AH ANNUAL REPORT 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

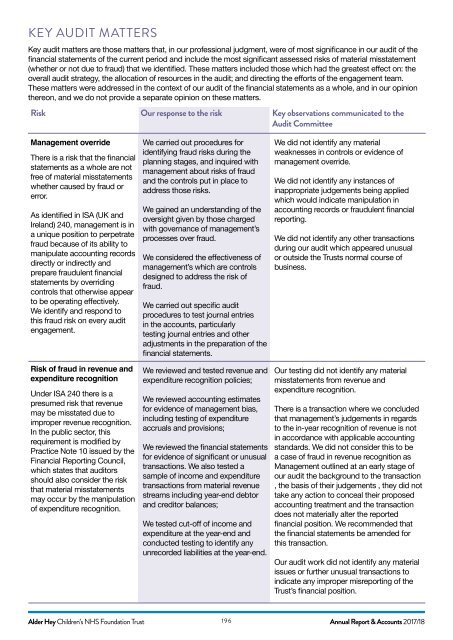

KEY AUDIT MATTERS<br />

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the<br />

financial statements of the current period and include the most significant assessed risks of material misstatement<br />

(whether or not due to fraud) that we identified. These matters included those which had the greatest effect on: the<br />

overall audit strategy, the allocation of resources in the audit; and directing the efforts of the engagement team.<br />

These matters were addressed in the context of our audit of the financial statements as a whole, and in our opinion<br />

thereon, and we do not provide a separate opinion on these matters.<br />

Risk Our response to the risk Key observations communicated to the<br />

Audit Committee<br />

Management override<br />

There is a risk that the financial<br />

statements as a whole are not<br />

free of material misstatements<br />

whether caused by fraud or<br />

error.<br />

As identified in ISA (UK and<br />

Ireland) 240, management is in<br />

a unique position to perpetrate<br />

fraud because of its ability to<br />

manipulate accounting records<br />

directly or indirectly and<br />

prepare fraudulent financial<br />

statements by overriding<br />

controls that otherwise appear<br />

to be operating effectively.<br />

We identify and respond to<br />

this fraud risk on every audit<br />

engagement.<br />

Risk of fraud in revenue and<br />

expenditure recognition<br />

Under ISA 240 there is a<br />

presumed risk that revenue<br />

may be misstated due to<br />

improper revenue recognition.<br />

In the public sector, this<br />

requirement is modified by<br />

Practice Note 10 issued by the<br />

Financial Reporting Council,<br />

which states that auditors<br />

should also consider the risk<br />

that material misstatements<br />

may occur by the manipulation<br />

of expenditure recognition.<br />

We carried out procedures for<br />

identifying fraud risks during the<br />

planning stages, and inquired with<br />

management about risks of fraud<br />

and the controls put in place to<br />

address those risks.<br />

We gained an understanding of the<br />

oversight given by those charged<br />

with governance of management’s<br />

processes over fraud.<br />

We considered the effectiveness of<br />

management’s which are controls<br />

designed to address the risk of<br />

fraud.<br />

We carried out specific audit<br />

procedures to test journal entries<br />

in the accounts, particularly<br />

testing journal entries and other<br />

adjustments in the preparation of the<br />

financial statements.<br />

We reviewed and tested revenue and<br />

expenditure recognition policies;<br />

We reviewed accounting estimates<br />

for evidence of management bias,<br />

including testing of expenditure<br />

accruals and provisions;<br />

We reviewed the financial statements<br />

for evidence of significant or unusual<br />

transactions. We also tested a<br />

sample of income and expenditure<br />

transactions from material revenue<br />

streams including year-end debtor<br />

and creditor balances;<br />

We tested cut-off of income and<br />

expenditure at the year-end and<br />

conducted testing to identify any<br />

unrecorded liabilities at the year-end.<br />

We did not identify any material<br />

weaknesses in controls or evidence of<br />

management override.<br />

We did not identify any instances of<br />

inappropriate judgements being applied<br />

which would indicate manipulation in<br />

accounting records or fraudulent financial<br />

reporting.<br />

We did not identify any other transactions<br />

during our audit which appeared unusual<br />

or outside the Trusts normal course of<br />

business.<br />

Our testing did not identify any material<br />

misstatements from revenue and<br />

expenditure recognition.<br />

There is a transaction where we concluded<br />

that management’s judgements in regards<br />

to the in-year recognition of revenue is not<br />

in accordance with applicable accounting<br />

standards. We did not consider this to be<br />

a case of fraud in revenue recognition as<br />

Management outlined at an early stage of<br />

our audit the background to the transaction<br />

, the basis of their judgements , they did not<br />

take any action to conceal their proposed<br />

accounting treatment and the transaction<br />

does not materially alter the reported<br />

financial position. We recommended that<br />

the financial statements be amended for<br />

this transaction.<br />

Our audit work did not identify any material<br />

issues or further unusual transactions to<br />

indicate any improper misreporting of the<br />

Trust’s financial position.<br />

Alder Hey Children’s NHS Foundation Trust 196<br />

Annual Report & Accounts 2017/18