FACULTY HANDBOOK July 2009 - Morgan State University

FACULTY HANDBOOK July 2009 - Morgan State University

FACULTY HANDBOOK July 2009 - Morgan State University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

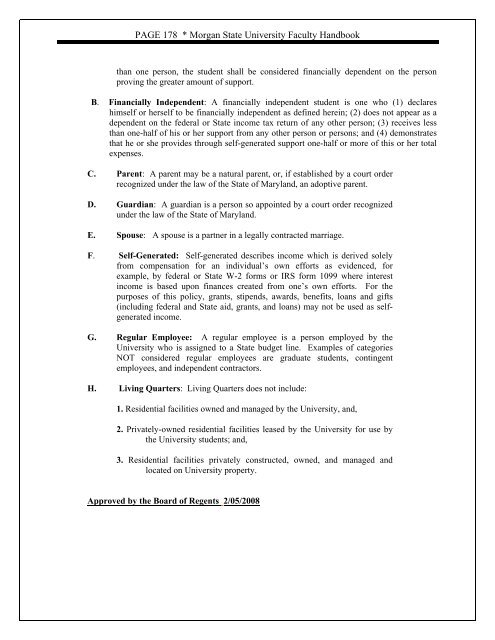

PAGE 178 * <strong>Morgan</strong> <strong>State</strong> <strong>University</strong> Faculty Handbookthan one person, the student shall be considered financially dependent on the personproving the greater amount of support.B. Financially Independent: A financially independent student is one who (1) declareshimself or herself to be financially independent as defined herein; (2) does not appear as adependent on the federal or <strong>State</strong> income tax return of any other person; (3) receives lessthan one-half of his or her support from any other person or persons; and (4) demonstratesthat he or she provides through self-generated support one-half or more of this or her totalexpenses.C. Parent: A parent may be a natural parent, or, if established by a court orderrecognized under the law of the <strong>State</strong> of Maryland, an adoptive parent.D. Guardian: A guardian is a person so appointed by a court order recognizedunder the law of the <strong>State</strong> of Maryland.E. Spouse: A spouse is a partner in a legally contracted marriage.F. Self-Generated: Self-generated describes income which is derived solelyfrom compensation for an individual’s own efforts as evidenced, forexample, by federal or <strong>State</strong> W-2 forms or IRS form 1099 where interestincome is based upon finances created from one’s own efforts. For thepurposes of this policy, grants, stipends, awards, benefits, loans and gifts(including federal and <strong>State</strong> aid, grants, and loans) may not be used as selfgeneratedincome.G. Regular Employee: A regular employee is a person employed by the<strong>University</strong> who is assigned to a <strong>State</strong> budget line. Examples of categoriesNOT considered regular employees are graduate students, contingentemployees, and independent contractors.H. Living Quarters: Living Quarters does not include:1. Residential facilities owned and managed by the <strong>University</strong>, and,2. Privately-owned residential facilities leased by the <strong>University</strong> for use bythe <strong>University</strong> students; and,3. Residential facilities privately constructed, owned, and managed andlocated on <strong>University</strong> property.Approved by the Board of Regents 2/05/2008