CATALOG - University of Maryland University College

CATALOG - University of Maryland University College

CATALOG - University of Maryland University College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

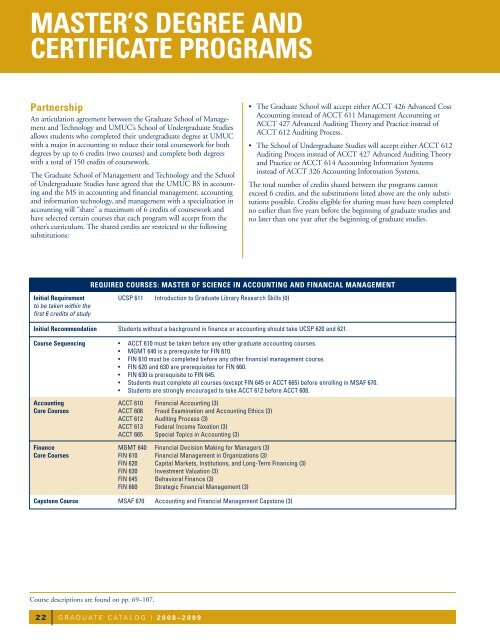

MASTER’S DEGREE ANDCERTIFICATE PROGRAMSPartnershipAn articulation agreement between the Graduate School <strong>of</strong> Managementand Technology and UMUC’s School <strong>of</strong> Undergraduate Studiesallows students who completed their undergraduate degree at UMUCwith a major in accounting to reduce their total coursework for bothdegrees by up to 6 credits (two courses) and complete both degreeswith a total <strong>of</strong> 150 credits <strong>of</strong> coursework.The Graduate School <strong>of</strong> Management and Technology and the School<strong>of</strong> Undergraduate Studies have agreed that the UMUC BS in accountingand the MS in accounting and financial management, accountingand information technology, and management with a specialization inaccounting will “share” a maximum <strong>of</strong> 6 credits <strong>of</strong> coursework andhave selected certain courses that each program will accept from theother’s curriculum. The shared credits are restricted to the followingsubstitutions:• The Graduate School will accept either ACCT 426 Advanced CostAccounting instead <strong>of</strong> ACCT 611 Management Accounting orACCT 427 Advanced Auditing Theory and Practice instead <strong>of</strong>ACCT 612 Auditing Process.• The School <strong>of</strong> Undergraduate Studies will accept either ACCT 612Auditing Process instead <strong>of</strong> ACCT 427 Advanced Auditing Theoryand Practice or ACCT 614 Accounting Information Systemsinstead <strong>of</strong> ACCT 326 Accounting Information Systems.The total number <strong>of</strong> credits shared between the programs cannotexceed 6 credits, and the substitutions listed above are the only substitutionspossible. Credits eligible for sharing must have been completedno earlier than five years before the beginning <strong>of</strong> graduate studies andno later than one year after the beginning <strong>of</strong> graduate studies.Initial Requirementto be taken within thefirst 6 credits <strong>of</strong> studyREQUIRED COURSES: MASTER OF SCIENCE IN ACCOUNTING AND FINANCIAL MANAGEMENTUCSP 611 Introduction to Graduate Library Research Skills (0)Initial Recommendation Students without a background in finance or accounting should take UCSP 620 and 621.Course Sequencing • ACCT 610 must be taken before any other graduate accounting courses.• MGMT 640 is a prerequisite for FIN 610.• FIN 610 must be completed before any other financial management course.• FIN 620 and 630 are prerequisites for FIN 660.• FIN 630 is prerequisite to FIN 645.• Students must complete all courses (except FIN 645 or ACCT 665) before enrolling in MSAF 670.• Students are strongly encouraged to take ACCT 612 before ACCT 608.AccountingCore CoursesFinanceCore CoursesACCT 610 Financial Accounting (3)ACCT 608 Fraud Examination and Accounting Ethics (3)ACCT 612 Auditing Process (3)ACCT 613 Federal Income Taxation (3)ACCT 665 Special Topics in Accounting (3)MGMT 640 Financial Decision Making for Managers (3)FIN 610 Financial Management in Organizations (3)FIN 620 Capital Markets, Institutions, and Long-Term Financing (3)FIN 630 Investment Valuation (3)FIN 645 Behavioral Finance (3)FIN 660 Strategic Financial Management (3)Capstone Course MSAF 670 Accounting and Financial Management Capstone (3)Course descriptions are found on pp. 69–107.22GRADUATE <strong>CATALOG</strong> | 2008–2009