 274 6,440 515 (3,019) (241)Comprehensive Risk Measure 2,593 208 4,063 325 (1,470) (117)St<strong>and</strong>ardised approach 2,652 212 2,386 191 266 21Trading book securitisation positions 263 21 777 62 (514) (41)Operational risk 51,154 4,092 54,617 4,369 (3,463) (277)Advanced Measurement Approach (AMA) 35,586 2,847 38,628 3,090 (3,042) (243)St<strong>and</strong>ardised approach 9,518 761 9,470 758 48 3Basic indicator approach 6,050 484 6,519 521 (471) (37)TOTAL 551,839 44,147 613,567 49,085 (61,728) (4,938)Explanations for the changes in <strong>2012</strong> can be found in the various appropriate sections .<strong>2012</strong> <strong>Registration</strong> <strong>document</strong> <strong>and</strong> <strong>annual</strong> <strong>financial</strong> <strong>report</strong> - <strong>BNP</strong> PARIBAS 2335

- Page 1 and 2:

2012REGISTRATION DOCUMENTAND ANNUAL

- Page 3 and 4:

2012 Registration documentand annua

- Page 5:

1GROUP PRESENTATION1.1 Group presen

- Page 9 and 10:

GROUP PRESENTATIONPresentation of a

- Page 11 and 12:

GROUP PRESENTATIONPresentation of a

- Page 13 and 14:

GROUP PRESENTATIONPresentation of a

- Page 15:

GROUP PRESENTATIONPresentation of a

- Page 18 and 19:

1GROUPPRESENTATIONBNP Paribas and i

- Page 20 and 21:

1GROUPPRESENTATIONBNP Paribas and i

- Page 22 and 23:

1GROUPPRESENTATIONBNP Paribas and i

- Page 24 and 25:

1GROUPPRESENTATIONBNP Paribas and i

- Page 26 and 27:

1GROUPPRESENTATIONBNP Paribas and i

- Page 28 and 29:

1GROUPPRESENTATIONBNP Paribas and i

- Page 30 and 31:

1GROUPPRESENTATION1282012 Registrat

- Page 32 and 33:

2CORPORATEGOVERNANCEBoard of Direct

- Page 34 and 35:

2CORPORATEGOVERNANCEBoard of Direct

- Page 36 and 37:

2CORPORATEGOVERNANCEBoard of Direct

- Page 38 and 39:

2CORPORATEGOVERNANCEBoard of Direct

- Page 40 and 41:

2CORPORATEGOVERNANCEBoard of Direct

- Page 42 and 43:

2CORPORATEGOVERNANCEBoard of Direct

- Page 44 and 45:

2CORPORATEGOVERNANCEBoard of Direct

- Page 46 and 47:

2CORPORATEGOVERNANCEBoard of Direct

- Page 48 and 49:

2CORPORATEGOVERNANCEReport of the C

- Page 50 and 51:

2CORPORATEGOVERNANCEReport of the C

- Page 52 and 53:

2CORPORATEGOVERNANCEReport of the C

- Page 54 and 55:

2CORPORATEGOVERNANCEReport of the C

- Page 56 and 57:

2CORPORATEGOVERNANCEReport of the C

- Page 58 and 59:

2CORPORATEGOVERNANCEReport of the C

- Page 60 and 61:

2CORPORATEGOVERNANCEReport of the C

- Page 62 and 63:

2CORPORATEGOVERNANCEReport of the C

- Page 64 and 65:

2CORPORATEGOVERNANCEReport of the C

- Page 66 and 67:

2CORPORATEGOVERNANCEReport of the C

- Page 68 and 69:

2CORPORATEGOVERNANCEReport of the C

- Page 70 and 71:

2CORPORATEGOVERNANCEReport of the C

- Page 72 and 73:

2CORPORATEGOVERNANCEReport of the C

- Page 74 and 75:

2CORPORATEGOVERNANCEReport of the C

- Page 76 and 77:

2CORPORATEGOVERNANCEExecutive Commi

- Page 78 and 79:

32012REVIEW OF OPERATIONSBNP Pariba

- Page 80 and 81:

32012REVIEW OF OPERATIONSCore busin

- Page 82 and 83:

32012REVIEW OF OPERATIONSCore busin

- Page 84 and 85:

32012REVIEW OF OPERATIONSCore busin

- Page 86 and 87:

32012REVIEW OF OPERATIONSCore busin

- Page 88 and 89:

32012REVIEW OF OPERATIONSCore busin

- Page 90 and 91:

32012REVIEW OF OPERATIONSCore busin

- Page 92 and 93:

32012REVIEW OF OPERATIONSBalance sh

- Page 94 and 95:

32012REVIEW OF OPERATIONSBalance sh

- Page 96 and 97:

32012REVIEW OF OPERATIONSProfit and

- Page 98 and 99:

32012REVIEW OF OPERATIONSProfit and

- Page 100 and 101:

32012REVIEW OF OPERATIONSOutlook3.6

- Page 102 and 103:

32012REVIEW OF OPERATIONSLiquidity

- Page 104 and 105:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 106 and 107:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 108 and 109:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 110 and 111:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 112 and 113:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 114 and 115:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 116 and 117:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 118 and 119:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 120 and 121:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 122 and 123:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 124 and 125:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 126 and 127:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 128 and 129:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 130 and 131:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 132 and 133:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 134 and 135:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 136 and 137:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 138 and 139:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 140 and 141:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 142 and 143:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 144 and 145:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 146 and 147:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 148 and 149:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 150 and 151:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 152 and 153:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 154 and 155:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 156 and 157:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 158 and 159:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 160 and 161:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 162 and 163:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 164 and 165:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 166 and 167:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 168 and 169:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 170 and 171:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 172 and 173:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 174 and 175:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 176 and 177:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 178 and 179:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 180 and 181:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 182 and 183:

4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 184 and 185: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 186 and 187: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 188 and 189: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 190 and 191: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 192 and 193: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 194 and 195: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 196 and 197: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 198 and 199: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 200 and 201: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 202 and 203: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 204 and 205: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 206 and 207: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 208 and 209: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 210 and 211: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 212 and 213: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 214 and 215: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 216 and 217: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 218 and 219: 4CONSOLIDATEDFINANCIAL STATEMENTS -

- Page 220 and 221: 5RISKSAND CAPITAL ADEQUACY5.6 Count

- Page 222 and 223: 5RISKSAND CAPITAL ADEQUACYAnnual ri

- Page 224 and 225: 5RISKSAND CAPITAL ADEQUACYAnnual ri

- Page 226 and 227: 5RISKSAND CAPITAL ADEQUACYAnnual ri

- Page 228 and 229: 5RISKSAND CAPITAL ADEQUACYAnnual ri

- Page 230 and 231: 5RISKSAND CAPITAL ADEQUACYCapital m

- Page 232 and 233: 5RISKSAND CAPITAL ADEQUACYCapital m

- Page 236 and 237: 5RISKSAND CAPITAL ADEQUACYCapital m

- Page 238 and 239: 5RISKSAND CAPITAL ADEQUACYCapital m

- Page 240 and 241: 5RISKSAND CAPITAL ADEQUACYRisk mana

- Page 242 and 243: 5RISKSAND CAPITAL ADEQUACYRisk mana

- Page 244 and 245: 5RISKSAND CAPITAL ADEQUACYRisk mana

- Page 246 and 247: 5RISKSAND CAPITAL ADEQUACYRisk mana

- Page 248 and 249: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 250 and 251: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 252 and 253: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 254 and 255: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 256 and 257: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 258 and 259: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 260 and 261: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 262 and 263: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 264 and 265: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 266 and 267: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 268 and 269: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 270 and 271: 5RISKSAND CAPITAL ADEQUACYCredit ri

- Page 272 and 273: 5RISKSAND CAPITAL ADEQUACYSecuritis

- Page 274 and 275: 5RISKSAND CAPITAL ADEQUACYSecuritis

- Page 276 and 277: 5RISKSAND CAPITAL ADEQUACYSecuritis

- Page 278 and 279: 5RISKSAND CAPITAL ADEQUACYSecuritis

- Page 280 and 281: 5RISKSAND CAPITAL ADEQUACYSecuritis

- Page 282 and 283: 5RISKSAND CAPITAL ADEQUACYSecuritis

- Page 284 and 285:

5RISKSAND CAPITAL ADEQUACYCounterpa

- Page 286 and 287:

5RISKSAND CAPITAL ADEQUACYCounterpa

- Page 288 and 289:

5RISKSAND CAPITAL ADEQUACYMarket ri

- Page 290 and 291:

5RISKSAND CAPITAL ADEQUACYMarket ri

- Page 292 and 293:

5RISKSAND CAPITAL ADEQUACYMarket ri

- Page 294 and 295:

5RISKSAND CAPITAL ADEQUACYMarket ri

- Page 296 and 297:

5RISKSAND CAPITAL ADEQUACYMarket ri

- Page 298 and 299:

5RISKSAND CAPITAL ADEQUACYMarket ri

- Page 300 and 301:

5RISKSAND CAPITAL ADEQUACYMarket ri

- Page 302 and 303:

5RISKSAND CAPITAL ADEQUACYSovereign

- Page 304 and 305:

5RISKSAND CAPITAL ADEQUACYSovereign

- Page 306 and 307:

5RISKSAND CAPITAL ADEQUACYLiquidity

- Page 308 and 309:

5RISKSAND CAPITAL ADEQUACYLiquidity

- Page 310 and 311:

5RISKSAND CAPITAL ADEQUACYLiquidity

- Page 312 and 313:

5RISKSAND CAPITAL ADEQUACYOperation

- Page 314 and 315:

5RISKSAND CAPITAL ADEQUACYOperation

- Page 316 and 317:

5RISKSAND CAPITAL ADEQUACYOperation

- Page 318 and 319:

5RISKSAND CAPITAL ADEQUACYComplianc

- Page 320 and 321:

5RISKSAND CAPITAL ADEQUACYInsurance

- Page 322 and 323:

5RISKSAND CAPITAL ADEQUACYInsurance

- Page 324 and 325:

5RISKSAND CAPITAL ADEQUACYAppendice

- Page 326 and 327:

5RISKSAND CAPITAL ADEQUACYAppendix

- Page 328 and 329:

5RISKSAND CAPITAL ADEQUACYAppendix

- Page 330 and 331:

5RISKSAND CAPITAL ADEQUACYAppendix

- Page 332 and 333:

5RISKSAND CAPITAL ADEQUACYAppendix

- Page 334 and 335:

5RISKSAND CAPITAL ADEQUACYAppendix

- Page 336 and 337:

6INFORMATIONON THE PARENT COMPANY F

- Page 338 and 339:

6INFORMATIONON THE PARENT COMPANY F

- Page 340 and 341:

6INFORMATIONON THE PARENT COMPANY F

- Page 342 and 343:

6INFORMATIONON THE PARENT COMPANY F

- Page 344 and 345:

6INFORMATIONON THE PARENT COMPANY F

- Page 346 and 347:

6INFORMATIONON THE PARENT COMPANY F

- Page 348 and 349:

6INFORMATIONON THE PARENT COMPANY F

- Page 350 and 351:

6INFORMATIONON THE PARENT COMPANY F

- Page 352 and 353:

6INFORMATIONON THE PARENT COMPANY F

- Page 354 and 355:

6INFORMATIONON THE PARENT COMPANY F

- Page 356 and 357:

6INFORMATIONON THE PARENT COMPANY F

- Page 358 and 359:

6INFORMATIONON THE PARENT COMPANY F

- Page 360 and 361:

6INFORMATIONON THE PARENT COMPANY F

- Page 362 and 363:

6INFORMATIONON THE PARENT COMPANY F

- Page 364 and 365:

6INFORMATIONON THE PARENT COMPANY F

- Page 366 and 367:

6INFORMATIONON THE PARENT COMPANY F

- Page 368 and 369:

6INFORMATIONON THE PARENT COMPANY F

- Page 370 and 371:

6INFORMATIONON THE PARENT COMPANY F

- Page 372 and 373:

6INFORMATIONON THE PARENT COMPANY F

- Page 374 and 375:

6INFORMATIONON THE PARENT COMPANY F

- Page 376 and 377:

6INFORMATIONON THE PARENT COMPANY F

- Page 378 and 379:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 380 and 381:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 382 and 383:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 384 and 385:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 386 and 387:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 388 and 389:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 390 and 391:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 392 and 393:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 394 and 395:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 396 and 397:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 398 and 399:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 400 and 401:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 402 and 403:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 404 and 405:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 406 and 407:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 408 and 409:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 410 and 411:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 412 and 413:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 414 and 415:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 416 and 417:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 418 and 419:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 420 and 421:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 422 and 423:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 424 and 425:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 426 and 427:

7ARESPONSIBLE BANK: INFORMATION ON

- Page 428 and 429:

8GENERALINFORMATIONDocuments on dis

- Page 430 and 431:

8GENERALINFORMATIONFounding documen

- Page 432 and 433:

8GENERALINFORMATIONFounding documen

- Page 434 and 435:

8GENERALINFORMATIONFounding documen

- Page 436 and 437:

8GENERALINFORMATIONStatutory Audito

- Page 438 and 439:

8GENERALINFORMATIONStatutory Audito

- Page 440 and 441:

9STATUTORYAUDITORSStatutory Auditor

- Page 442 and 443:

10PERSON RESPONSIBLE FOR THE REGIST

- Page 444 and 445:

11TABLE OF CONCORDANCEHeadings as l

- Page 448:

HEAD OFFICE16, boulevard des Italie