ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

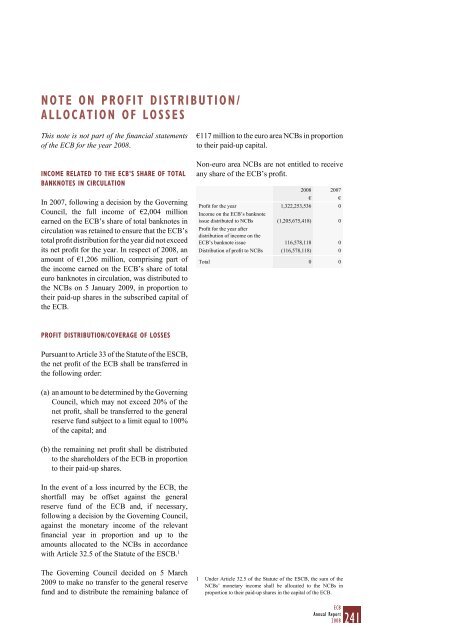

NOTE ON PROFIT DISTRIBUTION/ALLOCATION OF LOSSESThis note is not part <strong>of</strong> <strong>the</strong> fi nancial statements<strong>of</strong> <strong>the</strong> ECB for <strong>the</strong> year <strong>2008</strong>.INCOME RELATED TO THE ECB’S SHARE OF TOTALBANKNOTES IN CIRCULATIONIn 2007, following a decision by <strong>the</strong> GoverningCouncil, <strong>the</strong> full income <strong>of</strong> €2,004 millionearned on <strong>the</strong> ECB’s share <strong>of</strong> total banknotes incirculation was retained to ensure that <strong>the</strong> ECB’stotal pr<strong>of</strong>it distribution for <strong>the</strong> year did not exceedits net pr<strong>of</strong>it for <strong>the</strong> year. In respect <strong>of</strong> <strong>2008</strong>, anamount <strong>of</strong> €1,206 million, comprising part <strong>of</strong><strong>the</strong> income earned on <strong>the</strong> ECB’s share <strong>of</strong> totaleuro banknotes in circulation, was distributed to<strong>the</strong> NCBs on 5 January 2009, in proportion to<strong>the</strong>ir paid-up shares in <strong>the</strong> subscribed capital <strong>of</strong><strong>the</strong> ECB.€117 million to <strong>the</strong> euro area NCBs in proportionto <strong>the</strong>ir paid-up capital.Non-euro area NCBs are not entitled to receiveany share <strong>of</strong> <strong>the</strong> ECB’s pr<strong>of</strong>it.<strong>2008</strong> 2007€ €Pr<strong>of</strong>it for <strong>the</strong> year 1,322,253,536 0Income on <strong>the</strong> ECB’s banknoteissue distributed to NCBs (1,205,675,418) 0Pr<strong>of</strong>it for <strong>the</strong> year afterdistribution <strong>of</strong> income on <strong>the</strong>ECB’s banknote issue 116,578,118 0Distribution <strong>of</strong> pr<strong>of</strong>it to NCBs (116,578,118) 0Total 0 0PROFIT DISTRIBUTION/COVERAGE OF LOSSESPursuant to Article 33 <strong>of</strong> <strong>the</strong> Statute <strong>of</strong> <strong>the</strong> ESCB,<strong>the</strong> net pr<strong>of</strong>it <strong>of</strong> <strong>the</strong> ECB shall be transferred in<strong>the</strong> following order:(a) an amount to be determined by <strong>the</strong> GoverningCouncil, which may not exceed 20% <strong>of</strong> <strong>the</strong>net pr<strong>of</strong>it, shall be transferred to <strong>the</strong> generalreserve fund subject to a limit equal to 100%<strong>of</strong> <strong>the</strong> capital; and(b) <strong>the</strong> remaining net pr<strong>of</strong>it shall be distributedto <strong>the</strong> shareholders <strong>of</strong> <strong>the</strong> ECB in proportionto <strong>the</strong>ir paid-up shares.In <strong>the</strong> event <strong>of</strong> a loss incurred by <strong>the</strong> ECB, <strong>the</strong>shortfall may be <strong>of</strong>fset against <strong>the</strong> generalreserve fund <strong>of</strong> <strong>the</strong> ECB and, if necessary,following a decision by <strong>the</strong> Governing Council,against <strong>the</strong> monetary income <strong>of</strong> <strong>the</strong> relevantfinancial year in proportion and up to <strong>the</strong>amounts allocated to <strong>the</strong> NCBs in accordancewith Article 32.5 <strong>of</strong> <strong>the</strong> Statute <strong>of</strong> <strong>the</strong> ESCB. 1The Governing Council decided on 5 March2009 to make no transfer to <strong>the</strong> general reservefund and to distribute <strong>the</strong> remaining balance <strong>of</strong>1Under Article 32.5 <strong>of</strong> <strong>the</strong> Statute <strong>of</strong> <strong>the</strong> ESCB, <strong>the</strong> sum <strong>of</strong> <strong>the</strong>NCBs’ monetary income shall be allocated to <strong>the</strong> NCBs inproportion to <strong>the</strong>ir paid-up shares in <strong>the</strong> capital <strong>of</strong> <strong>the</strong> ECB.ECBAnnual Report<strong>2008</strong>241

![KNOW YOUR NEW GIBRALTAR BANKNOTES - [Home] bThe/b](https://img.yumpu.com/50890985/1/184x260/know-your-new-gibraltar-banknotes-home-bthe-b.jpg?quality=85)

![PAPUA NEW GUINEA - [Home] - Polymer Bank Notes of the World](https://img.yumpu.com/49758743/1/190x143/papua-new-guinea-home-polymer-bank-notes-of-the-world.jpg?quality=85)