ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

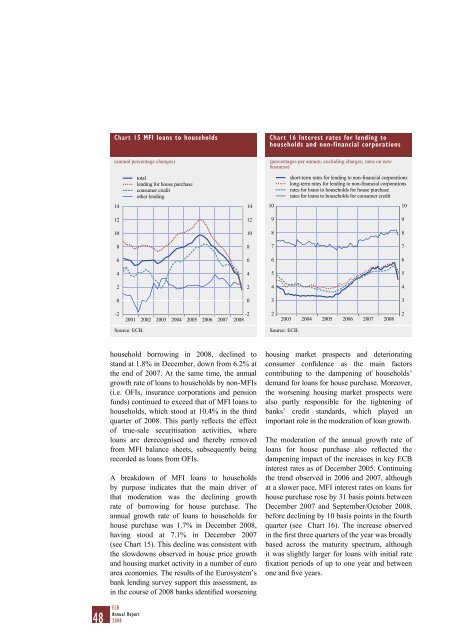

Chart 15 MFI loans to households(annual percentage changes)Chart 16 Interest rates for lending tohouseholds and non-financial corporations(percentages per annum; excluding charges; rates on newbusiness)totallending for house purchaseconsumer credito<strong>the</strong>r lendingshort-term rates for lending to non-financial corporationslong-term rates for lending to non-financial corporationsrates for loans to households for house purchaserates for loans to households for consumer credit1414101012129910108888776666445522440033-22001 2002 2003 2004 2005 2006 2007-2<strong>2008</strong>22003 2004 2005 2006 2007 <strong>2008</strong>2Source: ECB.Source: ECB.household borrowing in <strong>2008</strong>, declined tostand at 1.8% in December, down from 6.2% at<strong>the</strong> end <strong>of</strong> 2007. At <strong>the</strong> same time, <strong>the</strong> annualgrowth rate <strong>of</strong> loans to households by non-MFIs(i.e. OFIs, insurance corporations and pensionfunds) continued to exceed that <strong>of</strong> MFI loans tohouseholds, which stood at 10.4% in <strong>the</strong> thirdquarter <strong>of</strong> <strong>2008</strong>. This partly reflects <strong>the</strong> effect<strong>of</strong> true-sale securitisation activities, whereloans are derecognised and <strong>the</strong>reby removedfrom MFI balance sheets, subsequently beingrecorded as loans from OFIs.A breakdown <strong>of</strong> MFI loans to householdsby purpose indicates that <strong>the</strong> main driver <strong>of</strong>that moderation was <strong>the</strong> declining growthrate <strong>of</strong> borrowing for house purchase. Theannual growth rate <strong>of</strong> loans to households forhouse purchase was 1.7% in December <strong>2008</strong>,having stood at 7.1% in December 2007(see Chart 15). This decline was consistent with<strong>the</strong> slowdowns observed in house price growthand housing market activity in a number <strong>of</strong> euroarea economies. The results <strong>of</strong> <strong>the</strong> Eurosystem’sbank lending survey support this assessment, asin <strong>the</strong> course <strong>of</strong> <strong>2008</strong> banks identified worseninghousing market prospects and deterioratingconsumer confidence as <strong>the</strong> main factorscontributing to <strong>the</strong> dampening <strong>of</strong> households’demand for loans for house purchase. Moreover,<strong>the</strong> worsening housing market prospects werealso partly responsible for <strong>the</strong> tightening <strong>of</strong>banks’ credit standards, which played animportant role in <strong>the</strong> moderation <strong>of</strong> loan growth.The moderation <strong>of</strong> <strong>the</strong> annual growth rate <strong>of</strong>loans for house purchase also reflected <strong>the</strong>dampening impact <strong>of</strong> <strong>the</strong> increases in key ECBinterest rates as <strong>of</strong> December 2005. Continuing<strong>the</strong> trend observed in 2006 and 2007, althoughat a slower pace, MFI interest rates on loans forhouse purchase rose by 31 basis points betweenDecember 2007 and September/October <strong>2008</strong>,before declining by 10 basis points in <strong>the</strong> fourthquarter (see Chart 16). The increase observedin <strong>the</strong> first three quarters <strong>of</strong> <strong>the</strong> year was broadlybased across <strong>the</strong> maturity spectrum, althoughit was slightly larger for loans with initial ratefixation periods <strong>of</strong> up to one year and betweenone and five years.48 ECBAnnual Report<strong>2008</strong>

![KNOW YOUR NEW GIBRALTAR BANKNOTES - [Home] bThe/b](https://img.yumpu.com/50890985/1/184x260/know-your-new-gibraltar-banknotes-home-bthe-b.jpg?quality=85)

![PAPUA NEW GUINEA - [Home] - Polymer Bank Notes of the World](https://img.yumpu.com/49758743/1/190x143/papua-new-guinea-home-polymer-bank-notes-of-the-world.jpg?quality=85)