BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

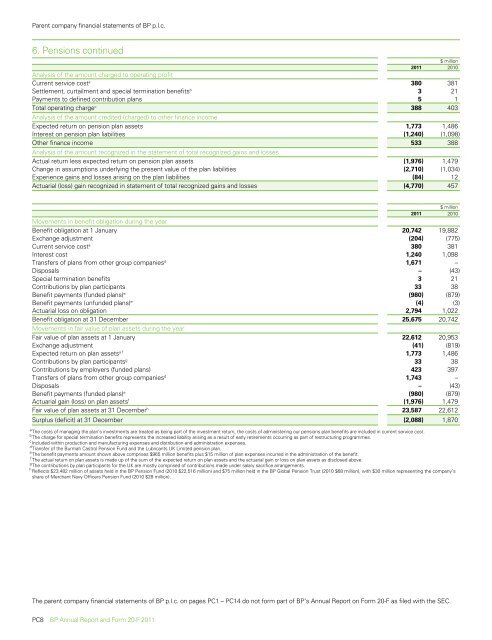

Parent company financial statements of <strong>BP</strong> p.l.c.6. Pensions continued$ million<strong>20</strong>11 <strong>20</strong>10Analysis of the amount charged to operating profitCurrent service cost a 380 381Settlement, curtailment <strong>and</strong> special termination benefits b 3 21Payments to defined contribution plans 5 1Total operating charge c 388 403Analysis of the amount credited (charged) to other finance incomeExpected return on pension plan assets 1,773 1,486Interest on pension plan liabilities (1,240) (1,098)Other finance income 533 388Analysis of the amount recognized in the statement of total recognized gains <strong>and</strong> lossesActual return less expected return on pension plan assets (1,976) 1,479Change in assumptions underlying the present value of the plan liabilities (2,710) (1,034)Experience gains <strong>and</strong> losses arising on the plan liabilities (84) 12Actuarial (loss) gain recognized in statement of total recognized gains <strong>and</strong> losses (4,770) 457$ million<strong>20</strong>11 <strong>20</strong>10Movements in benefit obligation during the yearBenefit obligation at 1 January <strong>20</strong>,742 19,882Exchange adjustment (<strong>20</strong>4) (775)Current service cost a 380 381Interest cost 1,240 1,098Transfers of plans from other group companies d 1,671 –Disposals – (43)Special termination benefits 3 21Contributions by plan participants 33 38Benefit payments (funded plans) e (980) (879)Benefit payments (unfunded plans) e (4) (3)Actuarial loss on obligation 2,794 1,022Benefit obligation at 31 December 25,675 <strong>20</strong>,742Movements in fair value of plan assets during the yearFair value of plan assets at 1 January 22,612 <strong>20</strong>,953Exchange adjustment (41) (819)Expected return on plan assets a f 1,773 1,486Contributions by plan participants g 33 38Contributions by employers (funded plans) 423 397Transfers of plans from other group companies d 1,743 –Disposals – (43)Benefit payments (funded plans) e (980) (879)Actuarial gain (loss) on plan assets f (1,976) 1,479Fair value of plan assets at 31 December h 23,587 22,612Surplus (deficit) at 31 December (2,088) 1,870aThe costs of managing the plan’s investments are treated as being part of the investment return, the costs of administering our pensions plan benefits are included in current service cost.bThe charge for special termination benefits represents the increased liability arising as a result of early retirements occurring as part of restructuring programmes.cIncluded within production <strong>and</strong> manufacturing expenses <strong>and</strong> distribution <strong>and</strong> administration expenses.dTransfer of the Burmah Castrol Pension Fund <strong>and</strong> the Lubricants UK Limited pension plan.eThe benefit payments amount shown above comprises $965 million benefits plus $15 million of plan expenses incurred in the administration of the benefit.fThe actual return on plan assets is made up of the sum of the expected return on plan assets <strong>and</strong> the actuarial gain or loss on plan assets as disclosed above.gThe contributions by plan participants for the UK are mostly comprised of contributions made under salary sacrifice arrangements.hReflects $23,482 million of assets held in the <strong>BP</strong> Pension Fund (<strong>20</strong>10 $22,516 million) <strong>and</strong> $75 million held in the <strong>BP</strong> Global Pension Trust (<strong>20</strong>10 $68 million), with $30 million representing the company’sshare of Merchant Navy Officers Pension Fund (<strong>20</strong>10 $28 million).The parent company financial statements of <strong>BP</strong> p.l.c. on pages PC1 – PC14 do not form part of <strong>BP</strong>’s <strong>Annual</strong> <strong>Report</strong> on <strong>Form</strong> <strong>20</strong>-F as filed with the SEC.PC8 <strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>11