ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

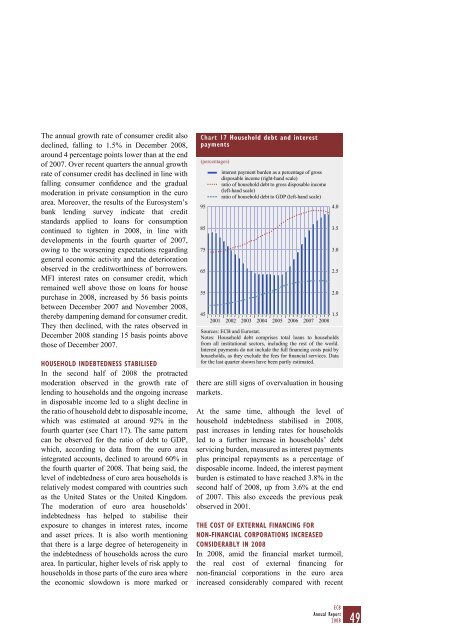

The annual growth rate <strong>of</strong> consumer credit alsodeclined, falling to 1.5% in December <strong>2008</strong>,around 4 percentage points lower than at <strong>the</strong> end<strong>of</strong> 2007. Over recent quarters <strong>the</strong> annual growthrate <strong>of</strong> consumer credit has declined in line withfalling consumer confidence and <strong>the</strong> gradualmoderation in private consumption in <strong>the</strong> euroarea. Moreover, <strong>the</strong> results <strong>of</strong> <strong>the</strong> Eurosystem’sbank lending survey indicate that creditstandards applied to loans for consumptioncontinued to tighten in <strong>2008</strong>, in line withdevelopments in <strong>the</strong> fourth quarter <strong>of</strong> 2007,owing to <strong>the</strong> worsening expectations regardinggeneral economic activity and <strong>the</strong> deteriorationobserved in <strong>the</strong> creditworthiness <strong>of</strong> borrowers.MFI interest rates on consumer credit, whichremained well above those on loans for housepurchase in <strong>2008</strong>, increased by 56 basis pointsbetween December 2007 and November <strong>2008</strong>,<strong>the</strong>reby dampening demand for consumer credit.They <strong>the</strong>n declined, with <strong>the</strong> rates observed inDecember <strong>2008</strong> standing 15 basis points abovethose <strong>of</strong> December 2007.HOUSEHOLD INDEBTEDNESS STABILISEDIn <strong>the</strong> second half <strong>of</strong> <strong>2008</strong> <strong>the</strong> protractedmoderation observed in <strong>the</strong> growth rate <strong>of</strong>lending to households and <strong>the</strong> ongoing increasein disposable income led to a slight decline in<strong>the</strong> ratio <strong>of</strong> household debt to disposable income,which was estimated at around 92% in <strong>the</strong>fourth quarter (see Chart 17). The same patterncan be observed for <strong>the</strong> ratio <strong>of</strong> debt to GDP,which, according to data from <strong>the</strong> euro areaintegrated accounts, declined to around 60% in<strong>the</strong> fourth quarter <strong>of</strong> <strong>2008</strong>. That being said, <strong>the</strong>level <strong>of</strong> indebtedness <strong>of</strong> euro area households isrelatively modest compared with countries suchas <strong>the</strong> United States or <strong>the</strong> United Kingdom.The moderation <strong>of</strong> euro area households’indebtedness has helped to stabilise <strong>the</strong>irexposure to changes in interest rates, incomeand asset prices. It is also worth mentioningthat <strong>the</strong>re is a large degree <strong>of</strong> heterogeneity in<strong>the</strong> indebtedness <strong>of</strong> households across <strong>the</strong> euroarea. In particular, higher levels <strong>of</strong> risk apply tohouseholds in those parts <strong>of</strong> <strong>the</strong> euro area where<strong>the</strong> economic slowdown is more marked orChart 17 Household debt and interestpayments(percentages)9585756555452001interest payment burden as a percentage <strong>of</strong> grossdisposable income (right-hand scale)ratio <strong>of</strong> household debt to gross disposable income(left-hand scale)ratio <strong>of</strong> household debt to GDP (left-hand scale)1.52002 2003 2004 2005 2006 2007 <strong>2008</strong>Sources: ECB and Eurostat.<strong>Notes</strong>: Household debt comprises total loans to householdsfrom all institutional sectors, including <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world.Interest payments do not include <strong>the</strong> full financing costs paid byhouseholds, as <strong>the</strong>y exclude <strong>the</strong> fees for financial services. Datafor <strong>the</strong> last quarter shown have been partly estimated.<strong>the</strong>re are still signs <strong>of</strong> overvaluation in housingmarkets.At <strong>the</strong> same time, although <strong>the</strong> level <strong>of</strong>household indebtedness stabilised in <strong>2008</strong>,past increases in lending rates for householdsled to a fur<strong>the</strong>r increase in households’ debtservicing burden, measured as interest paymentsplus principal repayments as a percentage <strong>of</strong>disposable income. Indeed, <strong>the</strong> interest paymentburden is estimated to have reached 3.8% in <strong>the</strong>second half <strong>of</strong> <strong>2008</strong>, up from 3.6% at <strong>the</strong> end<strong>of</strong> 2007. This also exceeds <strong>the</strong> previous peakobserved in 2001.THE COST OF EXTERNAL FINANCING FORNON-FINANCIAL CORPORATIONS INCREASEDCONSIDERABLY IN <strong>2008</strong>In <strong>2008</strong>, amid <strong>the</strong> financial market turmoil,<strong>the</strong> real cost <strong>of</strong> external financing fornon-financial corporations in <strong>the</strong> euro areaincreased considerably compared with recent4.03.53.02.52.0ECBAnnual Report<strong>2008</strong>49

![KNOW YOUR NEW GIBRALTAR BANKNOTES - [Home] bThe/b](https://img.yumpu.com/50890985/1/184x260/know-your-new-gibraltar-banknotes-home-bthe-b.jpg?quality=85)

![PAPUA NEW GUINEA - [Home] - Polymer Bank Notes of the World](https://img.yumpu.com/49758743/1/190x143/papua-new-guinea-home-polymer-bank-notes-of-the-world.jpg?quality=85)