Nuclear Energy

Nuclear Energy

Nuclear Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Opinion of Credit Ratings Agencies and IFIs<br />

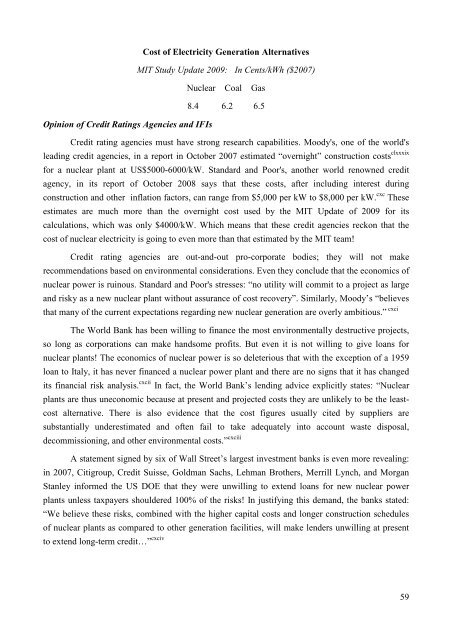

Cost of Electricity Generation Alternatives<br />

MIT Study Update 2009: In Cents/kWh ($2007)<br />

<strong>Nuclear</strong> Coal Gas<br />

8.4 6.2 6.5<br />

Credit rating agencies must have strong research capabilities. Moody's, one of the world's<br />

leading credit agencies, in a report in October 2007 estimated “overnight” construction costs clxxxix<br />

for a nuclear plant at US$5000-6000/kW. Standard and Poor's, another world renowned credit<br />

agency, in its report of October 2008 says that these costs, after including interest during<br />

construction and other inflation factors, can range from $5,000 per kW to $8,000 per kW. cxc These<br />

estimates are much more than the overnight cost used by the MIT Update of 2009 for its<br />

calculations, which was only $4000/kW. Which means that these credit agencies reckon that the<br />

cost of nuclear electricity is going to even more than that estimated by the MIT team!<br />

Credit rating agencies are out-and-out pro-corporate bodies; they will not make<br />

recommendations based on environmental considerations. Even they conclude that the economics of<br />

nuclear power is ruinous. Standard and Poor's stresses: “no utility will commit to a project as large<br />

and risky as a new nuclear plant without assurance of cost recovery”. Similarly, Moody’s “believes<br />

that many of the current expectations regarding new nuclear generation are overly ambitious.” cxci<br />

The World Bank has been willing to finance the most environmentally destructive projects,<br />

so long as corporations can make handsome profits. But even it is not willing to give loans for<br />

nuclear plants! The economics of nuclear power is so deleterious that with the exception of a 1959<br />

loan to Italy, it has never financed a nuclear power plant and there are no signs that it has changed<br />

its financial risk analysis. cxcii In fact, the World Bank’s lending advice explicitly states: “<strong>Nuclear</strong><br />

plants are thus uneconomic because at present and projected costs they are unlikely to be the least-<br />

cost alternative. There is also evidence that the cost figures usually cited by suppliers are<br />

substantially underestimated and often fail to take adequately into account waste disposal,<br />

decommissioning, and other environmental costs.” cxciii<br />

A statement signed by six of Wall Street’s largest investment banks is even more revealing:<br />

in 2007, Citigroup, Credit Suisse, Goldman Sachs, Lehman Brothers, Merrill Lynch, and Morgan<br />

Stanley informed the US DOE that they were unwilling to extend loans for new nuclear power<br />

plants unless taxpayers shouldered 100% of the risks! In justifying this demand, the banks stated:<br />

“We believe these risks, combined with the higher capital costs and longer construction schedules<br />

of nuclear plants as compared to other generation facilities, will make lenders unwilling at present<br />

to extend long-term credit…” cxciv<br />

59