ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

ANNUAL REPORT 2008 - Polymer Bank Notes of the World

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

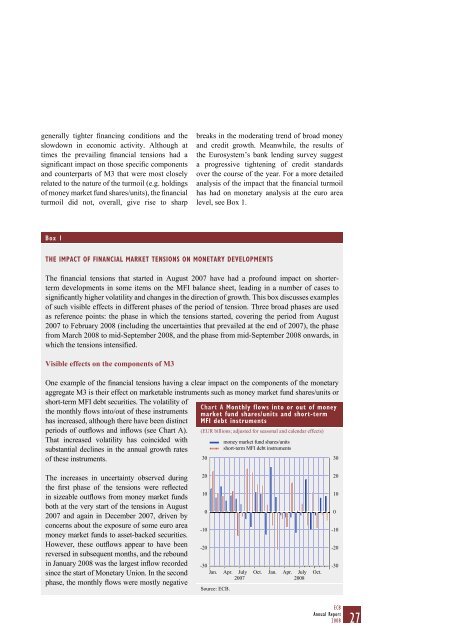

generally tighter financing conditions and <strong>the</strong>slowdown in economic activity. Although attimes <strong>the</strong> prevailing financial tensions had asignificant impact on those specific componentsand counterparts <strong>of</strong> M3 that were most closelyrelated to <strong>the</strong> nature <strong>of</strong> <strong>the</strong> turmoil (e.g. holdings<strong>of</strong> money market fund shares/units), <strong>the</strong> financialturmoil did not, overall, give rise to sharpbreaks in <strong>the</strong> moderating trend <strong>of</strong> broad moneyand credit growth. Meanwhile, <strong>the</strong> results <strong>of</strong><strong>the</strong> Eurosystem’s bank lending survey suggesta progressive tightening <strong>of</strong> credit standardsover <strong>the</strong> course <strong>of</strong> <strong>the</strong> year. For a more detailedanalysis <strong>of</strong> <strong>the</strong> impact that <strong>the</strong> financial turmoilhas had on monetary analysis at <strong>the</strong> euro arealevel, see Box 1.Box 1THE IMPACT OF FINANCIAL MARKET TENSIONS ON MONETARY DEVELOPMENTSThe financial tensions that started in August 2007 have had a pr<strong>of</strong>ound impact on shortertermdevelopments in some items on <strong>the</strong> MFI balance sheet, leading in a number <strong>of</strong> cases tosignificantly higher volatility and changes in <strong>the</strong> direction <strong>of</strong> growth. This box discusses examples<strong>of</strong> such visible effects in different phases <strong>of</strong> <strong>the</strong> period <strong>of</strong> tension. Three broad phases are usedas reference points: <strong>the</strong> phase in which <strong>the</strong> tensions started, covering <strong>the</strong> period from August2007 to February <strong>2008</strong> (including <strong>the</strong> uncertainties that prevailed at <strong>the</strong> end <strong>of</strong> 2007), <strong>the</strong> phasefrom March <strong>2008</strong> to mid-September <strong>2008</strong>, and <strong>the</strong> phase from mid-September <strong>2008</strong> onwards, inwhich <strong>the</strong> tensions intensified.Visible effects on <strong>the</strong> components <strong>of</strong> M3One example <strong>of</strong> <strong>the</strong> financial tensions having a clear impact on <strong>the</strong> components <strong>of</strong> <strong>the</strong> monetaryaggregate M3 is <strong>the</strong>ir effect on marketable instruments such as money market fund shares/units orshort-term MFI debt securities. The volatility <strong>of</strong><strong>the</strong> monthly flows into/out <strong>of</strong> <strong>the</strong>se instrumentshas increased, although <strong>the</strong>re have been distinctperiods <strong>of</strong> outflows and inflows (see Chart A).That increased volatility has coincided withsubstantial declines in <strong>the</strong> annual growth rates<strong>of</strong> <strong>the</strong>se instruments.Chart A Monthly flows into or out <strong>of</strong> moneymarket fund shares/units and short-termMFI debt instruments(EUR billions; adjusted for seasonal and calendar effects)30money market fund shares/unitsshort-term MFI debt instruments30The increases in uncertainty observed during<strong>the</strong> first phase <strong>of</strong> <strong>the</strong> tensions were reflectedin sizeable outflows from money market fundsboth at <strong>the</strong> very start <strong>of</strong> <strong>the</strong> tensions in August2007 and again in December 2007, driven byconcerns about <strong>the</strong> exposure <strong>of</strong> some euro areamoney market funds to asset-backed securities.However, <strong>the</strong>se outflows appear to have beenreversed in subsequent months, and <strong>the</strong> reboundin January <strong>2008</strong> was <strong>the</strong> largest inflow recordedsince <strong>the</strong> start <strong>of</strong> Monetary Union. In <strong>the</strong> secondphase, <strong>the</strong> monthly flows were mostly negative20100-10-20-30Jan. Apr. July2007Source: ECB.Oct.Jan.Apr. July<strong>2008</strong>Oct.20100-10-20-30ECBAnnual Report<strong>2008</strong>27

![KNOW YOUR NEW GIBRALTAR BANKNOTES - [Home] bThe/b](https://img.yumpu.com/50890985/1/184x260/know-your-new-gibraltar-banknotes-home-bthe-b.jpg?quality=85)

![PAPUA NEW GUINEA - [Home] - Polymer Bank Notes of the World](https://img.yumpu.com/49758743/1/190x143/papua-new-guinea-home-polymer-bank-notes-of-the-world.jpg?quality=85)