CATALOG - University of Maryland University College

CATALOG - University of Maryland University College

CATALOG - University of Maryland University College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

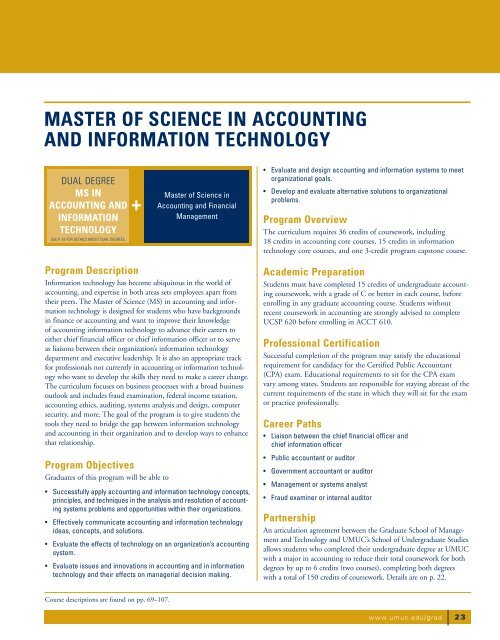

MASTER OF SCIENCE IN ACCOUNTINGAND INFORMATION TECHNOLOGYDUAL DEGREEMS INACCOUNTING ANDINFORMATIONTECHNOLOGYSEE P. 57 FOR DETAILS ABOUT DUAL DEGREES.+Master <strong>of</strong> Science inAccounting and FinancialManagement• Evaluate and design accounting and information systems to meetorganizational goals.• Develop and evaluate alternative solutions to organizationalproblems.Program OverviewThe curriculum requires 36 credits <strong>of</strong> coursework, including18 credits in accounting core courses, 15 credits in informationtechnology core courses, and one 3-credit program capstone course.Program DescriptionInformation technology has become ubiquitous in the world <strong>of</strong>accounting, and expertise in both areas sets employees apart fromtheir peers. The Master <strong>of</strong> Science (MS) in accounting and informationtechnology is designed for students who have backgroundsin finance or accounting and want to improve their knowledge<strong>of</strong> accounting information technology to advance their careers toeither chief financial <strong>of</strong>ficer or chief information <strong>of</strong>ficer or to serveas liaisons between their organization’s information technologydepartment and executive leadership. It is also an appropriate trackfor pr<strong>of</strong>essionals not currently in accounting or information technologywho want to develop the skills they need to make a career change.The curriculum focuses on business processes with a broad businessoutlook and includes fraud examination, federal income taxation,accounting ethics, auditing, systems analysis and design, computersecurity, and more. The goal <strong>of</strong> the program is to give students thetools they need to bridge the gap between information technologyand accounting in their organization and to develop ways to enhancethat relationship.Program ObjectivesGraduates <strong>of</strong> this program will be able to• Successfully apply accounting and information technology concepts,principles, and techniques in the analysis and resolution <strong>of</strong> accountingsystems problems and opportunities within their organizations.• Effectively communicate accounting and information technologyideas, concepts, and solutions.• Evaluate the effects <strong>of</strong> technology on an organization’s accountingsystem.• Evaluate issues and innovations in accounting and in informationtechnology and their effects on managerial decision making.Academic PreparationStudents must have completed 15 credits <strong>of</strong> undergraduate accountingcoursework, with a grade <strong>of</strong> C or better in each course, beforeenrolling in any graduate accounting course. Students withoutrecent coursework in accounting are strongly advised to completeUCSP 620 before enrolling in ACCT 610.Pr<strong>of</strong>essional CertificationSuccessful completion <strong>of</strong> the program may satisfy the educationalrequirement for candidacy for the Certified Public Accountant(CPA) exam. Educational requirements to sit for the CPA examvary among states. Students are responsible for staying abreast <strong>of</strong> thecurrent requirements <strong>of</strong> the state in which they will sit for the examor practice pr<strong>of</strong>essionally.Career Paths• Liaison between the chief financial <strong>of</strong>ficer andchief information <strong>of</strong>ficer• Public accountant or auditor• Government accountant or auditor• Management or systems analyst• Fraud examiner or internal auditorPartnershipAn articulation agreement between the Graduate School <strong>of</strong> Managementand Technology and UMUC’s School <strong>of</strong> Undergraduate Studiesallows students who completed their undergraduate degree at UMUCwith a major in accounting to reduce their total coursework for bothdegrees by up to 6 credits (two courses), completing both degreeswith a total <strong>of</strong> 150 credits <strong>of</strong> coursework. Details are on p. 22.Course descriptions are found on pp. 69–107.www.umuc.edu/grad 23