Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

se<strong>as</strong>on. Sunamgonj, <strong>as</strong> Haor region, mostly produce one crop <strong>in</strong> a year. Farmers will<strong>in</strong>g to<br />

pay m<strong>in</strong>imum amount compared to other two regions and with<strong>in</strong> Tk. 50 to 100 per month.<br />

While <strong>in</strong> Lalmonirht, they can produce 2-3 crops. Premium will<strong>in</strong>g to pay there varies from<br />

Tk. 50 to 300 per month. At Pirojpur mostly produce two crops. Premium level varies around<br />

Tk. 50 to 200. On an average the will<strong>in</strong>gness to premium payment rate is around 3-6% of<br />

yield value per se<strong>as</strong>on. The amount varies among rich, poor and medium farmers <strong>as</strong> well <strong>as</strong><br />

high, low and medium risk zones. At Sunamgonj it is evident that the rich people like to pay<br />

more, likewise the highly vulnerable group.<br />

Organizational structure preferred: About the choice of organizational structure, there are<br />

mixed reaction. Farmers from Sunamgonj and Pirojpur preferred NGO <strong>as</strong> the most suitable<br />

for CI programme. However, farmers from Lalmonirhat preferred Bank. Probably it is<br />

because of the confidence level. For some reputed NGOs people have confidence, <strong>as</strong> it is<br />

better than bureaucratic har<strong>as</strong>sment and corruption of government bodies. However, the<br />

susta<strong>in</strong>ability of NGOs <strong>in</strong> the long run is crucial question <strong>as</strong> well. In Lalmonirhat it happened<br />

that an NGO took money for <strong>Crop</strong> <strong>Insurance</strong> purposes but later became bankrupt and went <strong>in</strong><br />

hide. There is no such problem for government organization or large <strong>in</strong>surance companies or<br />

Banks.<br />

Other concern regard<strong>in</strong>g CI implementation: In most c<strong>as</strong>es farmers want them to be<br />

protected from all sorts of dis<strong>as</strong>ters, i.e. multi-peril. Regard<strong>in</strong>g adverse selection and moral<br />

hazards, their answer implies no such <strong>in</strong>tention. It may be true for some <strong>in</strong>itial years <strong>as</strong><br />

because they might not abruptly change their cultivation practice simply because they are<br />

under crop <strong>in</strong>surance program. With the progress of CI programme, whether they will <strong>in</strong>dulge<br />

<strong>in</strong> such adverse selection and moral hazards depends on the adm<strong>in</strong>istrative quality or <strong>in</strong>tegrity<br />

level. At present they are rather suspicious that whether they will get adequate compensation<br />

<strong>in</strong> the long run.<br />

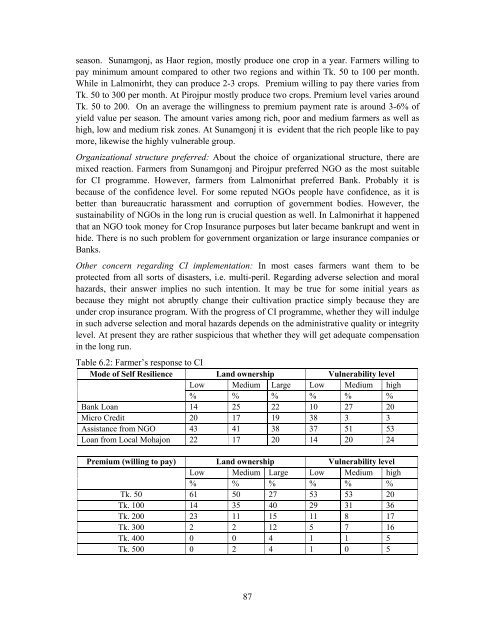

Table 6.2: Farmer’s response to CI<br />

Mode of Self Resilience Land ownership Vulnerability level<br />

Low Medium Large Low Medium high<br />

% % % % % %<br />

Bank Loan 14 25 22 10 27 20<br />

Micro Credit 20 17 19 38 3 3<br />

Assistance from NGO 43 41 38 37 51 53<br />

Loan from Local Mohajon 22 17 20 14 20 24<br />

Premium (will<strong>in</strong>g to pay) Land ownership Vulnerability level<br />

Low Medium Large Low Medium high<br />

% % % % % %<br />

Tk. 50 61 50 27 53 53 20<br />

Tk. 100 14 35 40 29 31 36<br />

Tk. 200 23 11 15 11 8 17<br />

Tk. 300 2 2 12 5 7 16<br />

Tk. 400 0 0 4 1 1 5<br />

Tk. 500 0 2 4 1 0 5<br />

87