BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

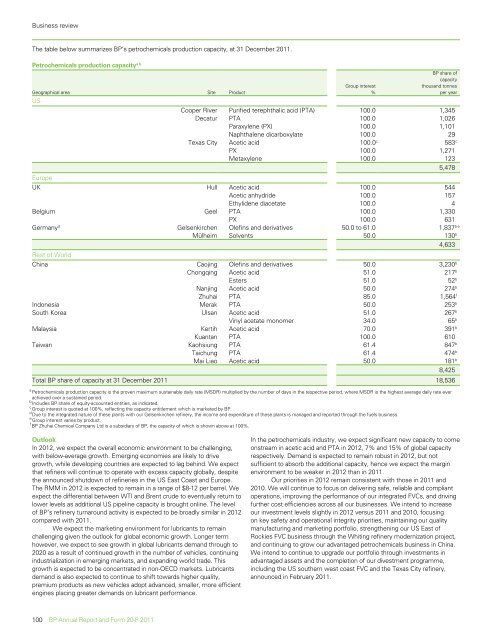

Business reviewThe table below summarizes <strong>BP</strong>’s petrochemicals production capacity, at 31 December <strong>20</strong>11.Petrochemicals production capacity a bGroup interest%<strong>BP</strong> share ofcapacitythous<strong>and</strong> tonnesper yearGeographical area Site ProductUSCooper River Purified terephthalic acid (PTA) 100.0 1,345Decatur PTA 100.0 1,026Paraxylene (PX) 100.0 1,101Naphthalene dicarboxylate 100.0 29Texas City Acetic acid 100.0 c 583 cPX 100.0 1,271Metaxylene 100.0 1235,478EuropeUK Hull Acetic acid 100.0 544Acetic anhydride 100.0 157Ethylidene diacetate 100.0 4Belgium Geel PTA 100.0 1,330PX 100.0 631Germany d Gelsenkirchen Olefins <strong>and</strong> derivatives 50.0 to 61.0 1,837 b eMülheim Solvents 50.0 130 b4,633Rest of WorldChina Caojing Olefins <strong>and</strong> derivatives 50.0 3,230 bChongqing Acetic acid 51.0 217 bEsters 51.0 52 bNanjing Acetic acid 50.0 274 bZhuhai PTA 85.0 1,564 fIndonesia Merak PTA 50.0 253 bSouth Korea Ulsan Acetic acid 51.0 267 bVinyl acetate monomer 34.0 65 bMalaysia Kertih Acetic acid 70.0 391 bKuantan PTA 100.0 610Taiwan Kaohsiung PTA 61.4 847 bTaichung PTA 61.4 474 bMai Liao Acetic acid 50.0 181 b8,425Total <strong>BP</strong> share of capacity at 31 December <strong>20</strong>11 18,536a Petrochemicals production capacity is the proven maximum sustainable daily rate (MSDR) multiplied by the number of days in the respective period, where MSDR is the highest average daily rate everachieved over a sustained period.b Includes <strong>BP</strong> share of equity-accounted entities, as indicated.c Group interest is quoted at 100%, reflecting the capacity entitlement which is marketed by <strong>BP</strong>.d Due to the integrated nature of these plants with our Gelsenkirchen refinery, the income <strong>and</strong> expenditure of these plants is managed <strong>and</strong> reported through the fuels business.e Group interest varies by product.f <strong>BP</strong> Zhuhai Chemical <strong>Company</strong> Ltd is a subsidiary of <strong>BP</strong>, the capacity of which is shown above at 100%.OutlookIn <strong>20</strong>12, we expect the overall economic environment to be challenging,with below-average growth. Emerging economies are likely to drivegrowth, while developing countries are expected to lag behind. We expectthat refiners will continue to operate with excess capacity globally, despitethe announced shutdown of refineries in the US East Coast <strong>and</strong> Europe.The RMM in <strong>20</strong>12 is expected to remain in a range of $8-12 per barrel. Weexpect the differential between WTI <strong>and</strong> Brent crude to eventually return tolower levels as additional US pipeline capacity is brought online. The levelof <strong>BP</strong>’s refinery turnaround activity is expected to be broadly similar in <strong>20</strong>12compared with <strong>20</strong>11.We expect the marketing environment for lubricants to remainchallenging given the outlook for global economic growth. Longer termhowever, we expect to see growth in global lubricants dem<strong>and</strong> through to<strong>20</strong><strong>20</strong> as a result of continued growth in the number of vehicles, continuingindustrialization in emerging markets, <strong>and</strong> exp<strong>and</strong>ing world trade. Thisgrowth is expected to be concentrated in non-OECD markets. Lubricantsdem<strong>and</strong> is also expected to continue to shift towards higher quality,premium products as new vehicles adopt advanced, smaller, more efficientengines placing greater dem<strong>and</strong>s on lubricant performance.In the petrochemicals industry, we expect significant new capacity to comeonstream in acetic acid <strong>and</strong> PTA in <strong>20</strong>12, 7% <strong>and</strong> 15% of global capacityrespectively. Dem<strong>and</strong> is expected to remain robust in <strong>20</strong>12, but notsufficient to absorb the additional capacity, hence we expect the marginenvironment to be weaker in <strong>20</strong>12 than in <strong>20</strong>11.Our priorities in <strong>20</strong>12 remain consistent with those in <strong>20</strong>11 <strong>and</strong><strong>20</strong>10. We will continue to focus on delivering safe, reliable <strong>and</strong> compliantoperations, improving the performance of our integrated FVCs, <strong>and</strong> drivingfurther cost efficiencies across all our businesses. We intend to increaseour investment levels slightly in <strong>20</strong>12 versus <strong>20</strong>11 <strong>and</strong> <strong>20</strong>10, focusingon key safety <strong>and</strong> operational integrity priorities, maintaining our qualitymanufacturing <strong>and</strong> marketing portfolio, strengthening our US East ofRockies FVC business through the Whiting refinery modernization project,<strong>and</strong> continuing to grow our advantaged petrochemicals business in China.We intend to continue to upgrade our portfolio through investments inadvantaged assets <strong>and</strong> the completion of our divestment programme,including the US southern west coast FVC <strong>and</strong> the Texas City refinery,announced in February <strong>20</strong>11.100 <strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>11