AH ANNUAL REPORT 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

of Financial Position’ by the trust. In accordance<br />

with IAS 17, the underlying assets are recognised<br />

as property, plant and equipment, together with<br />

an equivalent finance lease liability. Subsequently,<br />

the assets are accounted for as property, plant and<br />

equipment and/or intangible assets as appropriate.<br />

The annual contract payments are apportioned<br />

between the repayment of the liability, a finance cost<br />

and the charges for services.<br />

The service charge is recognised in operating expenses<br />

and the finance cost is charged to finance costs in the<br />

Statement of Comprehensive Income.<br />

Components of the asset replaced by the contractor<br />

during the contract (lifecycle replacement) are<br />

capitalised where they meet the trust’s criteria for<br />

capital expenditure. They are capitalised at the<br />

time they are provided by the operator and are<br />

measured initially at cost. The element of the annual<br />

unitary payment allocated to lifecycle replacement<br />

is pre-determined for each year of the contract<br />

from the operator’s planned programme of lifecycle<br />

replacement. Where the lifecycle component is<br />

provided earlier or later than expected, a short-term<br />

accrual or prepayment is recognised respectively.<br />

Where the fair value of the lifecycle component is<br />

less than the amount determined in the contract, the<br />

difference is recognised as an expense when the<br />

replacement is provided. If the fair value is greater than<br />

the amount determined in the contract, the difference<br />

is treated as a ‘free’ asset and a deferred income<br />

balance is recognised. The deferred income is released<br />

to operating income over the shorter of the remaining<br />

contract period or the useful economic life of the<br />

replacement component.<br />

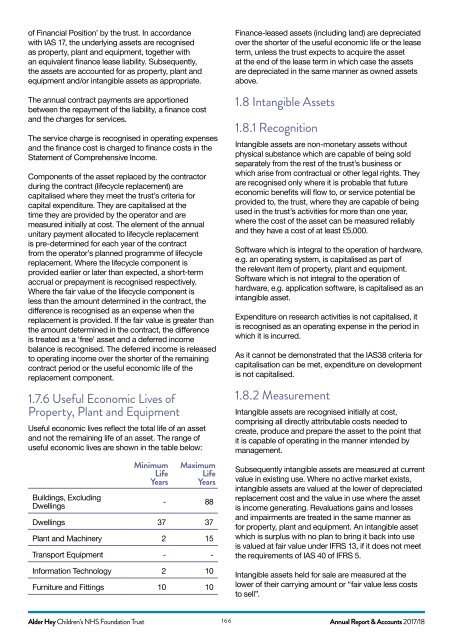

1.7.6 Useful Economic Lives of<br />

Property, Plant and Equipment<br />

Useful economic lives reflect the total life of an asset<br />

and not the remaining life of an asset. The range of<br />

useful economic lives are shown in the table below:<br />

Buildings, Excluding<br />

Dwellings<br />

Minimum<br />

Life<br />

Years<br />

Maximum<br />

Life<br />

Years<br />

- 88<br />

Dwellings 37 37<br />

Plant and Machinery 2 15<br />

Transport Equipment - -<br />

Information Technology 2 10<br />

Furniture and Fittings 10 10<br />

Finance-leased assets (including land) are depreciated<br />

over the shorter of the useful economic life or the lease<br />

term, unless the trust expects to acquire the asset<br />

at the end of the lease term in which case the assets<br />

are depreciated in the same manner as owned assets<br />

above.<br />

1.8 Intangible Assets<br />

1.8.1 Recognition<br />

Intangible assets are non-monetary assets without<br />

physical substance which are capable of being sold<br />

separately from the rest of the trust’s business or<br />

which arise from contractual or other legal rights. They<br />

are recognised only where it is probable that future<br />

economic benefits will flow to, or service potential be<br />

provided to, the trust, where they are capable of being<br />

used in the trust’s activities for more than one year,<br />

where the cost of the asset can be measured reliably<br />

and they have a cost of at least £5,000.<br />

Software which is integral to the operation of hardware,<br />

e.g. an operating system, is capitalised as part of<br />

the relevant item of property, plant and equipment.<br />

Software which is not integral to the operation of<br />

hardware, e.g. application software, is capitalised as an<br />

intangible asset.<br />

Expenditure on research activities is not capitalised, it<br />

is recognised as an operating expense in the period in<br />

which it is incurred.<br />

As it cannot be demonstrated that the IAS38 criteria for<br />

capitalisation can be met, expenditure on development<br />

is not capitalised.<br />

1.8.2 Measurement<br />

Intangible assets are recognised initially at cost,<br />

comprising all directly attributable costs needed to<br />

create, produce and prepare the asset to the point that<br />

it is capable of operating in the manner intended by<br />

management.<br />

Subsequently intangible assets are measured at current<br />

value in existing use. Where no active market exists,<br />

intangible assets are valued at the lower of depreciated<br />

replacement cost and the value in use where the asset<br />

is income generating. Revaluations gains and losses<br />

and impairments are treated in the same manner as<br />

for property, plant and equipment. An intangible asset<br />

which is surplus with no plan to bring it back into use<br />

is valued at fair value under IFRS 13, if it does not meet<br />

the requirements of IAS 40 of IFRS 5.<br />

Intangible assets held for sale are measured at the<br />

lower of their carrying amount or “fair value less costs<br />

to sell”.<br />

Alder Hey Children’s NHS Foundation Trust 166<br />

Annual Report & Accounts 2017/18