BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

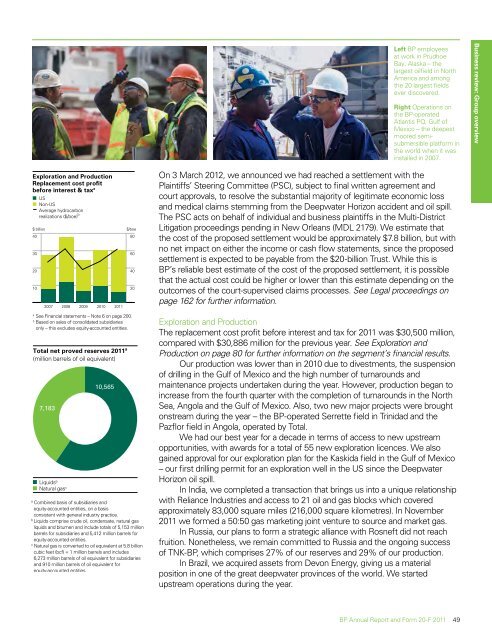

Left <strong>BP</strong> employeesat work in PrudhoeBay, Alaska – thelargest oilfield in NorthAmerica <strong>and</strong> amongthe <strong>20</strong> largest fieldsever discovered.Right Operations onthe <strong>BP</strong>-operatedAtlantis PQ, Gulf ofMexico – the deepestmoored semisubmersibleplatform inthe world when it wasinstalled in <strong>20</strong>07.Business review: Group overviewExploration <strong>and</strong> ProductionReplacement cost profitbefore interest & tax aUSNon-USAverage hydrocarbonrealizations ($/boe) b$ billion $/boe408030<strong>20</strong>10<strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09 <strong>20</strong>10 <strong>20</strong>11aSee Financial statements – Note 6 on page <strong>20</strong>0.bBased on sales of consolidated subsidiariesonly – this excludes equity-accounted entities.Total net proved reserves <strong>20</strong>11 a(million barrels of oil equivalent)7,183Liquids bNatural gas c10,565aCombined basis of subsidiaries <strong>and</strong>equity-accounted entities, on a basisconsistent with general industry practice.b Liquids comprise crude oil, condensate, natural gasliquids <strong>and</strong> bitumen <strong>and</strong> include totals of 5,153 millionbarrels for subsidiaries <strong>and</strong> 5,412 million barrels forequity-accounted entities.cNatural gas is converted to oil equivalent at 5.8 billioncubic feet (bcf) = 1 million barrels <strong>and</strong> includes6,273 million barrels of oil equivalent for subsidiaries<strong>and</strong> 910 million barrels of oil equivalent forequity-accounted entities.6040<strong>20</strong>On 3 March <strong>20</strong>12, we announced we had reached a settlement with thePlaintiffs’ Steering Committee (PSC), subject to final written agreement <strong>and</strong>court approvals, to resolve the substantial majority of legitimate economic loss<strong>and</strong> medical claims stemming from the Deepwater Horizon accident <strong>and</strong> oil spill.The PSC acts on behalf of individual <strong>and</strong> business plaintiffs in the Multi-DistrictLitigation proceedings pending in New Orleans (MDL 2179). We estimate thatthe cost of the proposed settlement would be approximately $7.8 billion, but withno net impact on either the income or cash flow statements, since the proposedsettlement is expected to be payable from the $<strong>20</strong>-billion Trust. While this is<strong>BP</strong>’s reliable best estimate of the cost of the proposed settlement, it is possiblethat the actual cost could be higher or lower than this estimate depending on theoutcomes of the court-supervised claims processes. See Legal proceedings onpage 162 for further information.Exploration <strong>and</strong> ProductionThe replacement cost profit before interest <strong>and</strong> tax for <strong>20</strong>11 was $30,500 million,compared with $30,886 million for the previous year. See Exploration <strong>and</strong>Production on page 80 for further information on the segment’s financial results.Our production was lower than in <strong>20</strong>10 due to divestments, the suspensionof drilling in the Gulf of Mexico <strong>and</strong> the high number of turnarounds <strong>and</strong>maintenance projects undertaken during the year. However, production began toincrease from the fourth quarter with the completion of turnarounds in the NorthSea, Angola <strong>and</strong> the Gulf of Mexico. Also, two new major projects were broughtonstream during the year – the <strong>BP</strong>-operated Serrette field in Trinidad <strong>and</strong> thePazflor field in Angola, operated by Total.We had our best year for a decade in terms of access to new upstreamopportunities, with awards for a total of 55 new exploration licences. We alsogained approval for our exploration plan for the Kaskida field in the Gulf of Mexico– our first drilling permit for an exploration well in the US since the DeepwaterHorizon oil spill.In India, we completed a transaction that brings us into a unique relationshipwith Reliance Industries <strong>and</strong> access to 21 oil <strong>and</strong> gas blocks which coveredapproximately 83,000 square miles (216,000 square kilometres). In November<strong>20</strong>11 we formed a 50:50 gas marketing joint venture to source <strong>and</strong> market gas.In Russia, our plans to form a strategic alliance with Rosneft did not reachfruition. Nonetheless, we remain committed to Russia <strong>and</strong> the ongoing successof TNK-<strong>BP</strong>, which comprises 27% of our reserves <strong>and</strong> 29% of our production.In Brazil, we acquired assets from Devon Energy, giving us a materialposition in one of the great deepwater provinces of the world. We startedupstream operations during the year.<strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>11 49