ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

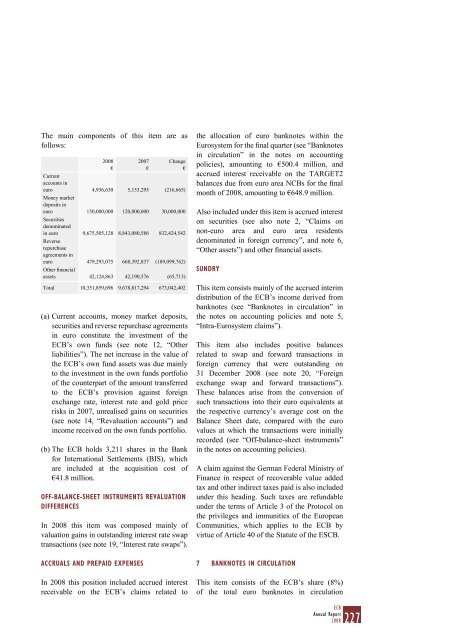

The main components <strong>of</strong> this item are asfollows:<strong>2008</strong>€(a) Current accounts, money market deposits,securities and reverse repurchase agreementsin euro constitute <strong>the</strong> investment <strong>of</strong> <strong>the</strong>ECB’s own funds (see note 12, “O<strong>the</strong>rliabilities”). The net increase in <strong>the</strong> value <strong>of</strong><strong>the</strong> ECB’s own fund assets was due mainlyto <strong>the</strong> investment in <strong>the</strong> own funds portfolio<strong>of</strong> <strong>the</strong> counterpart <strong>of</strong> <strong>the</strong> amount transferredto <strong>the</strong> ECB’s provision against foreignexchange rate, interest rate and gold pricerisks in 2007, unrealised gains on securities(see note 14, “Revaluation accounts”) andincome received on <strong>the</strong> own funds portfolio.(b) The ECB holds 3,211 shares in <strong>the</strong> <strong>Bank</strong>for International Settlements (BIS), whichare included at <strong>the</strong> acquisition cost <strong>of</strong>€41.8 million.OFF-BALANCE-SHEET INSTRUMENTS REVALUATIONDIFFERENCESIn <strong>2008</strong> this item was composed mainly <strong>of</strong>valuation gains in outstanding interest rate swaptransactions (see note 19, “Interest rate swaps”).ACCRUALS AND PREPAID EXPENSES2007€Change€Currentaccounts ineuro 4,936,630 5,153,295 (216,665)Money marketdeposits ineuro 150,000,000 120,000,000 30,000,000Securitiesdenominatedin euro 9,675,505,128 8,843,080,586 832,424,542Reverserepurchaseagreements ineuro 479,293,075 668,392,837 (189,099,762)O<strong>the</strong>r financialassets 42,124,863 42,190,576 (65,713)Total 10,351,859,696 9,678,817,294 673,042,402In <strong>2008</strong> this position included accrued interestreceivable on <strong>the</strong> ECB’s claims related to<strong>the</strong> allocation <strong>of</strong> euro banknotes within <strong>the</strong>Eurosystem for <strong>the</strong> final quarter (see “<strong>Bank</strong>notesin circulation” in <strong>the</strong> notes on accountingpolicies), amounting to €500.4 million, andaccrued interest receivable on <strong>the</strong> TARGET2balances due from euro area NCBs for <strong>the</strong> finalmonth <strong>of</strong> <strong>2008</strong>, amounting to €648.9 million.Also included under this item is accrued intereston securities (see also note 2, “Claims onnon-euro area and euro area residentsdenominated in foreign currency”, and note 6,“O<strong>the</strong>r assets”) and o<strong>the</strong>r financial assets.SUNDRYThis item consists mainly <strong>of</strong> <strong>the</strong> accrued interimdistribution <strong>of</strong> <strong>the</strong> ECB’s income derived frombanknotes (see “<strong>Bank</strong>notes in circulation” in<strong>the</strong> notes on accounting policies and note 5,“Intra-Eurosystem claims”).This item also includes positive balancesrelated to swap and forward transactions inforeign currency that were outstanding on31 December <strong>2008</strong> (see note 20, “Foreignexchange swap and forward transactions”).These balances arise from <strong>the</strong> conversion <strong>of</strong>such transactions into <strong>the</strong>ir euro equivalents at<strong>the</strong> respective currency’s average cost on <strong>the</strong>Balance Sheet date, compared with <strong>the</strong> eurovalues at which <strong>the</strong> transactions were initiallyrecorded (see “Off-balance-sheet instruments”in <strong>the</strong> notes on accounting policies).A claim against <strong>the</strong> German Federal Ministry <strong>of</strong>Finance in respect <strong>of</strong> recoverable value addedtax and o<strong>the</strong>r indirect taxes paid is also includedunder this heading. Such taxes are refundableunder <strong>the</strong> terms <strong>of</strong> Article 3 <strong>of</strong> <strong>the</strong> Protocol on<strong>the</strong> privileges and immunities <strong>of</strong> <strong>the</strong> EuropeanCommunities, which applies to <strong>the</strong> ECB byvirtue <strong>of</strong> Article 40 <strong>of</strong> <strong>the</strong> Statute <strong>of</strong> <strong>the</strong> ESCB.7 BANKNOTES IN CIRCULATIONThis item consists <strong>of</strong> <strong>the</strong> ECB’s share (8%)<strong>of</strong> <strong>the</strong> total euro banknotes in circulationECBAnnual Report<strong>2008</strong>227

![KNOW YOUR NEW GIBRALTAR BANKNOTES - [Home] bThe/b](https://img.yumpu.com/50890985/1/184x260/know-your-new-gibraltar-banknotes-home-bthe-b.jpg?quality=85)

![PAPUA NEW GUINEA - [Home] - Polymer Bank Notes of the World](https://img.yumpu.com/49758743/1/190x143/papua-new-guinea-home-polymer-bank-notes-of-the-world.jpg?quality=85)