BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

BP Annual Report and Form 20-F 2011 - Company Reporting

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

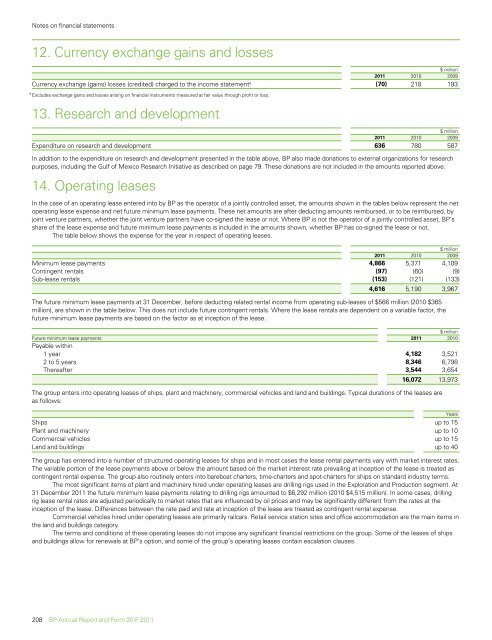

Notes on financial statements12. Currency exchange gains <strong>and</strong> losses$ million<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09Currency exchange (gains) losses (credited) charged to the income statement a (70) 218 193aExcludes exchange gains <strong>and</strong> losses arising on financial instruments measured at fair value through profit or loss.13. Research <strong>and</strong> development$ million<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09Expenditure on research <strong>and</strong> development 636 780 587In addition to the expenditure on research <strong>and</strong> development presented in the table above, <strong>BP</strong> also made donations to external organizations for researchpurposes, including the Gulf of Mexico Research Initiative as described on page 79. These donations are not included in the amounts reported above.14. Operating leasesIn the case of an operating lease entered into by <strong>BP</strong> as the operator of a jointly controlled asset, the amounts shown in the tables below represent the netoperating lease expense <strong>and</strong> net future minimum lease payments. These net amounts are after deducting amounts reimbursed, or to be reimbursed, byjoint venture partners, whether the joint venture partners have co-signed the lease or not. Where <strong>BP</strong> is not the operator of a jointly controlled asset, <strong>BP</strong>’sshare of the lease expense <strong>and</strong> future minimum lease payments is included in the amounts shown, whether <strong>BP</strong> has co-signed the lease or not.The table below shows the expense for the year in respect of operating leases.$ million<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09Minimum lease payments 4,866 5,371 4,109Contingent rentals (97) (60) (9)Sub-lease rentals (153) (121) (133)4,616 5,190 3,967The future minimum lease payments at 31 December, before deducting related rental income from operating sub-leases of $566 million (<strong>20</strong>10 $365million), are shown in the table below. This does not include future contingent rentals. Where the lease rentals are dependent on a variable factor, thefuture minimum lease payments are based on the factor as at inception of the lease.$ millionFuture minimum lease payments <strong>20</strong>11 <strong>20</strong>10Payable within1 year 4,182 3,5212 to 5 years 8,346 6,798Thereafter 3,544 3,65416,072 13,973The group enters into operating leases of ships, plant <strong>and</strong> machinery, commercial vehicles <strong>and</strong> l<strong>and</strong> <strong>and</strong> buildings. Typical durations of the leases areas follows:YearsShips up to 15Plant <strong>and</strong> machinery up to 10Commercial vehicles up to 15L<strong>and</strong> <strong>and</strong> buildings up to 40The group has entered into a number of structured operating leases for ships <strong>and</strong> in most cases the lease rental payments vary with market interest rates.The variable portion of the lease payments above or below the amount based on the market interest rate prevailing at inception of the lease is treated ascontingent rental expense. The group also routinely enters into bareboat charters, time-charters <strong>and</strong> spot-charters for ships on st<strong>and</strong>ard industry terms.The most significant items of plant <strong>and</strong> machinery hired under operating leases are drilling rigs used in the Exploration <strong>and</strong> Production segment. At31 December <strong>20</strong>11 the future minimum lease payments relating to drilling rigs amounted to $6,292 million (<strong>20</strong>10 $4,515 million). In some cases, drillingrig lease rental rates are adjusted periodically to market rates that are influenced by oil prices <strong>and</strong> may be significantly different from the rates at theinception of the lease. Differences between the rate paid <strong>and</strong> rate at inception of the lease are treated as contingent rental expense.Commercial vehicles hired under operating leases are primarily railcars. Retail service station sites <strong>and</strong> office accommodation are the main items inthe l<strong>and</strong> <strong>and</strong> buildings category.The terms <strong>and</strong> conditions of these operating leases do not impose any significant financial restrictions on the group. Some of the leases of ships<strong>and</strong> buildings allow for renewals at <strong>BP</strong>’s option, <strong>and</strong> some of the group’s operating leases contain escalation clauses.<strong>20</strong>8 <strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>11