ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

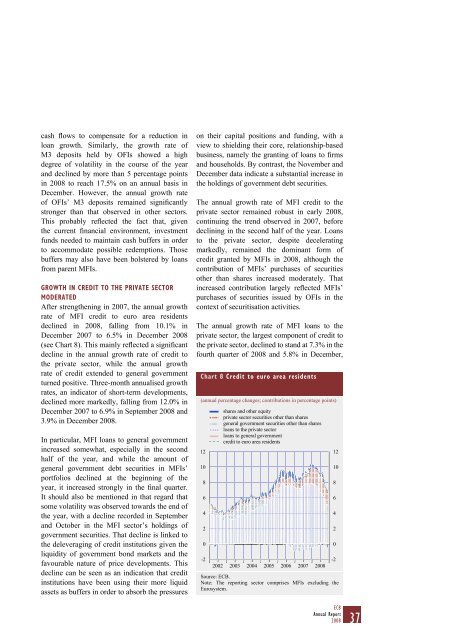

cash flows to compensate for a reduction inloan growth. Similarly, <strong>the</strong> growth rate <strong>of</strong>M3 deposits held by OFIs showed a highdegree <strong>of</strong> volatility in <strong>the</strong> course <strong>of</strong> <strong>the</strong> yearand declined by more than 5 percentage pointsin <strong>2008</strong> to reach 17.5% on an annual basis inDecember. However, <strong>the</strong> annual growth rate<strong>of</strong> OFIs’ M3 deposits remained significantlystronger than that observed in o<strong>the</strong>r sectors.This probably reflected <strong>the</strong> fact that, given<strong>the</strong> current financial environment, investmentfunds needed to maintain cash buffers in orderto accommodate possible redemptions. Thosebuffers may also have been bolstered by loansfrom parent MFIs.GROWTH IN CREDIT TO THE PRIVATE SECTORMODERATEDAfter streng<strong>the</strong>ning in 2007, <strong>the</strong> annual growthrate <strong>of</strong> MFI credit to euro area residentsdeclined in <strong>2008</strong>, falling from 10.1% inDecember 2007 to 6.5% in December <strong>2008</strong>(see Chart 8). This mainly reflected a significantdecline in <strong>the</strong> annual growth rate <strong>of</strong> credit to<strong>the</strong> private sector, while <strong>the</strong> annual growthrate <strong>of</strong> credit extended to general governmentturned positive. Three-month annualised growthrates, an indicator <strong>of</strong> short-term developments,declined more markedly, falling from 12.0% inDecember 2007 to 6.9% in September <strong>2008</strong> and3.9% in December <strong>2008</strong>.In particular, MFI loans to general governmentincreased somewhat, especially in <strong>the</strong> secondhalf <strong>of</strong> <strong>the</strong> year, and while <strong>the</strong> amount <strong>of</strong>general government debt securities in MFIs’portfolios declined at <strong>the</strong> beginning <strong>of</strong> <strong>the</strong>year, it increased strongly in <strong>the</strong> final quarter.It should also be mentioned in that regard thatsome volatility was observed towards <strong>the</strong> end <strong>of</strong><strong>the</strong> year, with a decline recorded in Septemberand October in <strong>the</strong> MFI sector’s holdings <strong>of</strong>government securities. That decline is linked to<strong>the</strong> deleveraging <strong>of</strong> credit institutions given <strong>the</strong>liquidity <strong>of</strong> government bond markets and <strong>the</strong>favourable nature <strong>of</strong> price developments. Thisdecline can be seen as an indication that creditinstitutions have been using <strong>the</strong>ir more liquidassets as buffers in order to absorb <strong>the</strong> pressureson <strong>the</strong>ir capital positions and funding, with aview to shielding <strong>the</strong>ir core, relationship-basedbusiness, namely <strong>the</strong> granting <strong>of</strong> loans to firmsand households. By contrast, <strong>the</strong> November andDecember data indicate a substantial increase in<strong>the</strong> holdings <strong>of</strong> government debt securities.The annual growth rate <strong>of</strong> MFI credit to <strong>the</strong>private sector remained robust in early <strong>2008</strong>,continuing <strong>the</strong> trend observed in 2007, beforedeclining in <strong>the</strong> second half <strong>of</strong> <strong>the</strong> year. Loansto <strong>the</strong> private sector, despite deceleratingmarkedly, remained <strong>the</strong> dominant form <strong>of</strong>credit granted by MFIs in <strong>2008</strong>, although <strong>the</strong>contribution <strong>of</strong> MFIs’ purchases <strong>of</strong> securitieso<strong>the</strong>r than shares increased moderately. Thatincreased contribution largely reflected MFIs’purchases <strong>of</strong> securities issued by OFIs in <strong>the</strong>context <strong>of</strong> securitisation activities.The annual growth rate <strong>of</strong> MFI loans to <strong>the</strong>private sector, <strong>the</strong> largest component <strong>of</strong> credit to<strong>the</strong> private sector, declined to stand at 7.3% in <strong>the</strong>fourth quarter <strong>of</strong> <strong>2008</strong> and 5.8% in December,Chart 8 Credit to euro area residents(annual percentage changes; contributions in percentage points)121086420-2shares and o<strong>the</strong>r equityprivate sector securities o<strong>the</strong>r than sharesgeneral government securities o<strong>the</strong>r than sharesloans to <strong>the</strong> private sectorloans to general governmentcredit to euro area residents2002 2003 2004 2005 2006 2007<strong>2008</strong>Source: ECB.Note: The reporting sector comprises MFIs excluding <strong>the</strong>Eurosystem.121086420-2ECBAnnual Report<strong>2008</strong>37

![KNOW YOUR NEW GIBRALTAR BANKNOTES - [Home] bThe/b](https://img.yumpu.com/50890985/1/184x260/know-your-new-gibraltar-banknotes-home-bthe-b.jpg?quality=85)

![PAPUA NEW GUINEA - [Home] - Polymer Bank Notes of the World](https://img.yumpu.com/49758743/1/190x143/papua-new-guinea-home-polymer-bank-notes-of-the-world.jpg?quality=85)