Notes on financial statements46. Condensed consolidating information on certain US subsidiaries continuedBalance Sheet$ millionAt 31 December <strong>20</strong>11Issuer Guarantor<strong>BP</strong>Exploration(Alaska) Inc. <strong>BP</strong> p.l.c.OthersubsidiariesEliminations<strong>and</strong>reclassifications <strong>BP</strong> groupNon-current assetsProperty, plant <strong>and</strong> equipment 8,653 – 110,561 – 119,214Goodwill – – 12,100 – 12,100Intangible assets 456 – <strong>20</strong>,646 – 21,102Investments in jointly controlled entities – – 15,518 – 15,518Investments in associates – 2 13,289 – 13,291Other investments – – 2,117 – 2,117Subsidiaries – equity-accounted basis 4,802 129,042 – (133,844) –Fixed assets 13,911 129,044 174,231 (133,844) 183,342Loans 46 38 5,113 (4,313) 884Other receivables – – 4,337 – 4,337Derivative financial instruments – – 5,038 – 5,038Prepayments – – 1,255 – 1,255Deferred tax assets – – 611 – 611Defined benefit pension plan surpluses – – 17 – 1713,957 129,082 190,602 (138,157) 195,484Current assetsLoans – – 244 – 244Inventories 167 – 25,494 – 25,661Trade <strong>and</strong> other receivables 4,109 17,698 49,753 (28,034) 43,526Derivative financial instruments – – 3,857 – 3,857Prepayments 7 – 1,279 – 1,286Current tax receivable – – 235 – 235Other investments – – 288 – 288Cash <strong>and</strong> cash equivalents (1) – 14,068 – 14,0674,282 17,698 95,218 (28,034) 89,164Assets classified as held for sale – – 8,4<strong>20</strong> – 8,4<strong>20</strong>4,282 17,698 103,638 (28,034) 97,584Total assets 18,239 146,780 294,240 (166,191) 293,068Current liabilitiesTrade <strong>and</strong> other payables 5,035 2,390 73,014 (28,034) 52,405Derivative financial instruments – – 3,2<strong>20</strong> – 3,2<strong>20</strong>Accruals – 28 5,904 – 5,932Finance debt – – 9,044 – 9,044Current tax payable 287 – 1,654 – 1,941Provisions – – 11,238 – 11,2385,322 2,418 104,074 (28,034) 83,780Liabilities directly associated with assets classified as held for sale – – 538 – 5385,322 2,418 104,612 (28,034) 84,318Non-current liabilitiesOther payables 9 4,264 3,477 (4,313) 3,437Derivative financial instruments – – 3,773 – 3,773Accruals – 35 354 – 389Finance debt – – 35,169 – 35,169Deferred tax liabilities 1,966 – 13,112 – 15,078Provisions 1,6<strong>20</strong> – 24,784 – 26,404Defined benefit pension plan <strong>and</strong> other post-retirement benefitplan deficits – 2,088 9,930 – 12,0183,595 6,387 90,599 (4,313) 96,268Total liabilities 8,917 8,805 195,211 (32,347) 180,586Net assets 9,322 137,975 99,029 (133,844) 112,482Equity<strong>BP</strong> shareholders’ equity 9,322 137,975 98,012 (133,844) 111,465Minority interest – – 1,017 – 1,017Total equity 9,322 137,975 99,029 (133,844) 112,482256 <strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>11

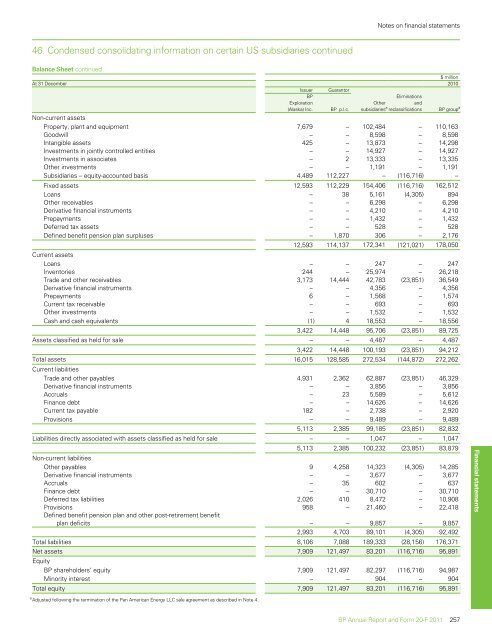

Notes on financial statements46. Condensed consolidating information on certain US subsidiaries continuedBalance Sheet continued$ millionAt 31 December <strong>20</strong>10Issuer Guarantor<strong>BP</strong>ExplorationOtherEliminations<strong>and</strong>(Alaska) Inc. <strong>BP</strong> p.l.c. subsidiaries a reclassifications <strong>BP</strong> group aNon-current assetsProperty, plant <strong>and</strong> equipment 7,679 – 102,484 – 110,163Goodwill – – 8,598 – 8,598Intangible assets 425 – 13,873 – 14,298Investments in jointly controlled entities – – 14,927 – 14,927Investments in associates – 2 13,333 – 13,335Other investments – – 1,191 – 1,191Subsidiaries – equity-accounted basis 4,489 112,227 – (116,716) –Fixed assets 12,593 112,229 154,406 (116,716) 162,512Loans – 38 5,161 (4,305) 894Other receivables – – 6,298 – 6,298Derivative financial instruments – – 4,210 – 4,210Prepayments – – 1,432 – 1,432Deferred tax assets – – 528 – 528Defined benefit pension plan surpluses – 1,870 306 – 2,17612,593 114,137 172,341 (121,021) 178,050Current assetsLoans – – 247 – 247Inventories 244 – 25,974 – 26,218Trade <strong>and</strong> other receivables 3,173 14,444 42,783 (23,851) 36,549Derivative financial instruments – – 4,356 – 4,356Prepayments 6 – 1,568 – 1,574Current tax receivable – – 693 – 693Other investments – – 1,532 – 1,532Cash <strong>and</strong> cash equivalents (1) 4 18,553 – 18,5563,422 14,448 95,706 (23,851) 89,725Assets classified as held for sale – – 4,487 – 4,4873,422 14,448 100,193 (23,851) 94,212Total assets 16,015 128,585 272,534 (144,872) 272,262Current liabilitiesTrade <strong>and</strong> other payables 4,931 2,362 62,887 (23,851) 46,329Derivative financial instruments – – 3,856 – 3,856Accruals – 23 5,589 – 5,612Finance debt – – 14,626 – 14,626Current tax payable 182 – 2,738 – 2,9<strong>20</strong>Provisions – – 9,489 – 9,4895,113 2,385 99,185 (23,851) 82,832Liabilities directly associated with assets classified as held for sale – – 1,047 – 1,0475,113 2,385 100,232 (23,851) 83,879Non-current liabilitiesOther payables 9 4,258 14,323 (4,305) 14,285Derivative financial instruments – – 3,677 – 3,677Accruals – 35 602 – 637Finance debt – – 30,710 – 30,710Deferred tax liabilities 2,026 410 8,472 – 10,908Provisions 958 – 21,460 – 22,418Defined benefit pension plan <strong>and</strong> other post-retirement benefitplan deficits – – 9,857 – 9,8572,993 4,703 89,101 (4,305) 92,492Total liabilities 8,106 7,088 189,333 (28,156) 176,371Net assets 7,909 121,497 83,<strong>20</strong>1 (116,716) 95,891Equity<strong>BP</strong> shareholders’ equity 7,909 121,497 82,297 (116,716) 94,987Minority interest – – 904 – 904Total equity 7,909 121,497 83,<strong>20</strong>1 (116,716) 95,891Financial statementsa Adjusted following the termination of the Pan American Energy LLC sale agreement as described in Note 4.<strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>11 257

- Page 2 and 3:

Cover imagePhotograph of DeepseaSta

- Page 4 and 5:

Cross reference to Form 20-FPageIte

- Page 6 and 7:

Miscellaneous termsIn this document

- Page 8 and 9:

6 BP Annual Report and Form 20-F 20

- Page 10:

Chairman’s letterCarl-Henric Svan

- Page 13 and 14:

During the year, the remuneration c

- Page 15 and 16:

Business review: Group overviewBP A

- Page 17 and 18:

SafetyDuring the year, we reorganiz

- Page 19 and 20:

In Refining and Marketing, our worl

- Page 21 and 22:

Crude oil and gas prices,and refini

- Page 23:

In detailFor more information, seeR

- Page 26 and 27:

Our market: Longer-term outlookThe

- Page 29 and 30:

BP’s distinctive capabilities and

- Page 31 and 32:

Technology will continue to play a

- Page 33 and 34:

In detailFor more information,see C

- Page 35 and 36:

In detailFind out more online.bp.co

- Page 37 and 38:

BP Annual Report and Form 20-F 2011

- Page 39 and 40:

Below BP has asignificant presencei

- Page 41 and 42:

What you can measure6 Active portfo

- Page 43 and 44:

Business review: Group overview2012

- Page 45 and 46:

Our risk management systemOur enhan

- Page 47 and 48:

Our current strategic priorities ar

- Page 49 and 50:

Our performance2011 was a year of f

- Page 51 and 52:

Left BP employeesat work in Prudhoe

- Page 53 and 54:

We continued to sell non-core asset

- Page 55 and 56:

Reported recordableinjury frequency

- Page 57 and 58:

Business reviewBP in more depth56 F

- Page 59 and 60:

Business reviewThe primary addition

- Page 61 and 62:

Business reviewRisk factorsWe urge

- Page 63 and 64:

Business review2010. Similar action

- Page 65 and 66:

Business reviewBusiness continuity

- Page 67:

Business reviewSafetyOver the past

- Page 70:

Business reviewour review of all th

- Page 73 and 74:

Business reviewGreenhouse gas regul

- Page 75 and 76:

Business reviewresources such as dr

- Page 77 and 78:

Business reviewExploration and Prod

- Page 79 and 80:

Business reviewCompleting the respo

- Page 81 and 82:

Business reviewgrants, which were s

- Page 83 and 84:

Business reviewOur performanceKey s

- Page 85 and 86:

Business reviewwere in Russia (Oren

- Page 87 and 88:

Business reviewCanadaIn Canada, BP

- Page 89 and 90:

Business review• In March 2011, T

- Page 91 and 92:

Business reviewaccess advantageous

- Page 93 and 94:

Business reviewBP’s vice presiden

- Page 95 and 96:

Business reviewhttp://www.bp.com/do

- Page 97 and 98:

Business reviewbalance of participa

- Page 99 and 100:

Business reviewAcquisitions and dis

- Page 101 and 102:

Business reviewLPGOur global LPG ma

- Page 103 and 104:

Business reviewOther businesses and

- Page 105 and 106:

Business reviewLiquidity and capita

- Page 107 and 108:

Business reviewThe group expects it

- Page 109 and 110:

Business reviewFrequently, work (in

- Page 111 and 112:

Business reviewHazardous and Noxiou

- Page 113 and 114:

Business reviewpart of a larger por

- Page 115 and 116:

Directors andsenior management114 D

- Page 117 and 118:

Directors and senior managementDire

- Page 119 and 120:

Directors and senior managementH L

- Page 121 and 122:

Corporate governanceCorporate gover

- Page 123 and 124:

Corporate governanceAntony Burgmans

- Page 125 and 126:

Corporate governanceBoard oversight

- Page 127 and 128:

Corporate governanceBoard and commi

- Page 129 and 130:

Corporate governancefinancial repor

- Page 131 and 132:

Corporate governancechairs and secr

- Page 133 and 134:

Corporate governance• Oversee GCR

- Page 135 and 136:

Corporate governanceCommittee’s r

- Page 137 and 138:

Corporate governanceControls and pr

- Page 139 and 140:

Corporate governanceThe Act require

- Page 141 and 142:

Directors’ remuneration reportRem

- Page 143 and 144:

Directors’ remuneration reportSum

- Page 145 and 146:

Directors’ remuneration reportSaf

- Page 147 and 148:

Directors’ remuneration reportRem

- Page 149 and 150:

Directors’ remuneration reportThe

- Page 151 and 152:

Directors’ remuneration reportSha

- Page 153 and 154:

Directors’ remuneration reportNon

- Page 155 and 156:

Additional informationfor sharehold

- Page 157 and 158:

Additional information for sharehol

- Page 159 and 160:

Additional information for sharehol

- Page 161 and 162:

Additional information for sharehol

- Page 163 and 164:

Additional information for sharehol

- Page 165 and 166:

Additional information for sharehol

- Page 167 and 168:

Additional information for sharehol

- Page 169 and 170:

Additional information for sharehol

- Page 171 and 172:

Additional information for sharehol

- Page 173 and 174:

Additional information for sharehol

- Page 175 and 176:

Financial statements174 Statement o

- Page 177 and 178:

Consolidated financial statements o

- Page 179 and 180:

Consolidated financial statements o

- Page 181 and 182:

Consolidated financial statements o

- Page 183 and 184:

Consolidated financial statements o

- Page 185 and 186:

Notes on financial statements1. Sig

- Page 187 and 188:

Notes on financial statements1. Sig

- Page 189 and 190:

Notes on financial statements1. Sig

- Page 191 and 192:

Notes on financial statements1. Sig

- Page 193 and 194:

Notes on financial statementshttp:/

- Page 195 and 196:

Notes on financial statementshttp:/

- Page 197 and 198:

Notes on financial statements3. Bus

- Page 199 and 200:

Notes on financial statements5. Dis

- Page 201 and 202:

Notes on financial statements5. Dis

- Page 203 and 204:

Notes on financial statementshttp:/

- Page 205 and 206:

Notes on financial statementshttp:/

- Page 207 and 208: Notes on financial statements7. Int

- Page 209 and 210: Notes on financial statements10. Im

- Page 211 and 212: Notes on financial statements15. Ex

- Page 213 and 214: Notes on financial statementshttp:/

- Page 215 and 216: Notes on financial statementshttp:/

- Page 217 and 218: Notes on financial statementshttp:/

- Page 219 and 220: Notes on financial statements26. Fi

- Page 221 and 222: Notes on financial statements26. Fi

- Page 223 and 224: Notes on financial statements26. Fi

- Page 225 and 226: Notes on financial statements29. Tr

- Page 227 and 228: Notes on financial statements33. De

- Page 229 and 230: Notes on financial statements33. De

- Page 231 and 232: Notes on financial statements34. Fi

- Page 233 and 234: Notes on financial statementshttp:/

- Page 235 and 236: Notes on financial statements36. Pr

- Page 237 and 238: Notes on financial statements37. Pe

- Page 239 and 240: Notes on financial statements37. Pe

- Page 241 and 242: Notes on financial statements37. Pe

- Page 243 and 244: Notes on financial statements38. Ca

- Page 245 and 246: Notes on financial statementsTotal

- Page 247 and 248: Notes on financial statements39. Ca

- Page 249 and 250: Notes on financial statements40. Sh

- Page 251 and 252: Notes on financial statements42. Re

- Page 253 and 254: Notes on financial statements45. Su

- Page 255 and 256: Notes on financial statements46. Co

- Page 257: Notes on financial statements46. Co

- Page 262 and 263: Supplementary information on oil an

- Page 264 and 265: Supplementary information on oil an

- Page 266 and 267: Supplementary information on oil an

- Page 268 and 269: Supplementary information on oil an

- Page 270 and 271: Supplementary information on oil an

- Page 272 and 273: Supplementary information on oil an

- Page 274 and 275: Supplementary information on oil an

- Page 276 and 277: Supplementary information on oil an

- Page 278 and 279: Supplementary information on oil an

- Page 280 and 281: Supplementary information on oil an

- Page 282 and 283: Supplementary information on oil an

- Page 284 and 285: SignaturesThe registrant hereby cer

- Page 286 and 287: Parent company financial statements

- Page 288 and 289: Parent company financial statements

- Page 290 and 291: Parent company financial statements

- Page 292 and 293: Parent company financial statements

- Page 294 and 295: Parent company financial statements

- Page 296 and 297: Parent company financial statements

- Page 298 and 299: Parent company financial statements