- Page 1 and 2:

CEIS Health Report 2006 Management

- Page 3 and 4:

CEIS Health Report 2006 Management

- Page 6 and 7:

Index Report Presentation by Pagane

- Page 8 and 9:

1.6 - The Regional Primary Care Agr

- Page 10 and 11:

Chapter 3 - Efficiency 3.1 - The Ef

- Page 12 and 13:

3.8 - Private Health Insurance and

- Page 14:

Ceis - Sanità Report presentation

- Page 17 and 18:

Warning The figures in the volume f

- Page 19 and 20:

CEIS Health Report 2006 stantial, i

- Page 21 and 22:

CEIS Health Report 2006 If, therefo

- Page 23 and 24:

CEIS Health Report 2006 Cross-check

- Page 25 and 26:

CEIS Health Report 2006 over € 6.

- Page 27 and 28:

CEIS Health Report 2006 made; final

- Page 29 and 30:

CEIS Health Report 2006 Although th

- Page 31 and 32:

CEIS Health Report 2006 Aside from

- Page 33 and 34:

CEIS Health Report 2006 Regulations

- Page 35 and 36:

CEIS Health Report 2006 especially

- Page 38:

Chapter 1 Health expenditure and fu

- Page 41 and 42:

CEIS Health Report 2006 The questio

- Page 43 and 44:

CEIS Health Report 2006 Table 1 - T

- Page 45 and 46:

CEIS Health Report 2006 Figure 3 -

- Page 47 and 48:

CEIS Health Report 2006 Figure 6 -

- Page 49 and 50:

CEIS Health Report 2006 Figure 8 -

- Page 51 and 52:

CEIS Health Report 2006 Figure 10 -

- Page 53 and 54:

CEIS Health Report 2006 ciated with

- Page 55 and 56:

CEIS Health Report 2006 ● OECD (2

- Page 57 and 58:

CEIS Health Report 2006 Figure 2 -

- Page 59 and 60:

CEIS Health Report 2006 the phenome

- Page 61 and 62:

CEIS Health Report 2006 Table 3 - R

- Page 63 and 64:

CEIS Health Report 2006 The indicat

- Page 65 and 66:

CEIS Health Report 2006 References

- Page 67 and 68:

CEIS Health Report 2006 All the var

- Page 69 and 70:

CEIS Health Report 2006 Diagram 1 -

- Page 71 and 72:

CEIS Health Report 2006 1.4 - Pharm

- Page 73 and 74:

CEIS Health Report 2006 % Pharmaceu

- Page 75 and 76:

CEIS Health Report 2006 The second

- Page 77 and 78:

CEIS Health Report 2006 tion of res

- Page 79 and 80:

CEIS Health Report 2006 Table 4 - R

- Page 81 and 82:

CEIS Health Report 2006 The variati

- Page 83 and 84:

CEIS Health Report 2006 1.5 - The r

- Page 85 and 86:

CEIS Health Report 2006 Figure 2 -

- Page 87 and 88:

CEIS Health Report 2006 southern Re

- Page 89 and 90:

CEIS Health Report 2006 1.5.5 Absor

- Page 91 and 92:

CEIS Health Report 2006 For day hos

- Page 93 and 94:

CEIS Health Report 2006 There is co

- Page 95 and 96:

CEIS Health Report 2006 1.6 - The r

- Page 97 and 98:

CEIS Health Report 2006 the Primary

- Page 99 and 100:

CEIS Health Report 2006 Table 1 - T

- Page 101 and 102:

CEIS Health Report 2006 • “phys

- Page 103 and 104:

CEIS Health Report 2006 1.7 - Evolu

- Page 105 and 106:

CEIS Health Report 2006 As can be o

- Page 107 and 108:

CEIS Health Report 2006 Another int

- Page 109 and 110:

CEIS Health Report 2006 Some signif

- Page 111 and 112:

CEIS Health Report 2006 1.7.5 Concl

- Page 113 and 114:

CEIS Health Report 2006 [114]

- Page 116:

Introduction Public deficit in the

- Page 119 and 120:

CEIS Health Report 2006 The cumulat

- Page 121 and 122:

CEIS Health Report 2006 tegies of i

- Page 123 and 124:

CEIS Health Report 2006 gest that t

- Page 125 and 126:

CEIS Health Report 2006 increase of

- Page 127 and 128:

CEIS Health Report 2006 increase in

- Page 129 and 130:

CEIS Health Report 2006 [130]

- Page 131 and 132:

CEIS Health Report 2006 It is also

- Page 133 and 134:

CEIS Health Report 2006 shifting be

- Page 135 and 136:

CEIS Health Report 2006 year (AIHW

- Page 137 and 138:

CEIS Health Report 2006 cost of the

- Page 139 and 140:

CEIS Health Report 2006 The Second

- Page 141 and 142:

CEIS Health Report 2006 2.5 - Imple

- Page 143 and 144:

CEIS Health Report 2006 2.5.3 Shift

- Page 145 and 146:

CEIS Health Report 2006 Table 1 - P

- Page 147 and 148:

CEIS Health Report 2006 and, conseq

- Page 149 and 150:

CEIS Health Report 2006 Grant whose

- Page 151 and 152:

CEIS Health Report 2006 Generally s

- Page 153 and 154:

CEIS Health Report 2006 Scheme for

- Page 156 and 157:

3.1 - The efficiency of Regional He

- Page 158 and 159:

Table 2 - LEA Financing REGIONS HOS

- Page 160 and 161:

• Campania, with strong financial

- Page 162 and 163:

[163] CEIS Health Report 2006

- Page 164 and 165:

hospital stays has reduced the aver

- Page 166 and 167:

treated varies greatly. The highest

- Page 168 and 169:

CMS = f(COST, CMP, PL, RC, DM , PME

- Page 170 and 171:

formance, implying an increase in a

- Page 172 and 173: 3.3 - The National Health System Ev

- Page 174 and 175: 3.3.3 Cooperation with the Regional

- Page 176 and 177: the contract conditions are previou

- Page 178 and 179: Consequentially, in order to avoid

- Page 180 and 181: order through the MEPA) numbered 14

- Page 182 and 183: 3.4 - Strengthening the capacity fo

- Page 184 and 185: for designing and governing organiz

- Page 186 and 187: the hierarchical and management rol

- Page 188 and 189: tions may appear and disappear, the

- Page 190 and 191: lop, rather than a variable to be c

- Page 192 and 193: units along business lines were unq

- Page 194 and 195: cooperation to achieve the developm

- Page 196 and 197: However, to manage a multi-site hos

- Page 198 and 199: Figure 2 - AVS Strategy map • con

- Page 200 and 201: cialties, but what sets them apart,

- Page 202 and 203: nistically or quantitatively. Hence

- Page 204 and 205: portant for healthcare industry, as

- Page 206 and 207: tor is that General Managers usuall

- Page 208 and 209: cation of the ABC and, in general,

- Page 210 and 211: ● Kaplan R, Norton D (1992), “T

- Page 212 and 213: 3.7 - The management of healthcare

- Page 214 and 215: Table 1 - Pathway for st elevated a

- Page 216 and 217: [217] CEIS Health Report 2006 Table

- Page 218 and 219: Vaginal childbirth Some synthesis i

- Page 220 and 221: Politiche sanitarie, marzo-aprile.

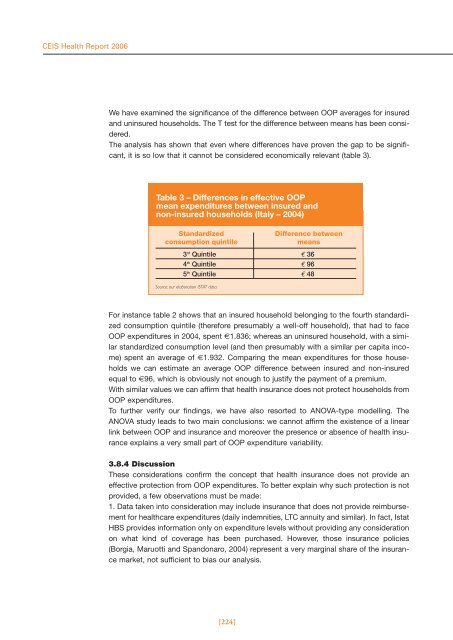

- Page 224 and 225: 2. We might suppose that the state

- Page 226: ● OECD (2004), “Towards High -

- Page 230 and 231: 4.1 - Equity in the italian healthc

- Page 232 and 233: Table 2 - Association indexes betwe

- Page 234 and 235: 4.1.5 Structure of health expenditu

- Page 236 and 237: Table 9 - Regional distribution of

- Page 238 and 239: strophic payments; moreover, the se

- Page 240: ● Doglia M, Spandonaro F, “Il p

- Page 243 and 244: CEIS Health Report 2006 (i represen

- Page 245 and 246: CEIS Health Report 2006 sence of di

- Page 247 and 248: CEIS Health Report 2006 -0,0030, wh

- Page 249 and 250: CEIS Health Report 2006 Although co

- Page 252 and 253: 5.1 - The median age at death for m

- Page 254 and 255: causes and the median age at genera

- Page 256 and 257: in the South and Islands, not only

- Page 258 and 259: 5.2 - Analysis of avoidable deaths

- Page 260 and 261: population of Italian citizens acco

- Page 262 and 263: We wish to underline the mortality

- Page 264 and 265: Diagram 4 - % composition of years

- Page 266 and 267: 5.2.4 Comments The results of the a

- Page 268 and 269: among whites and blacks,1979-1989

- Page 270 and 271: Figure 1 - Division % of the quota

- Page 272 and 273:

Figure 3 - Pharmaceutics expenditur

- Page 274 and 275:

Table 3 - Gross fixed investments i

- Page 276 and 277:

Table 4 - Share of medical device w

- Page 278 and 279:

age dimension of enterprises (90 em

- Page 280 and 281:

BOX 2: National Medical Device Clas

- Page 282 and 283:

maceutiche in Italia (1997-2001)”

- Page 284 and 285:

5.4 - Mobility of italian patients

- Page 286 and 287:

Authority (ASL) will be charged for

- Page 288 and 289:

43.950.716,00. At this stage, if yo

- Page 290 and 291:

esting data are certainly provided

- Page 292 and 293:

have carried out economic and stati

- Page 294 and 295:

[295] CEIS Health Report 2006

- Page 296 and 297:

✔ DE POUVOURVILLE GÉRARD Researc

- Page 298 and 299:

✔ MENNINI FRANCESCO SAVERIO Degre

- Page 300:

✔ SCHWEIGER ARTURO Health Economi